Kayrros

Founded Year

2016Stage

Series C | AliveTotal Raised

$78.03MValuation

$0000Last Raised

$44.09M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-44 points in the past 30 days

About Kayrros

Kayrros operates in environmental intelligence and asset observation technology within the energy and environmental sectors. It utilizes artificial intelligence and geoanalytics to analyze satellite imagery and ground-truth data, providing intelligence on energy, climate, and sustainability. Kayrros serves financial institutions, commodity and carbon trading sectors, energy and nature-based solutions, and government and regulatory bodies. It was founded in 2016 and is based in Paris, France.

Loading...

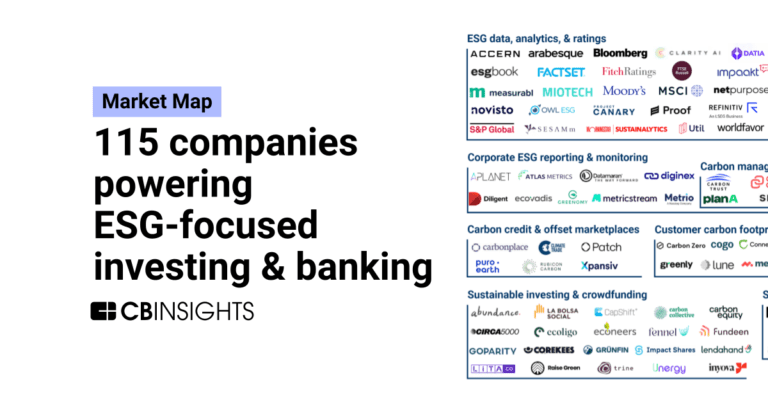

ESPs containing Kayrros

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The gas leak detection and flaring reduction solutions market provides technologies and services for identifying methane leaks from oil and gas operations and eliminating routine gas flaring. Companies offer solutions including optical gas imaging cameras, satellite monitoring, IoT sensors, and drone-based detection systems for leak identification, alongside gas recovery, utilization, and flare mo…

Kayrros named as Challenger among 15 other companies, including SLB, GHGSat, and MSA.

Kayrros's Products & Differentiators

Crude Oil Intelligence

Kayrros Crude Oil Intelligence sheds light on previously-opaque data, allowing traders to take decisions with confidence. Leverage satellite imagery, machine-learning algorithms and new proprietary technologies for unique insights on crude oil storage.

Loading...

Research containing Kayrros

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Kayrros in 8 CB Insights research briefs, most recently on May 10, 2024.

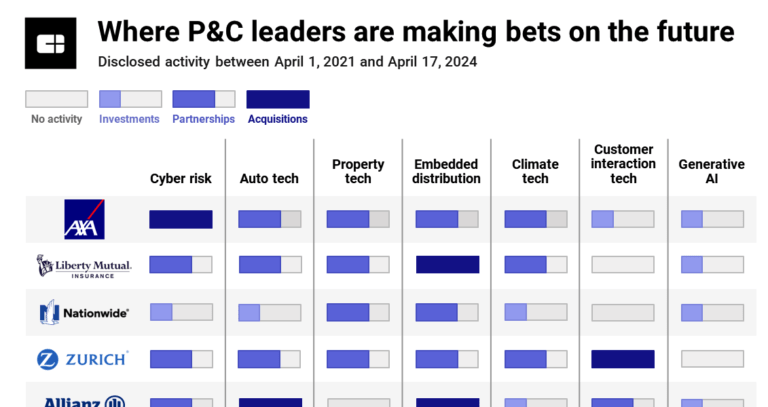

Mar 1, 2024

The satellite & geospatial tech market map

Sep 12, 2023

The climate tech in industrials market mapExpert Collections containing Kayrros

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Kayrros is included in 9 Expert Collections, including Capital Markets Tech.

Capital Markets Tech

1,170 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Oil & Gas Tech

4,980 items

Companies in the Oil & Gas Tech space, including those focused on improving operations across upstream, midstream, and downstream sectors, as well as those working on sustainable fuels.

