After a strong start to the year, digital health experienced a pullback in Q2’25. Deal volume declined, marking the lowest level of quarterly activity in the last 5 years. The drop reflects growing selectivity in a market still grappling with economic uncertainty and selective capital allocation.

AI continued to dominate funding, reflecting capital concentration in fewer, high-conviction bets. Established companies attracted investors, as evident by the quarter’s two $1B+ IPOs. The result is a market divided between mature companies attracting major capital, while the broader sector contracts.

Download the full report to access comprehensive data and charts on the evolving state of digital health.

Key takeaways from the report include:

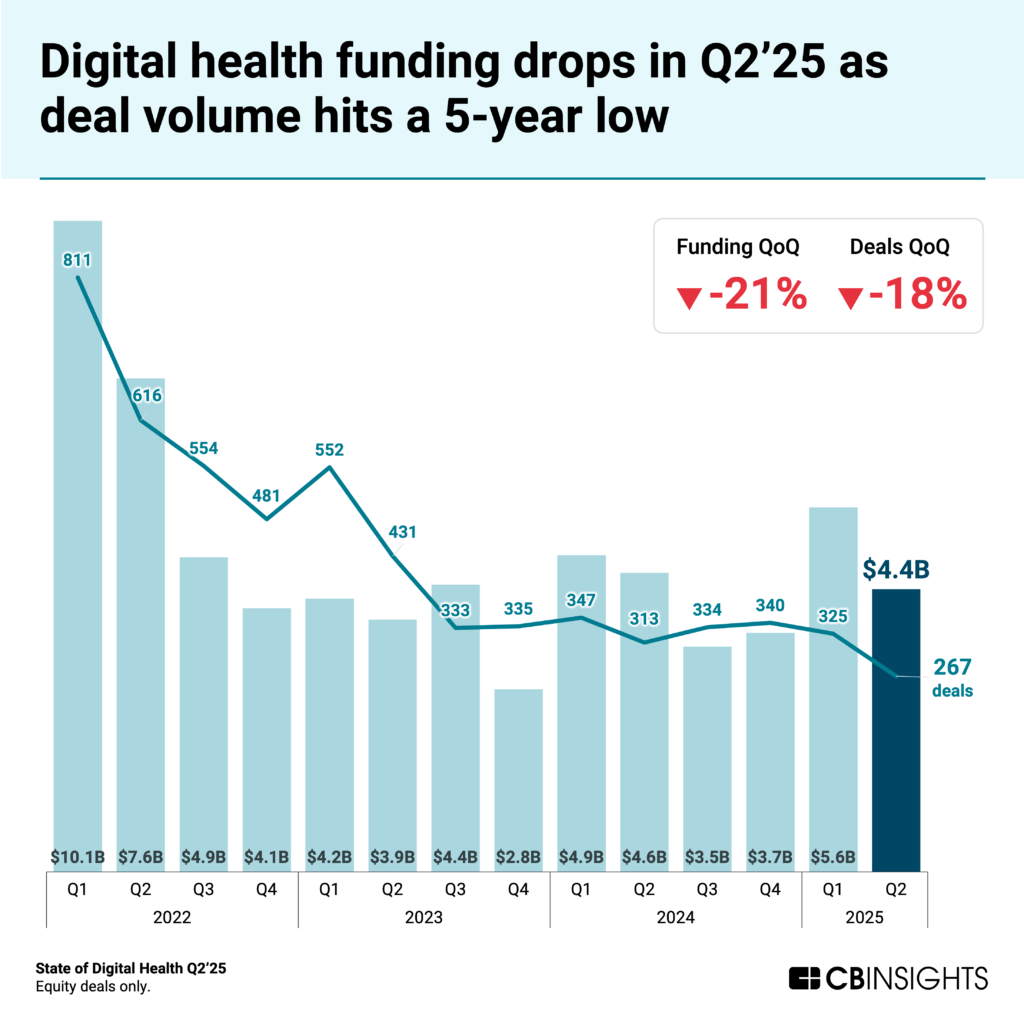

- Funding fell as deal volume hit a 5-year low. Equity funding dropped 21% QoQ to $4.4B, while deal count declined to 267 from 325 in Q1’25 — the lowest quarterly total in the last 5 years, according to CB Insights data. The pullback follows a strong Q1, with global economic uncertainty and reduced capital dampening dealmaking activity.

