J.P. Morgan Chase

Founded Year

2000Stage

PIPE | IPOMarket Cap

827.87BStock Price

301.07Revenue

$0000About J.P. Morgan Chase

J.P. Morgan Chase operates as a global financial services firm. It is focused on investment banking, financial transaction processing, asset management, and private equity. Its clientele includes individuals, small businesses, and large corporations seeking financial solutions. It was founded in 2000 and is based in New York, New York.

Loading...

ESPs containing J.P. Morgan Chase

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital insurance payments market enables insurance companies to manage and optimize payment processes for both premium billing and claims disbursements. These platforms facilitate electronic transactions through various payment methods including credit cards, ACH transfers, and digital wallets. Some solutions offer integrations with policy administration and claims lifecycle management system…

J.P. Morgan Chase named as Highflier among 15 other companies, including Mastercard, Guidewire, and Stripe.

Loading...

Research containing J.P. Morgan Chase

Get data-driven expert analysis from the CB Insights Intelligence Unit.

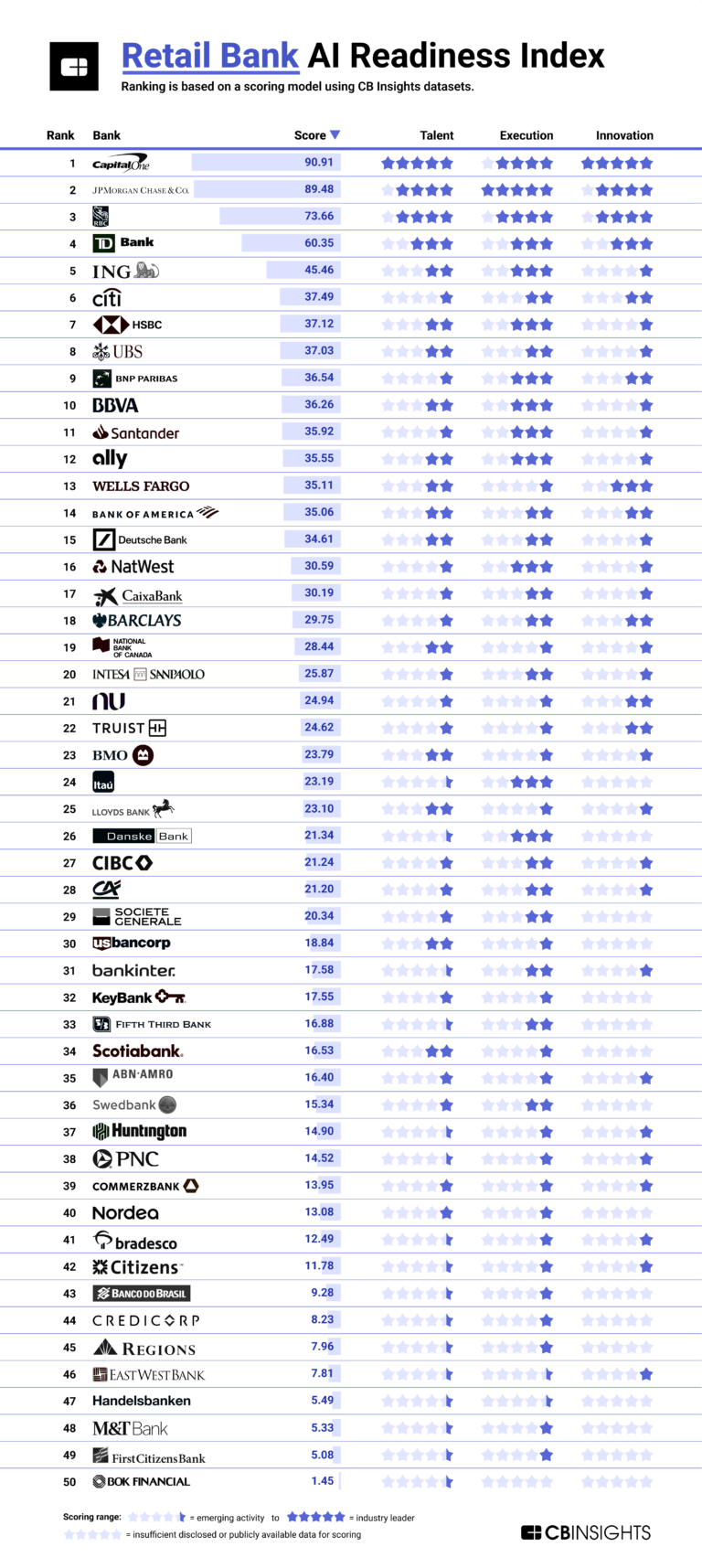

CB Insights Intelligence Analysts have mentioned J.P. Morgan Chase in 9 CB Insights research briefs, most recently on Jul 31, 2025.

