Instacart

Founded Year

2012Stage

IPO | IPOTotal Raised

$2.861BDate of IPO

9/19/2023Market Cap

11.71BStock Price

45.29Revenue

$0000About Instacart

Instacart offers grocery technology that operates an online marketplace for grocery delivery and pickup services. It connects customers with personal shoppers who pick, pack, and deliver groceries from local stores. Instacart serves the electronic commerce (e-commerce) industry by partnering with national, regional, and local retailers to facilitate online shopping and provide technology products for order fulfillment and digital store services. It was formerly known as Maplebear Canada. It was founded in 2012 and is based in San Francisco, California.

Loading...

ESPs containing Instacart

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

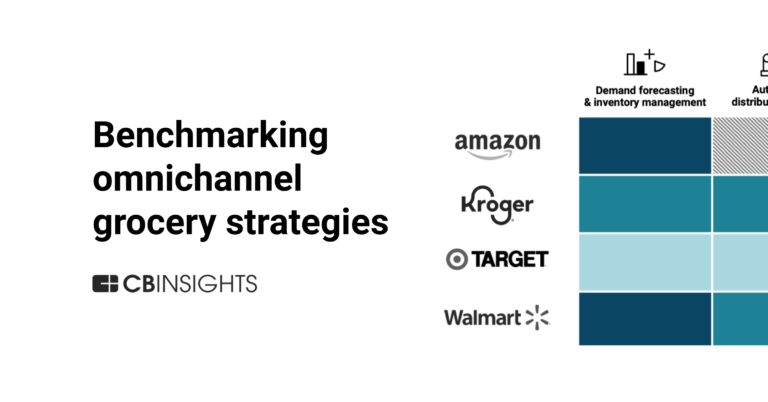

The on-demand grocery delivery market consists of third-party platforms that connect consumers with grocery products from multiple retailers, dark stores, or independent warehouses. Unlike retailer-owned delivery services, these companies operate as intermediaries, maintaining their own driver networks and technology infrastructure to enable rapid deliveries. They typically offer competitive prici…

Instacart named as Leader among 15 other companies, including Uber, DoorDash, and Ocado Group.

Loading...

Research containing Instacart

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Instacart in 19 CB Insights research briefs, most recently on Apr 7, 2025.

Jan 4, 2024 report

State of Venture 2023 Report

Nov 21, 2023

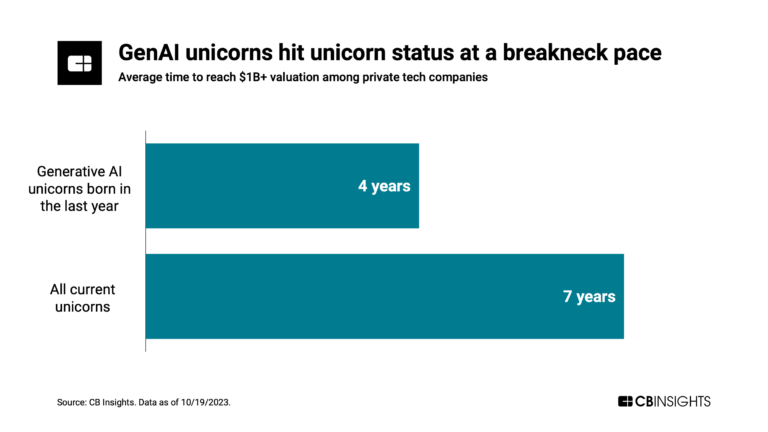

Has the global unicorn club reached its peak?

Nov 20, 2023 report

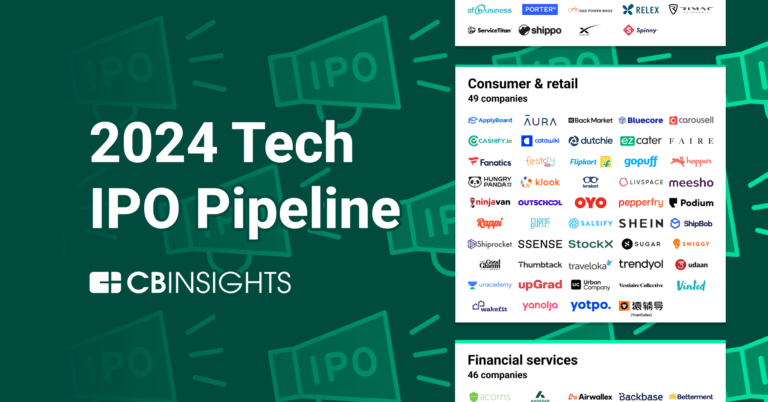

The 2024 Tech IPO Pipeline

Oct 12, 2023 report

State of Venture Q3’23 ReportExpert Collections containing Instacart

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Instacart is included in 8 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

