Investments

17Portfolio Exits

14Funds

1Partners & Customers

10Service Providers

3About Intuit

Intuit (NASDAQ: INTU) provides business and financial management solutions. It helps to simplify small business management and payroll processing, personal finance, tax preparation, and filing. It serves small and mid-sized businesses, financial institutions, credit unions, and more. It was founded in 1983 and is based in Mountain View, California.

Expert Collections containing Intuit

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Intuit in 6 Expert Collections, including HR Tech.

HR Tech

65 items

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Digital Lending

2,187 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

1,586 items

Gig Economy Value Chain

155 items

Startups in this collection are leveraging technology to provide financial services and HR offerings to the gig economy industry

Fintech

8,067 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Research containing Intuit

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Intuit in 4 CB Insights research briefs, most recently on Dec 18, 2023.

Oct 26, 2023

The CFO tech stack market map

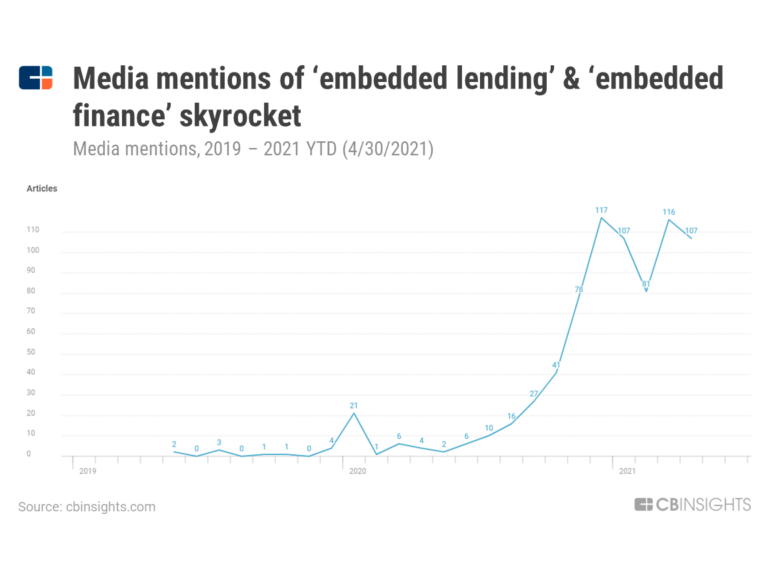

Jun 1, 2021

Should Banks Adopt Embedded Lending?Latest Intuit News

Mar 6, 2024

An article in the tested the accuracy of the tax advice given by models recently deployed by Intuit's TurboTax and H&R Block. Both companies were faulted for providing answers that were either irrelevant or flat out wrong. For instance, when asked about whether there were tax credits available for having installed a new air conditioner, TurboTax's AI responded with information about educational expenses; meanwhile, when asked about whether wash sale rules apply to cryptocurrency, H&R Block's AI responded that, yes, they do when, in fact, they do not. Heather Watts, senior vice president of consumer tax products at H&R Block, said in an email that AI Tax Assist is but one of many ways they assist with the preparation process and tax questions, which includes the ability to speak live to a human professional at no extra cost. The generative AI, she said, is more meant to supplement the tax preparation process, and is not meant to be the final word when it comes to one's taxes. Real time monitoring and evaluation of customer interactions with the AI tool, she said, do not suggest a significant number of incorrect or irrelevant answers. She added that the errors produced by the bot during the Washington Post's testing could be the result of insufficiently detailed prompts. "As with any AI tool, when individuals provide detailed, contextual information, AI Tax Assist generates more accurate and helpful responses. Regarding The Washington Post's coverage, our experts at The Tax Institute tested the responses deemed inaccurate, finding that alternate phrasing and use during the guided interview led to more accurate responses," she said, adding also that H&R Block overall is backed by guarantees including audit support, maximum refund and 100% accuracy. Karen Nolan, senior earned media manager with Intuit Consumer Group's TurboTax communications team, similarly, said the generative AI tool was never meant to be the end all be all of tax advice but, rather, one of many parts of the overall experience that helps people file with confidence. The use of AI, she said, is less about doing all the tax work for the user and more about automating repetitive tasks to save time and ensure accuracy. "For example, AI reduces data entry errors by extracting and categorizing data from forms, improves the identification, classification and placement of data in the correct fields, and auto-populates tax form information from tax documents," she said. Contrary to what the Post reported, she said Intuit has not found a significant number of people experiencing issues with their AI tool. Intuit, she said, understands the stakes involved in an accurate tax filing, which explains their guarantee policy. "At TurboTax, we understand the seriousness of taxes and finances and we provide every filer with a tax return lifetime guarantee, including 100% accurate calculations, audit support and a maximum refund," she said. This is but the latest controversy regarding the accuracy of claims made by generative AI bots. The Associated Press, for example, Meanwhile, there was also the matter of a generative AI chatbot used by giving someone inaccurate price information, saying a customer could claim a refund after purchasing tickets when, in fact, the specific policy was to not give refunds once the flight has been booked. While the airline tried to claim that the chatbot was a separate legal entity and that, further, the customer should have never trusted what it said anyway, a court nonetheless ordered the company to give him a partial refund plus additional damages to cover interest on the airfare and tribunal fees. In soon-to-be-forthcoming research data conducted by Accounting Today's parent company, it was found that inaccurate or irrelevant information was the number one concern accountants had about generative AI: 50% reported they were very concerned about this and 35% said they were somewhat concerned. The incidents also speak to another major concern we found in the data: the degradation of client trust and transparency: 42% are very concerned and 29% are somewhat concerned. Emails to Intuit and H&R Block have yet to be returned as of publication.