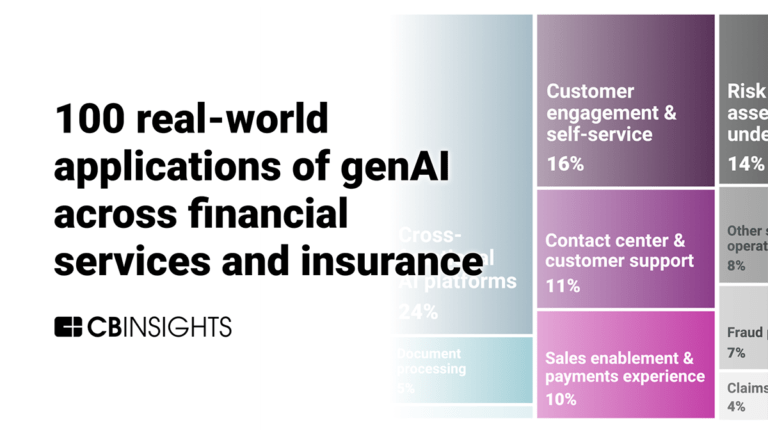

Jul 31, 2025 report

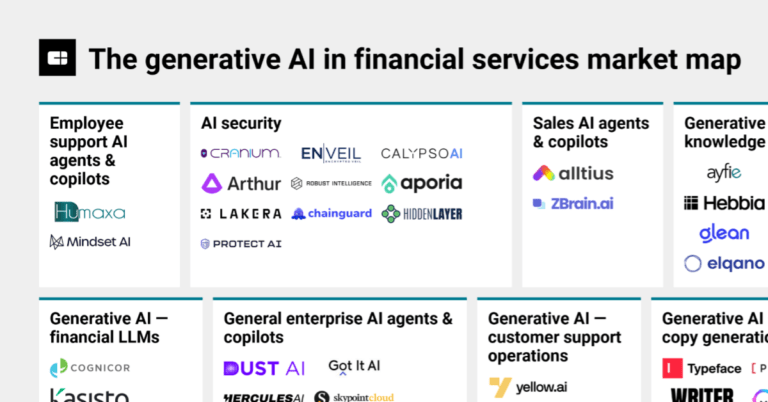

100 real-world applications of genAI across financial services and insurance

Expert Collections containing J.P. Morgan Chase

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

J.P. Morgan Chase is included in 2 Expert Collections, including Fintech.

Fintech

9,685 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

ITC Europe 2025

93 items

Sponsors, speaker companies, and startup kiosks as of May 5, 2025.

J.P. Morgan Chase Patents

J.P. Morgan Chase has filed 2705 patents.

The 3 most popular patent topics include:

- data management

- payment systems

- machine learning

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/7/2022 | 4/8/2025 | Google services, Natural language processing, Semantic Web, Knowledge bases, Semantics | Grant |

Application Date | 1/7/2022 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Google services, Natural language processing, Semantic Web, Knowledge bases, Semantics |