Grid and Utility

2,149 items

Companies that are developing and implementing new technologies to optimize the grid and utility sector. This includes, but is not limited to, distributed energy resources, infrastructure security, utility asset management, grid inspection, energy efficiency, grid storage, etc.

Artificial Intelligence

12,626 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

14,013 items

Excludes US-based companies

Carbon Capture, Utilization, and Storage (CCUS)

860 items

Companies in the Carbon Capture Utilization and Storage (CCUS) space, including those that are developing technologies to capture, utilize, and store carbon, as well as those creating carbon negative products.

Kayrros Patents

Kayrros has filed 8 patents.

The 3 most popular patent topics include:

- image processing

- carbon finance

- climate change policy

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/20/2022 | 4/8/2025 | Industrial gases, Firearm actions, Aircraft guns, Carbon finance, Climate change policy | Grant |

Application Date | 10/20/2022 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Industrial gases, Firearm actions, Aircraft guns, Carbon finance, Climate change policy |

Status | Grant |

Latest Kayrros News

Sep 6, 2025

As the oil market moves closer to a long-anticipated glut, traders are closely watching buying from China to see if it will absorb an excess that the world’s crude producing nations are set to pump. Author of the article: h6q4awd{na)(5v5dbvwcm}99_media_dl_1.png IEA Article content (Bloomberg) — As the oil market moves closer to a long-anticipated glut, traders are closely watching buying from China to see if it will absorb an excess that the world’s crude producing nations are set to pump. THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY Subscribe now to read the latest news in your city and across Canada. Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, and others. Daily content from Financial Times, the world's leading global business publication. Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account. National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on. Daily puzzles, including the New York Times Crossword. SUBSCRIBE TO UNLOCK MORE ARTICLES Subscribe now to read the latest news in your city and across Canada. Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman and others. Daily content from Financial Times, the world's leading global business publication. Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account. National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on. Daily puzzles, including the New York Times Crossword. REGISTER / SIGN IN TO UNLOCK MORE ARTICLES Create an account or sign in to continue with your reading experience. Access articles from across Canada with one account. Share your thoughts and join the conversation in the comments. Enjoy additional articles per month. Get email updates from your favourite authors. THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK. Create an account or sign in to continue with your reading experience. Access articles from across Canada with one account Share your thoughts and join the conversation in the comments Enjoy additional articles per month Get email updates from your favourite authors Sign In or Create an Account Email Address Article content “The key question is where stockbuilds will turn up,” HSBC Holdings Plc analysts including Kim Fustier wrote this week. “If China continues to absorb excess oil volumes via its strategic reserves, as it did in in the second quarter, stockbuilds in the OECD could be muted.” Article content The global market’s capacity to absorb barrels will be among talking points when OPEC+ nations meet to discuss supply on Sunday. Saudi Arabia wants the group to accelerate the return of another tranche of halted output — adding to concerns about a surplus that would depress prices — but all options are on the table. Article content About 10% of the nation’s crude stockpiling has been directed to its strategic petroleum reserves, according to Kayrros analyst Antoine Halff. There have also been additions to the country’s refining capacity, such as CNOOC Ltd.’s Daxie plant, and the addition of new tank space. Article content Article content It’s also possible that Beijing wants to hold more barrels in storage given the heightened levels of geopolitical risks over the last few years, the Oxford Institute for Energy Studies wrote in a note. Article content While China’s flagship crude futures contract was flashing a softer market over recent weeks, the world’s two main benchmark’s continued to suggest relatively tight supplies. Article content That’s because inventory builds so far this year have avoided western hubs. In Cushing, Oklahoma, the tank farm of about 15 storage terminals that underpins the West Texas Intermediate futures contract, inventories have been repeatedly near multi-year seasonal lows this year. Article content The International Energy Agency says that in the second quarter global oil stockpiles increased by the most since the third three months of 2020, when the global economy was still being ravaged by the Covid-19 pandemic. Over that period, stockpiles in the developed world climbed by 60,000 barrels a day, while expanding by more than a million barrels a day everywhere else. Article content It’s still possible that prices will need to fall from current levels for China buy in a big way, though, according to Frederic Lasserre, head of research at Gunvor Group. Advertisement 1 Article content Bank of America Corp. wrote last month that there’s about a billion barrels of empty tank capacity available across the globe to fill with inventories, which could mean that markets avoid falling into a heavily bearish structure. Article content There are signs that the surge in production is starting to come, though. Brazil’s output approached 4 million barrels a day for the first time over the summer, and a new field is due to start in the country before the end of the year. Guyana has moved from producing nothing to almost a million barrels a day and output in Canada’s oil heartland of Alberta hit a record in July. Article content At the same time, despite concerns about a decline in US output, the Energy Information Administration has consistently revised oil supply estimates higherover the last few months. Article content Article content “When we look at OECD inventories we’re still at a relatively low level,” Nadia Martin Wiggen, a director at Svelland Capital, said in a Bloomberg TV interview. “Yes, there is this supply glut coming according to expectations, but we need to see that materializing.” Article content Article content

