Investments

178Portfolio Exits

50Funds

7Partners & Customers

3Service Providers

1About Kaiser Permanente Ventures

Kaiser Permanente Ventures specializes in venture investing within the healthcare sector. The company invests in healthcare companies that address needs, offering solutions for patients, providers, and healthcare systems. Kaiser Permanente Ventures engages with startups in health information technology, digital health, healthcare services, medical devices, diagnostics, and precision medicine. It was founded in 1997 and is based in Oakland, California.

Research containing Kaiser Permanente Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Kaiser Permanente Ventures in 2 CB Insights research briefs, most recently on Sep 13, 2024.

Latest Kaiser Permanente Ventures News

Sep 5, 2024

Giles Bruce - Thursday, September 5th, 2024 Kaiser Permanente Ventures participated in a $65 million financing round for a virtual care startup focused on home-based patients. Vesta Healthcare , which serves more than 50,000 people, provides technology for home-based care services from primary care to passive monitoring. Investment firm RA Capital Management led the series C equity round that included new debt financing and closed Sept. 4, according to a news release. CareCentrix/Walgreens was among the other investors. Kaiser Permanente Ventures , the venture capital arm of the Oakland, Calif.-based health system, previously took part in the company's $65 million growth capital funding round in 2021.

Kaiser Permanente Ventures Investments

178 Investments

Kaiser Permanente Ventures has made 178 investments. Their latest investment was in Arine as part of their Series C on May 16, 2025.

Kaiser Permanente Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

5/16/2025 | Series C | Arine | $30M | Yes | Town Hall Ventures, and Undisclosed Investors | 4 |

5/8/2025 | Series A | Clarium | $27M | No | 3 | |

4/21/2025 | Unattributed VC | APCO | $3.45M | Yes | 1 | |

2/19/2025 | Unattributed VC | |||||

8/20/2024 | Seed VC |

Date | 5/16/2025 | 5/8/2025 | 4/21/2025 | 2/19/2025 | 8/20/2024 |

|---|---|---|---|---|---|

Round | Series C | Series A | Unattributed VC | Unattributed VC | Seed VC |

Company | Arine | Clarium | APCO | ||

Amount | $30M | $27M | $3.45M | ||

New? | Yes | No | Yes | ||

Co-Investors | Town Hall Ventures, and Undisclosed Investors | ||||

Sources | 4 | 3 | 1 |

Kaiser Permanente Ventures Portfolio Exits

50 Portfolio Exits

Kaiser Permanente Ventures has 50 portfolio exits. Their latest portfolio exit was Omada Health on June 06, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

6/6/2025 | IPO | Public | 8 | ||

5/12/2025 | Corporate Majority | 9 | |||

3/18/2025 | Merger | 3 | |||

Date | 6/6/2025 | 5/12/2025 | 3/18/2025 | ||

|---|---|---|---|---|---|

Exit | IPO | Corporate Majority | Merger | ||

Companies | |||||

Valuation | |||||

Acquirer | Public | ||||

Sources | 8 | 9 | 3 |

Kaiser Permanente Ventures Fund History

7 Fund Histories

Kaiser Permanente Ventures has 7 funds, including Kaiser Permanente Ventures V.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

12/5/2019 | Kaiser Permanente Ventures V | Multi-Stage Venture Capital | Closed | $141M | 3 |

6/30/2008 | KP Healthcare Fund V | ||||

10/1/2006 | Kaiser Permanente Healthcare Fund IV | ||||

3/30/2005 | Kaiser Permanente Healthcare Fund III | ||||

7/31/2004 | Kaiser Permanente Healthcare Side Fund |

Closing Date | 12/5/2019 | 6/30/2008 | 10/1/2006 | 3/30/2005 | 7/31/2004 |

|---|---|---|---|---|---|

Fund | Kaiser Permanente Ventures V | KP Healthcare Fund V | Kaiser Permanente Healthcare Fund IV | Kaiser Permanente Healthcare Fund III | Kaiser Permanente Healthcare Side Fund |

