Kasisto

Founded Year

2013Stage

Series D | AliveTotal Raised

$91.62MLast Raised

$8.65M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+54 points in the past 30 days

About Kasisto

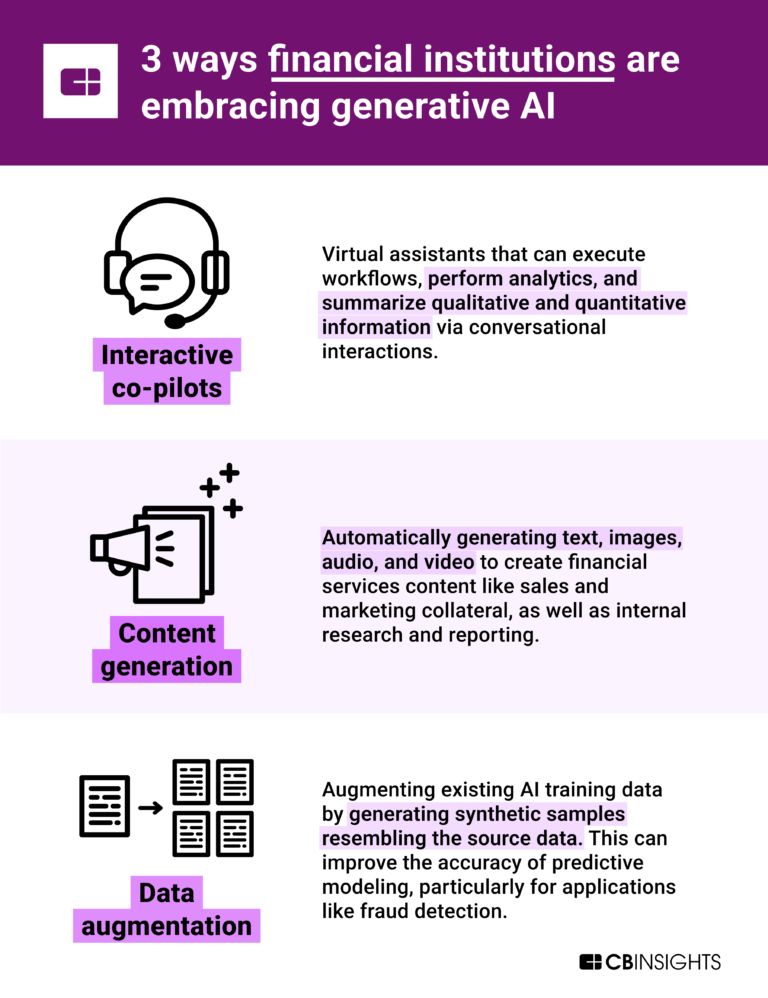

Kasisto focuses on conversational artificial intelligence solutions, primarily in the banking and finance sector. The company offers a platform that provides intelligent digital assistants, designed to facilitate accurate, human-like conversations and empower teams with financial knowledge. Kasisto primarily serves global financial institutions, regional banks, community banks, and credit unions. It was founded in 2013 and is based in New York, New York.

Loading...

Kasisto's Product Videos

_thumbnail.png?w=3840)

ESPs containing Kasisto

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The bank customer engagement solutions market provides technology solutions designed to enhance and optimize the engagement between banks and their customers through customization and rewards. Companies in this market embed customer data analytics into banks' existing products or offer off-the-shelf solutions that can be integrated into mobile banking apps, such as loyalty programs, card-linked ca…

Kasisto named as Highflier among 15 other companies, including Alkami Technology, Diebold Nixdorf, and BackBase.

Kasisto's Products & Differentiators

KAI Consumer Banking

KAI Consumer Banking (KCB), provides digitally-engaging experiences to users through a firm’s branded virtual assistant. KCB is fluent in banking from day one. This deep financial expertise eliminates the need for costly ramp-up time and training. KCB comes with everything firms need to develop, customize, maintain, and grow their consumer banking digital assistant and includes out of the box skills and intents focused on (but not limited to) the following banking experiences: Account Information Transaction Search Balances & Payments Credit Card Servicing Financial Wellness

Loading...

Research containing Kasisto

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Kasisto in 8 CB Insights research briefs, most recently on Aug 29, 2025.