Intuit Investments

17 Investments

Intuit has made 17 investments. Their latest investment was in Clearco as part of their Series C - II on July 08, 2021.

Intuit Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

7/8/2021 | Series C - II | Clearco | $215M | Yes | 59 | |

4/22/2020 | Grant | Virtual Enterprises International | $1M | Yes | 1 | |

11/28/2019 | Unattributed VC | Bolt | $50M | Yes | ||

8/2/2016 | Series B | |||||

11/18/2014 | Series C - II |

Date | 7/8/2021 | 4/22/2020 | 11/28/2019 | 8/2/2016 | 11/18/2014 |

|---|---|---|---|---|---|

Round | Series C - II | Grant | Unattributed VC | Series B | Series C - II |

Company | Clearco | Virtual Enterprises International | Bolt | ||

Amount | $215M | $1M | $50M | ||

New? | Yes | Yes | Yes | ||

Co-Investors | |||||

Sources | 59 | 1 |

Intuit Portfolio Exits

14 Portfolio Exits

Intuit has 14 portfolio exits. Their latest portfolio exit was Revel Systems on February 06, 2017.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

2/6/2017 | Acq - Fin | 2 | |||

3/8/2016 | Divestiture | Quickbase | 2 | ||

3/4/2016 | Divestiture | Quicken | 1 | ||

Date | 2/6/2017 | 3/8/2016 | 3/4/2016 | ||

|---|---|---|---|---|---|

Exit | Acq - Fin | Divestiture | Divestiture | ||

Companies | Quickbase | Quicken | |||

Valuation | |||||

Acquirer | |||||

Sources | 2 | 2 | 1 |

Intuit Acquisitions

61 Acquisitions

Intuit acquired 61 companies. Their latest acquisition was SeedFi on December 01, 2022.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

12/1/2022 | Other Venture Capital | $69M | Acquired | 10 | ||

12/21/2021 | Seed / Angel | $4M | Acquired | 5 | ||

9/13/2021 | Seed / Angel | $0.12M | Acquired | 40 | ||

2/2/2021 | ||||||

8/4/2020 | Series B |

Intuit Fund History

1 Fund History

Intuit has 1 fund, including Coalfield Solar Fund.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

Coalfield Solar Fund | 2 |

Closing Date | |

|---|---|

Fund | Coalfield Solar Fund |

Fund Type | |

Status | |

Amount | |

Sources | 2 |

Intuit Partners & Customers

10 Partners and customers

Intuit has 10 strategic partners and customers. Intuit recently partnered with Khan Academy on February 2, 2024.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

2/1/2024 | Partner | United States | 3 | ||

9/1/2023 | Partner | United States | 1 | ||

7/5/2023 | Partner | United States | 1 | ||

7/3/2023 | Partner | ||||

6/7/2023 | Partner |

Date | 2/1/2024 | 9/1/2023 | 7/5/2023 | 7/3/2023 | 6/7/2023 |

|---|---|---|---|---|---|

Type | Partner | Partner | Partner | Partner | Partner |

Business Partner | |||||

Country | United States | United States | United States | ||

News Snippet | |||||

Sources | 3 | 1 | 1 |

Intuit Service Providers

4 Service Providers

Intuit has 4 service provider relationships

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Acquired | Merchant Bank | Financial Advisor | |

Service Provider | |||

|---|---|---|---|

Associated Rounds | Acquired | ||

Provider Type | Merchant Bank | ||

Service Type | Financial Advisor |

Partnership data by VentureSource

Compare Intuit to Competitors

Intuit QuickBooks is a company that specializes in cloud-based accounting and tax software solutions. The company offers a range of products that help businesses manage their finances, including accounting, payroll, time tracking, and banking services. These services enable businesses to track expenses, manage bills, calculate sales tax, and handle various other financial tasks. It was founded in 1983 and is based in Mountain View, California.

Banana.ch is a software solution company that specializes in the development of accounting software for small businesses, non-profit organizations, and individuals. The company's main product, Banana Accounting Plus, is a user-friendly software that provides professional accounting services including expense and revenue management, VAT management, invoicing, budget planning, inventory management, and time management. The company primarily serves the financial technology industry. It was founded in 1990 and is based in Lugano, Switzerland.

Pilot provides bookkeeping, tax, and chief financial officer (CFO) services to startups and small businesses. It manages users' financial recordkeeping, including invoicing, expense tracking, bank reconciliation, and more. It prepares users' taxes and provides financial expertise and guidance to make informed business decisions. It offers solutions for startups, consumer goods retail companies, and more. It was formerly known as Zapgram. It was founded in 2016 and is based in San Francisco, California.

Jackson Hewitt Tax Service operates as a tax preparation company. it focuses on providing clients with tax-related services. The company offers full-service tax preparation, striving to ensure maximum refunds and accuracy for their clients' tax returns. Jackson Hewitt primarily serves individual taxpayers seeking assistance with their annual tax filings. It was founded in 1982 and is based in Sarasota, Florida.

Dext develops and provides bookkeeping automation software. It creates software to automate accounting processes such as the collection of receipts and invoices for small businesses. Dext was formerly known as Receipt Bank. It was founded in 2010 and is based in London, United Kingdom.

ContaAzul offers software-as-a-service accounting and invoicing solutions for small businesses. Its services include quotes by email, contract management, sales management, electronic invoice management, and more. It was founded in 2012 and is based in Joinville, Brazil.

Loading...