Status | Grant |

Latest J.P. Morgan Chase News

Aug 28, 2025

While gaps by gender and income persist, the bank said financial education will be crucial as more first-time investors face the realities of taxes, volatility, and losses. Over the past decade retail investors have become a force to be reckoned with, proving they have the strength in numbers to outplay Wall Street professionals if the mood takes them. And between 2015 and 2025 a new demographic has emerged to drive the cohort into its next era: Gen Z and, more specifically, men According to a study released by JPMorgan Chase this week, the number of 25-year-olds using savings accounts in 2015 was 6%. By 2024 that had surged to 37% with America's biggest bank expecting the trend to stick around. “Growth in the share of young people with investments accelerated in the years up to and during the pandemic. After that point, our measure shows a modest retracement,” authors Chris Wheat, president of the JPMorganChase Institute and George Eckerd, wealth and markets research director at the JPMorganChase Institute, wrote. “As context, labor force participation increases sharply for people in the late-teens, early-twenties population. For people without significant incomes during the pandemic, their finances were less likely to be directly affected by the savings boom. “The rise in investing for younger individuals may therefore capture a temporary cohort effect, strongest for those with meaningful incomes during the unique 2020−21 period. While investing participation for 25-year-olds may continue to decline from this peak, the new norm appears likely to remain substantially higher than during the pre-pandemic era.” Some might assume that young people, trapped in their homes and with money of their own to spend for the first time, may have spent their pandemic splurging their funds on online shopping. JPMorgan doesn't believe this is the case—at least not entirely—they believe earners also spent time on social media seeing how other people were investing their cash. Referencing a 2022 research letter about the retail traders involved in the GameStop frenzy, the authors wrote: “Demographic shifts in investing flows during the pandemic—driven in part by social media investment fads—were much larger than the modest month-to-month differentiation appearing in the ensuing years.” An increased interest in financial products among younger people offers an opportunity for improvement, added Wheat and Eckerd: “Expansion in investing of younger generations highlights the importance of financial education tailored to these new entrants in financial markets to support long-term outcomes for a larger population. In rising markets, a broader part of the population will face tax implications of capital gains, which may be a source of negative financial surprises around tax time if financial education doesn't adapt.” “In market downturns, we'll see a significant number of new investors facing losses—directly visible to them in real-time. New investors, or even seasoned ones, may not be adequately well equipped to manage their responses, suggesting potential shifting roles for financial advisors.” The investment gap Many of the individuals drawn to investing during the pandemic were men. JPMorgan's research found that while the number of female customers making transfers into investment accounts rose during the pandemic (up from around 15% in 2020 to 20% in 2021), ultimately their participation as a share of retail investors as a whole stayed relatively flat at a little over 35%. Conversely, the number of men transferring cash into investment accounts spiked from around 20% to approximately 30%—and still sit significantly (approximately 7%) ahead of female counterparts. “While investing flows of men increased in November 2024 relative to women, they subsequently returned close to their 2024 average. Changes in economic optimism, potentially related to political outcomes, could explain the temporary gender shift,” the JP duo added. While studies have shown women can prove to be better investors than men , they are also reportedly more risk-adverse and lose out on gains as a result. A 2024 study from insurance and pensions giant Aviva showed nearly four in 10 women don't invest, with 18% of them saying the risk is too high for them to consider it. But other imbalances are being addressed, JPMorgan found, with accessible investing platforms like mobile apps making it easier for lower-income earners to engage with markets. While “sizable” gaps remain between higher earners and lower, the report found the below-median-income share of investors in 2014 sat at around 22%, which spiked to approximately 35% during the pandemic. At present that figure has normalized to around 30%. “Greater growth among lower-income individuals has narrowed the investing gap across income groups,” the pair noted. “This means that in the first half of the 2010s, below-median-income individuals made up approximately 20% of those investing in a given month, whereas in May 2025 their share was 31%. Outside of months influenced by pandemic cash stimulus payments, this was the highest value in the series dating back to the Great Recession.” Introducing the 2025 Fortune Global 500 , the definitive ranking of the biggest companies in the world. Explore this year's list. About the Author Eleanor Pringle Reporter Eleanor Pringle is an award-winning reporter at Fortune covering news, the economy, and personal finance. Eleanor previously worked as a business correspondent and news editor in regional news in the U.K. She completed her journalism training with the Press Association after earning a degree from the University of East Anglia. SEE FULL BIO

J.P. Morgan Chase Frequently Asked Questions (FAQ)

When was J.P. Morgan Chase founded?

J.P. Morgan Chase was founded in 2000.

Where is J.P. Morgan Chase's headquarters?

J.P. Morgan Chase's headquarters is located at 270 Park Avenue, New York.

What is J.P. Morgan Chase's latest funding round?

J.P. Morgan Chase's latest funding round is PIPE.

Who are the investors of J.P. Morgan Chase?

Investors of J.P. Morgan Chase include Public Investment Fund and Berkshire Hathaway.

Who are J.P. Morgan Chase's competitors?

Competitors of J.P. Morgan Chase include Chime, Fidelity Investments, Discover, Revolut, Caceis and 7 more.

Loading...

Compare J.P. Morgan Chase to Competitors

Barclays is a financial services company that provides banking and financial solutions. Its offerings include digital banking services, personal banking, corporate banking, wealth management, and international banking. Barclays provides insurance products, investment services, mortgages, loans, savings accounts, and credit cards. It is based in London, England.

Truist Securities is the corporate and investment banking division of Truist Financial Corporation, focusing on various financial services. The company offers investment banking services, including strategic advisory, mergers and acquisitions, and capital markets solutions, as well as corporate banking services such as corporate finance, asset finance, risk management, and treasury management. Truist Securities serves corporate and institutional clients with its financial products and services. It was founded in 2020 and is based in Atlanta, Georgia.

Bank of Hunan is a financial institution that operates in the banking sector, providing services related to international money transfers. The company offers codes for its branches, which are used for routing international financial transactions. It was founded in 2010 and is based in Changsha, Hunan.

Citibank operates as a financial services company in the banking sector. The company offers a variety of services such as banking, credit cards, mortgage solutions, and personal loans. Citibank serves both individual consumers and businesses with these financial products. Citibank was formerly known as City Bank of New York. It was founded in 1812 and is based in New York, New York.

Fidelity Investments is a financial services company that provides retirement planning, wealth management, and brokerage services. The company offers various investment products such as mutual funds, ETFs, stocks, bonds, options, and annuities, along with financial planning and advice. It serves individuals, families, employers, wealth management firms, and institutions. It was founded in 1946 and is based in Boston, Massachusetts.

MUFG Bank operates as a core banking entity of the Mitsubishi UFJ Financial Group, offering financial services to individuals, businesses, and institutions globally. It provides financial solutions, including corporate and investment banking, retail banking, transaction banking, treasury and markets, and asset management. It was founded in 1919 and is based in Tokyo, Japan.

Loading...