Aug 29, 2025 report

Book of Scouting Reports: Generative AI in Financial Services

May 24, 2024

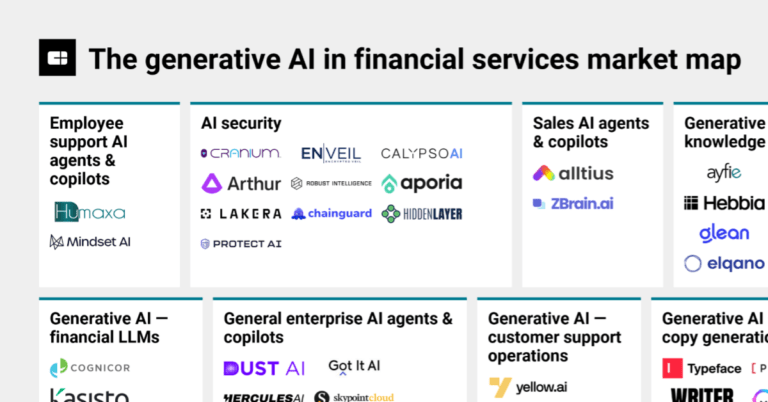

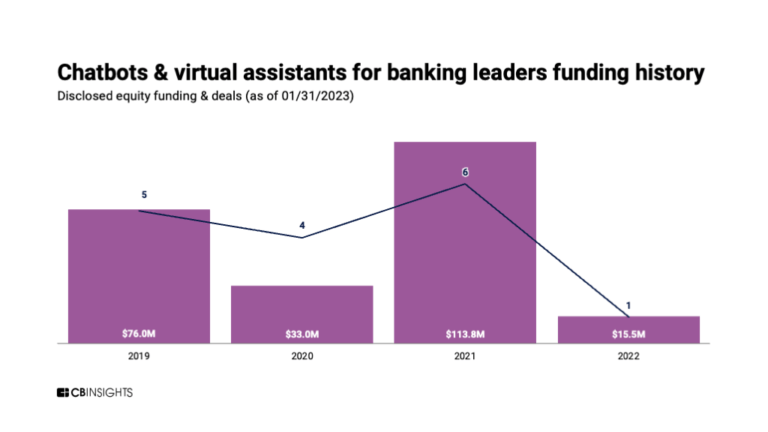

The generative AI market map

Jan 4, 2024

The core banking automation market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023

Expert Collections containing Kasisto

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Kasisto is included in 6 Expert Collections, including Fintech 100.

Fintech 100

598 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

9,685 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Sales & Customer Service Tech

600 items

Companies offering technology-driven solutions to enable, facilitate, and improve customer service across industries. This includes solutions pre-, during, and post-purchase of goods and services.

Digital Banking

1,016 items

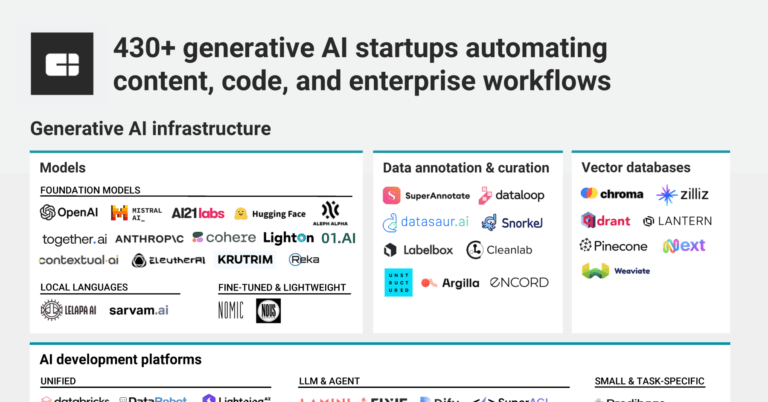

Generative AI

2,793 items

Companies working on generative AI applications and infrastructure.

Artificial Intelligence

10,195 items

Kasisto Patents

Kasisto has filed 5 patents.

The 3 most popular patent topics include:

- artificial intelligence

- data management

- diagrams

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

6/30/2020 | 1/10/2023 | Facebook employees, Facebook, Virtual assistants, Natural language processing, Artificial intelligence | Grant |

Application Date | 6/30/2020 |

|---|---|

Grant Date | 1/10/2023 |

Title | |

Related Topics | Facebook employees, Facebook, Virtual assistants, Natural language processing, Artificial intelligence |