6,172 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Grocery Retail Tech

648 items

Startups providing B2B solutions to grocery businesses to improve their store and omni-channel performance. Includes customer analytics platforms, in-store robots, predictive inventory management systems, online enablement for grocers and consumables retailers, and more.

On-Demand

1,244 items

Tech IPO Pipeline

568 items

Food & Meal Delivery

1,605 items

Startups and tech companies offering online grocery, food, beverage, and meal delivery services.

Conference Exhibitors

5,302 items

Latest Instacart News

Sep 6, 2025

40 index, according to Le Monde . They include Marguerite Bérard at ABN Amro, Ariane Gorin at Expedia, Christophe Fouquet at ASML, and Fidji Simo at Instacart While it isn't particularly unusual for a foreign national to head a major company in another country, what is surprising is the number of French C-suite players outside of French borders. Le Monde recently highlighted that a disproportionate number of French national CEOs lead companies outside their home country, more than in any other European country. Whether it's Marguerite Bérard at ABN Amro, Ariane Gorin at Expedia, Christophe Fouquet at ASML, or Fidji Simo at Instacart, there are many major French players at a very high level. Laurent Freixe at Nestlé would have been on this list too before being recently ousted for having concealed an affair with a more junior colleague. In fact, French nationals head about 30 major foreign companies with a total valuation of $2 trillion, comparable to the entire market cap of France's CAC 40 index, according to Le Monde So, what's the secret to French success overseas? Well, it starts early. Napoleon laid the foundation for the French school system, creating secondary schools that could produce a political class capable of effectively running the military and the country, as well as a middle class that wouldn't want to cause another revolution. Many functioned in a regimented manner, similar to military schools. Today, the French school system still separates the elite, continuously encouraging children—even at an elementary level—to consider how their grades today will help them secure the finest jobs after attending the best higher education institutions. These are the grandes écoles, where admission is fierce, and follow two years of intensive training in classes préparatoires, which are akin to university. The grandes écoles include elite business schools, such as École Polytechnique, HEC Paris, Institut d'Études Politiques de Paris, ESSEC, and Sciences Po, whose graduates have a reputation for strong business acumen, strategy, and analytical skills. And it is these skills that the business world highly values, wherever they may be located. Strong English skills are expected. Many of these graduates become French politicians or part of the French elite, effectively creating a management class in every part of French society. In 1980, an American study revealed that 80% of the top executives in the most prominent French companies came from just five grandes écoles. Some of these French executives relocate overseas through a posting with a French firm and then transition to a different company; some of these CEOs have been outside of France for decades. Matthieu Courtecuisse, founder of consulting firm Sia Partners, told Le Monde that he believes it's part of a brain drain. U.S. companies are filled with French PhD holders at all levels, many working in U.S. biology or artificial intelligence organizations, which he sees as a symptom of France's de-industrialization. Others might say that non-French companies are attractive to French executives because the French working world can be notoriously rigid. Strict hierarchical structures and highly bureaucratic labor laws discourage risk-taking. In addition, French employers expect candidates to possess specific qualifications and experience. However, work cultures differ, and companies outside of France can allow for more flexibility. An interesting conundrum arises from the fact that it may be the very nature of elite schools and a rigid corporate culture that encourages some French leaders to move away. Fortune Global Forum returns Oct. 26–27, 2025 in Riyadh. CEOs and global leaders will gather for a dynamic, invitation-only event shaping the future of business. Apply for an invitation. About the Author Alex Ledsom SEE FULL BIO

Instacart Frequently Asked Questions (FAQ)

When was Instacart founded?

Instacart was founded in 2012.

Where is Instacart's headquarters?

Instacart's headquarters is located at 50 Beale Street, San Francisco.

What is Instacart's latest funding round?

Instacart's latest funding round is IPO.

How much did Instacart raise?

Instacart raised a total of $2.861B.

Who are the investors of Instacart?