Fund Type | Multi-Stage Venture Capital | ||||

Status | Closed | ||||

Amount | $141M | ||||

Sources | 3 |

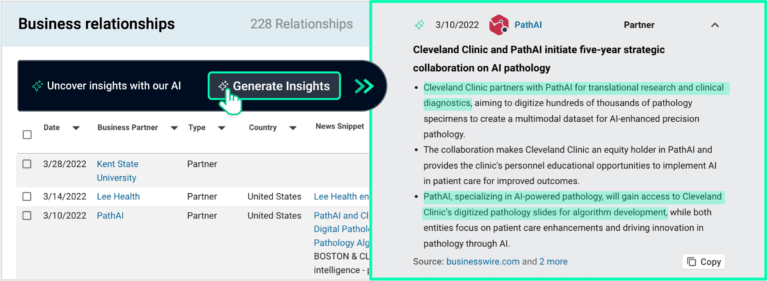

Kaiser Permanente Ventures Partners & Customers

3 Partners and customers

Kaiser Permanente Ventures has 3 strategic partners and customers. Kaiser Permanente Ventures recently partnered with Unite Us on May 5, 2019.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

5/30/2019 | Partner | United States | Event Recap – Community-Wide Collaboration Between the Health Care & Social Sectors - KP Ventures To read more about the Unite Us partnership with Kaiser Permanente Ventures on Thrive Local , please read here . | 1 | |

4/23/2019 | Partner | ||||

Partner |

Date | 5/30/2019 | 4/23/2019 | |

|---|---|---|---|

Type | Partner | Partner | Partner |

Business Partner | |||

Country | United States | ||

News Snippet | Event Recap – Community-Wide Collaboration Between the Health Care & Social Sectors - KP Ventures To read more about the Unite Us partnership with Kaiser Permanente Ventures on Thrive Local , please read here . | ||

Sources | 1 |

Kaiser Permanente Ventures Service Providers

1 Service Provider

Kaiser Permanente Ventures has 1 service provider relationship

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel |

Service Provider | |

|---|---|

Associated Rounds | |

Provider Type | Counsel |

Service Type |

Partnership data by VentureSource

Kaiser Permanente Ventures Team

7 Team Members

Kaiser Permanente Ventures has 7 team members, including current Senior Vice President, Chris M. Grant.

Name | Work History | Title | Status |

|---|---|---|---|

Chris M. Grant | Senior Vice President | Current | |

Name | Chris M. Grant | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Senior Vice President | ||||

Status | Current |

Compare Kaiser Permanente Ventures to Competitors

Averin Capital focuses on healthcare and biotechnology sectors. The company provides funding and support to organizations developing technologies in disease detection, personalized care, and medical advancements. It engages with companies seeking to enhance human health. Averin Capital was formerly known as Bedford Bridge. It was founded in 2023 and is based in New York, New York.

Light Curve Capital focuses on leveraging advances in data sciences and computational methods to impact the life sciences sector. It specializes in identifying, investing in, and supporting assets and companies within the life sciences domain. The firm is equipped with a team that possesses deep domain knowledge and operational expertise to back technologies and therapeutic areas anticipated to transform life sciences. It is based in South Salem, New York.

Discovery Ventures is a venture capital firm with a focus on the healthcare and biotechnology sectors. The company primarily invests in groundbreaking biotech innovations, with a particular emphasis on next-generation biomedical technologies such as gene therapy, advanced cell therapy, nanotechnology, bionics, AI, and big data. Discovery Ventures primarily serves the healthcare industry, with a specific focus on next-generation biomedical technology companies. It was founded in 1998 and is based in Wilmington, Delaware.

Falcon 5 Capital operates as an investment firm with a focus on technology-driven sectors. The company provides funding and support to entrepreneurial ventures, aiming to transform innovative visions into reality with a positive societal impact. It was founded in 2023 and is based in Lake Oswego, Oregon.

Aegis Ventures serves as a startup studio focused on originating, launching, and scaling companies across various sectors. The company partners with entrepreneurs and industry leaders to provide ideas, capital, and expertise to address societal problems. Aegis Ventures primarily targets sectors such as health, data, and digital technologies. It was founded in 2020 and is based in New York, New York.

Lightspeed Venture Partners invests in the enterprise, consumer, health, and fintech sectors. The firm provides funding and support to entrepreneurs at various stages of their development. Lightspeed serves the startup ecosystem by offering financial resources and industry knowledge to companies within its targeted sectors. It was founded in 2000 and is based in Menlo Park, California.

Loading...