Status | Grant |

Latest Kasisto News

Aug 22, 2025

Kasisto , the market leader for AI in banking, today launched KAIgentic, an agentic AI platform purpose built for banking and now available to banks and credit unions. KAIgentic delivers AI that thinks like a bank's best banker, combining intelligence, compliance, and bank grade performance in one platform across customer experience, employee experience, and AI operations. While many banks and credit unions experiment with generic large language models and untested agent frameworks, KAIgentic delivers what the industry needs: secure, auditable, domain specific AI agents deeply embedded within the systems that power banking. “Trust is the currency of banking, and most AI cannot be trusted,” said Lance Berks , CEO of Kasisto. “KAIgentic changes that. It is not a prototype or a pilot. It is production ready, compliant by design, and built to operate inside the real world systems banks rely on every day.” The platform orchestrates autonomous AI agents capable of delivering intelligent, personalized, and proactive experiences across voice and digital channels, all while meeting strict regulatory and risk management requirements. Key capabilities include: End to end compliance architecture: Integrated controls for fraud detection, audit logging, policy enforcement, and regulatory reporting. Pre processing with institutional intelligence: Dynamically conditions agent behavior with custom SOPs, compliance documents, and user defined prompts. Agentic post processing layer: Hallucination detection, confidence scoring, and wrap around agents for compliance, security, fraud, regulations, and QA. Enterprise grade insights engine: Uncovers emerging trends, customer friction points, and LLM behavior anomalies through deep analytics. Agent augmented workforce: An AI powered Agent Console supports human agents with summaries, recommendations, and compliance context. LLM deployment flexibility: Choose between trusted open models or deploy KaiGPT, a domain tuned LLM that runs securely within the bank's cloud or on premises environment. “Our vision is that every customer with a bank account will have a personal agent guiding their financial journey,” said Joshua Schechter , Chief Product and Innovation Officer at Kasisto. “KAIgentic makes that vision real, giving institutions the ability to earn trust, deepen relationships, and help customers build long term financial stability.” Availability and early access KAIgentic is in early access with select banks and credit unions, supporting customer interactions, employee workflows, and contact center experiences. Broader availability is expected later this year across North America, Europe, and Asia. Women Feel Less in Control of Their Pensions Than Men, New Data Shows Women are far more likely than men to feel powerless over their pension savings and retiring in comfort, new research from PensionBee Narmi and Grasshopper Launch First MCP Server By a U.S. Bank For AI-Driven Insights Kasisto Launches KAIgentic, AI That Thinks Like Your Best Banker

Kasisto Frequently Asked Questions (FAQ)

When was Kasisto founded?

Kasisto was founded in 2013.

Where is Kasisto's headquarters?

Kasisto's headquarters is located at 37 West 20th Street, New York.

What is Kasisto's latest funding round?

Kasisto's latest funding round is Series D.

How much did Kasisto raise?

Kasisto raised a total of $91.62M.

Who are the investors of Kasisto?

Investors of Kasisto include Oak HC/FT Partners, Westpac Group, BankSouth Holding, FIS, NCR Voyix and 22 more.

Who are Kasisto's competitors?

Competitors of Kasisto include WorkFusion, Indigo.ai, Posh, Rasa, Knowbl and 7 more.

What products does Kasisto offer?

Kasisto's products include KAI Consumer Banking and 2 more.

Who are Kasisto's customers?

Customers of Kasisto include VeraBank and Westpac.

Loading...

Compare Kasisto to Competitors

Senseforth provides conversational AI solutions for various business sectors. It offers a platform for developing AI-powered virtual assistants, speech analytics, semantic search, and agent assist tools. Senseforth's technology is used across industries such as banking, insurance, healthcare, and retail. It was founded in 2017 and is based in Bengaluru, India.

Avaamo provides conversational AI solutions for enterprises across various sectors. Its main offerings include virtual assistants and contact center solutions that enable self-service and automated interactions for HR, IT service desks, and customer service. Avaamo's platform supports multimodal interactions and integrates with a range of enterprise applications. It was founded in 2015 and is based in Los Altos, California.

Inbenta specializes in conversational AI and automation within the customer service sector. The company offers a suite of products, including AI-enabled chatbots, search tools, and knowledge management systems designed to enhance customer experience and streamline service operations. Inbenta's conversational AI platform is utilized across various industries to automate customer interactions, provide self-service options, and improve overall customer satisfaction. It was founded in 2005 and is based in Allen, Texas.

Pypestream develops customer engagement solutions within the technology sector. The company offers a platform that automates customer service, sales, and operational processes through the use of AI microagents, allowing businesses to interact through various channels. Pypestream serves enterprises across industries including insurance, healthcare, travel, telecommunications, streaming, financial services, and eCommerce. It was founded in 2015 and is based in New York, New York.

Posh specializes in conversational AI solutions for the banking sector. It offers products such as voice and digital assistants to automate customer service and enhance employee efficiency, as well as a knowledge assistant for information management. Posh's AI platform is designed to integrate seamlessly with existing banking processes, providing secure and efficient AI management. It was founded in 2018 and is based in Boston, Massachusetts.

Conversica specializes in conversational AI solutions for revenue teams in various business sectors. The company offers Revenue Digital Assistants that facilitate AI-powered, two-way dialogues to drive opportunities across the customer lifecycle. Its digital assistants engage and nurture leads, qualify sales opportunities, and support customer success initiatives with human-like interactions. It was founded in 2007 and is based in Foster City, California.

Loading...