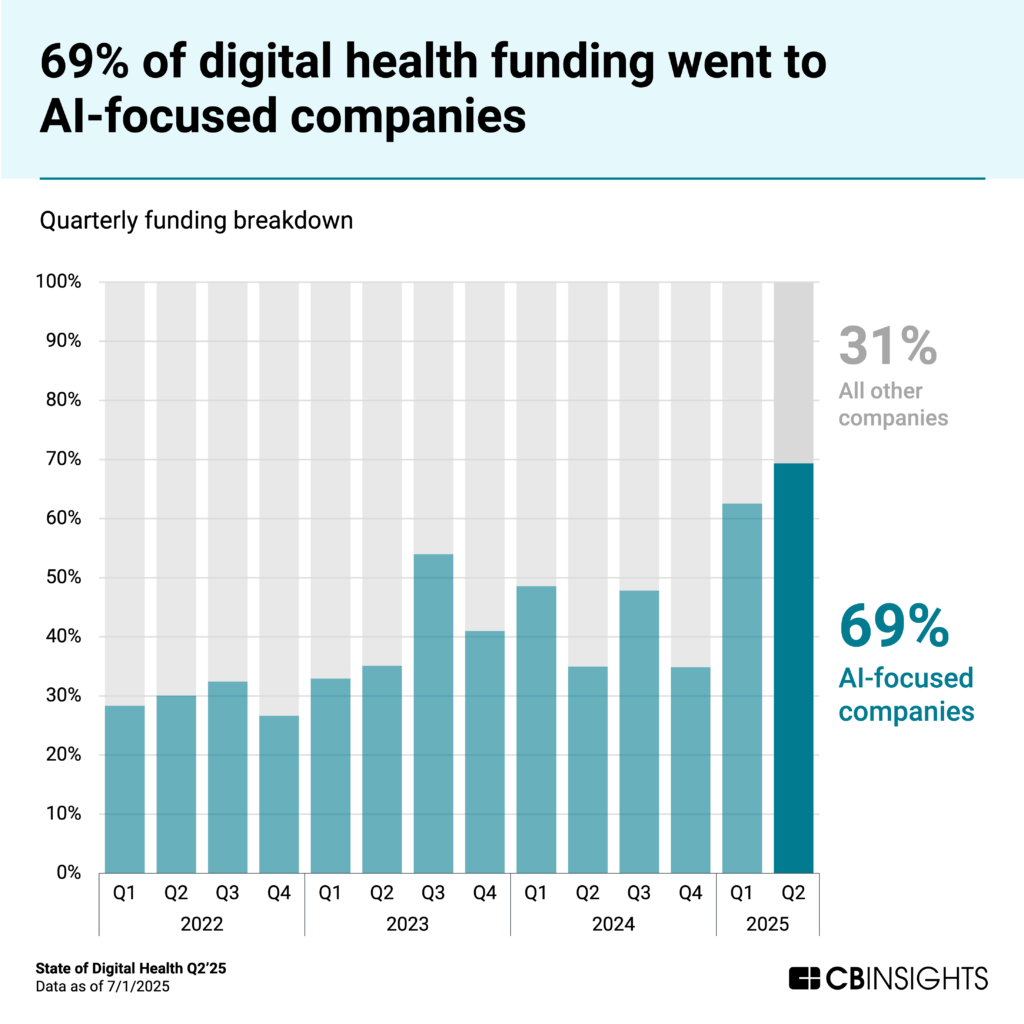

- AI companies captured more than two-thirds of digital health funding. AI startups raised $3B in Q2, accounting for 69% of all digital health funding, up from 60% in Q1. The AI deal share held steady from the previous quarter at 41%, with capital flowing to areas such as clinical documentation, brain-computer interfaces, and electronic health record (EHR) integration tools.