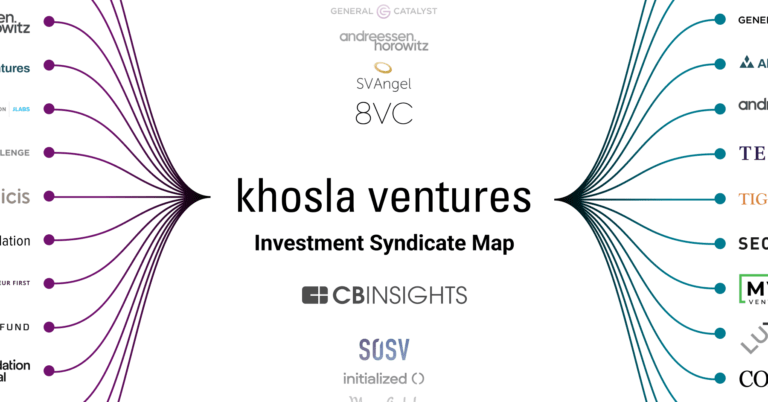

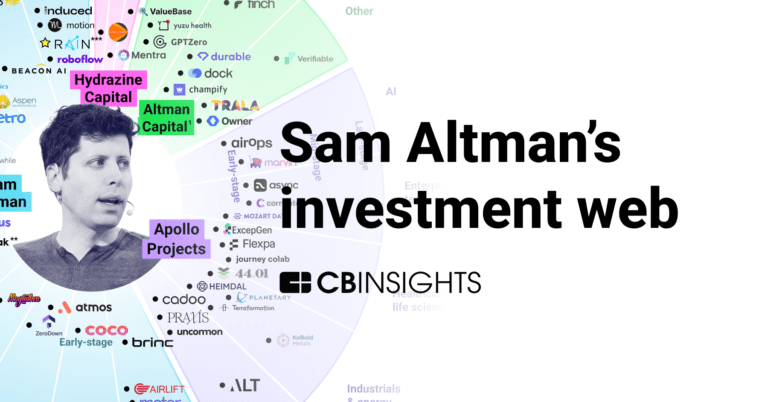

Investors of Instacart include PepsiCo, Sequoia Capital, D1 Capital Partners, Andreessen Horowitz, T. Rowe Price and 34 more.

Who are Instacart's competitors?

Competitors of Instacart include Rappi, Jokr, Shadowfax, Roadie, Ninja Van and 7 more.

Loading...

Compare Instacart to Competitors

Glovo provides delivery services across sectors. It offers a platform for users to order food, groceries, and other items from local businesses and have them delivered. It serves the electronic commerce industry with a focus on food delivery and retail items. It was founded in 2015 and is based in Barcelona, Spain.

Shadowfax offers ecommerce, Direct-to-Consumer (D2C), hyperlocal, and quick commerce delivery services. The company provides standard, same day, and next day delivery, as well as on-demand pickup and drop-off services for various sectors. Shadowfax serves ecommerce businesses, small and medium enterprises, and individuals requiring courier services. It was founded in 2015 and is based in Bengaluru, India.

Gopuff is a commerce platform operating in the retail sector. It offers various products, including groceries, alcohol, home essentials, cleaning products, medication, pet care, office supplies, beauty and wellness items, baby products, food, drinks, and local brands, all available for delivery. It was founded in 2013 and is based in Philadelphia, Pennsylvania.

Huolala is an internet logistics platform. It provides same-city and cross-city freight transportation, enterprise logistics services, less-than-truckload (LTL) transportation, car rental and after-sales services, and more. It was formerly known as EasyVan. The company was founded in 2013 and is based in Guangzhou, China.

Roadie provides logistics management and crowdsourced delivery solutions within the logistics and transportation industry. The company offers local same-day delivery, delivery from warehouse with in-house sortation, oversized delivery, and returns services. Its services are utilized in various sectors including electronic commerce, healthcare, and construction supplies. It was founded in 2014 and is based in Atlanta, Georgia. In September 2021, Roadie was acquired by United Parcel Service.

Ninja Van is a tech-enabled logistics company that specializes in e-commerce express logistics. The company offers a suite of solutions for parcel delivery, including digital and full-funnel marketing services to enhance shippers' sales. Ninja Van's network extends to various sectors, including e-commerce and business-to-business inventory restocking. It was founded in 2014 and is based in Singapore.

Loading...