Kayrros Frequently Asked Questions (FAQ)

When was Kayrros founded?

Kayrros was founded in 2016.

Where is Kayrros's headquarters?

Kayrros's headquarters is located at 20 Bis Rue La Fayette, Paris.

What is Kayrros's latest funding round?

Kayrros's latest funding round is Series C.

How much did Kayrros raise?

Kayrros raised a total of $78.03M.

Who are the investors of Kayrros?

Investors of Kayrros include Index Ventures, Korelya Capital, Cathay Innovation, AtlasInvest, Bpifrance and 11 more.

Who are Kayrros's competitors?

Competitors of Kayrros include EarthDaily Analytics, Privateer, Orbio Earth, GHGSat, OilX and 7 more.

What products does Kayrros offer?

Kayrros's products include Crude Oil Intelligence and 4 more.

Loading...

Compare Kayrros to Competitors

Kpler is a subscription-based data and analytics platform that provides tools for trade across various markets. The company offers insights and analytics for commodity trading, maritime operations, and energy transition. Kpler serves a range of clients, including physical and financial traders, charterers, vessel operators, fleet managers, and logistics and supply chain professionals. It was founded in 2014 and is based in Brussels, Belgium.

Vortexa provides energy cargo tracking and analytics within the energy and shipping industries. The company offers products that include energy flow data, freight analytics, and inventory levels, supporting trading and logistical decisions. Vortexa serves the energy sector, including companies involved in the trading of oil and gas, as well as shipping and logistics firms. It was founded in 2016 and is based in London, United Kingdom.

askEarth specializes in earth observation and analytics using advanced artificial intelligence and operates within the technology and data analysis sectors. The company offers solutions that transform data into actionable insights, satellite data, and natural language processing to inform, report, and de-risk for various sectors. askEarth primarily serves government entities and the insurance industry with its data analysis and predictive services. It was founded in 2023 and is based in Zurich, Switzerland.

ChAI provides information related to raw material market intelligence and operates within the commodity pricing and risk management industry. The company offers services including commodity price forecasts, market analysis, and insurance solutions related to price volatility. ChAI primarily serves sectors that require raw material procurement and are exposed to commodity price risks. It was founded in 2019 and is based in London, England.

SkyWatch focuses on geospatial data, making Earth-observation data available for different industries. The company offers a platform for discovering, purchasing, and integrating satellite imagery and other types of geospatial data into business workflows and applications. SkyWatch serves sectors including architecture, engineering, construction, energy, oil & gas, forestry, media, mining, natural resources, and utilities. It was founded in 2014 and is based in Kitchener, Ontario.

SatRev operates in the Earth-observation data and hardware sector of space technology. The company provides high-resolution and medium-resolution imagery for applications including agriculture, government, and environmental monitoring. SatRev offers satellite hardware and hosted payload missions to support the deployment of custom payloads into orbit. SatRev was formerly known as SatRevolution. It was founded in 2016 and is based in Wroclaw, Poland.

Loading...