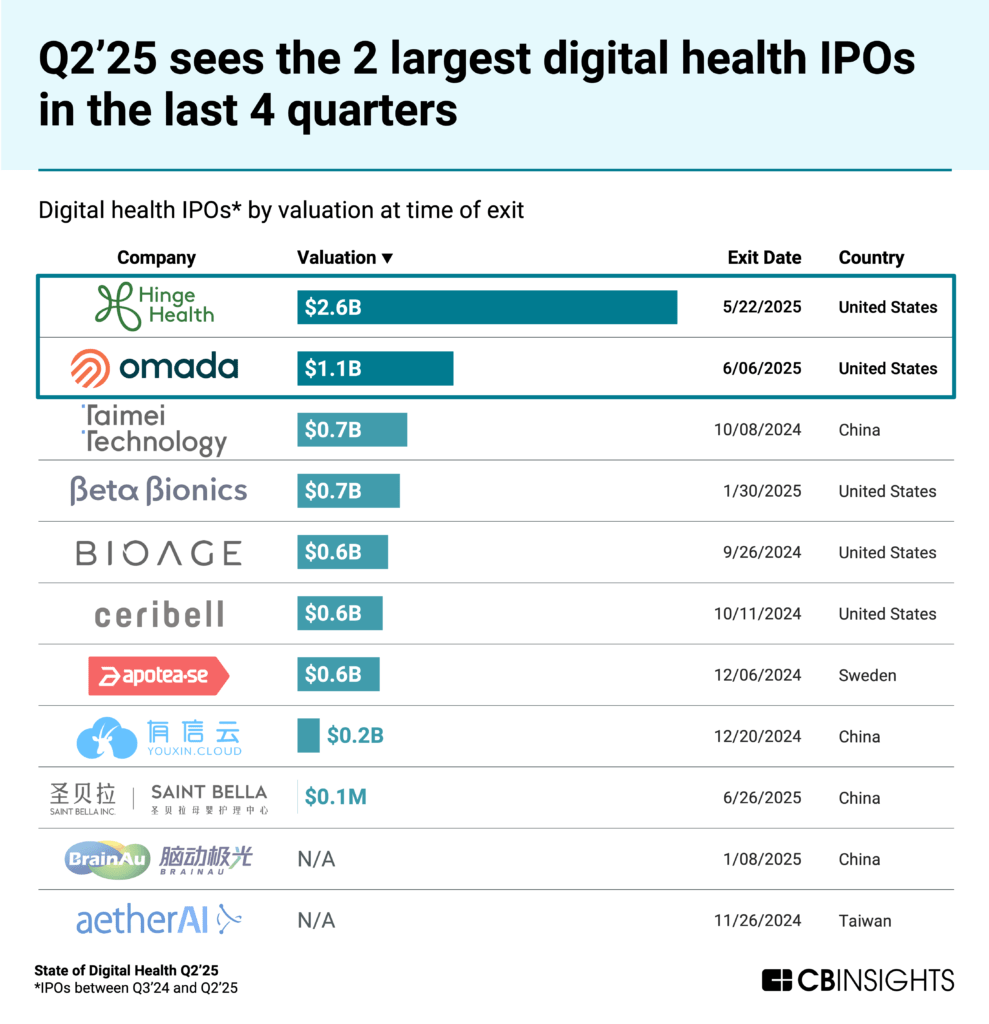

- 2 digital health companies went public with $1B+ valuations. Hinge Health and Omada Health went public in Q2 at valuations of $2.6B and $1.1B, respectively. Both companies offer employer-driven chronic care programs and represent the year’s largest digital health IPOs — the first to debut above the $1B mark in the last 4 quarters.

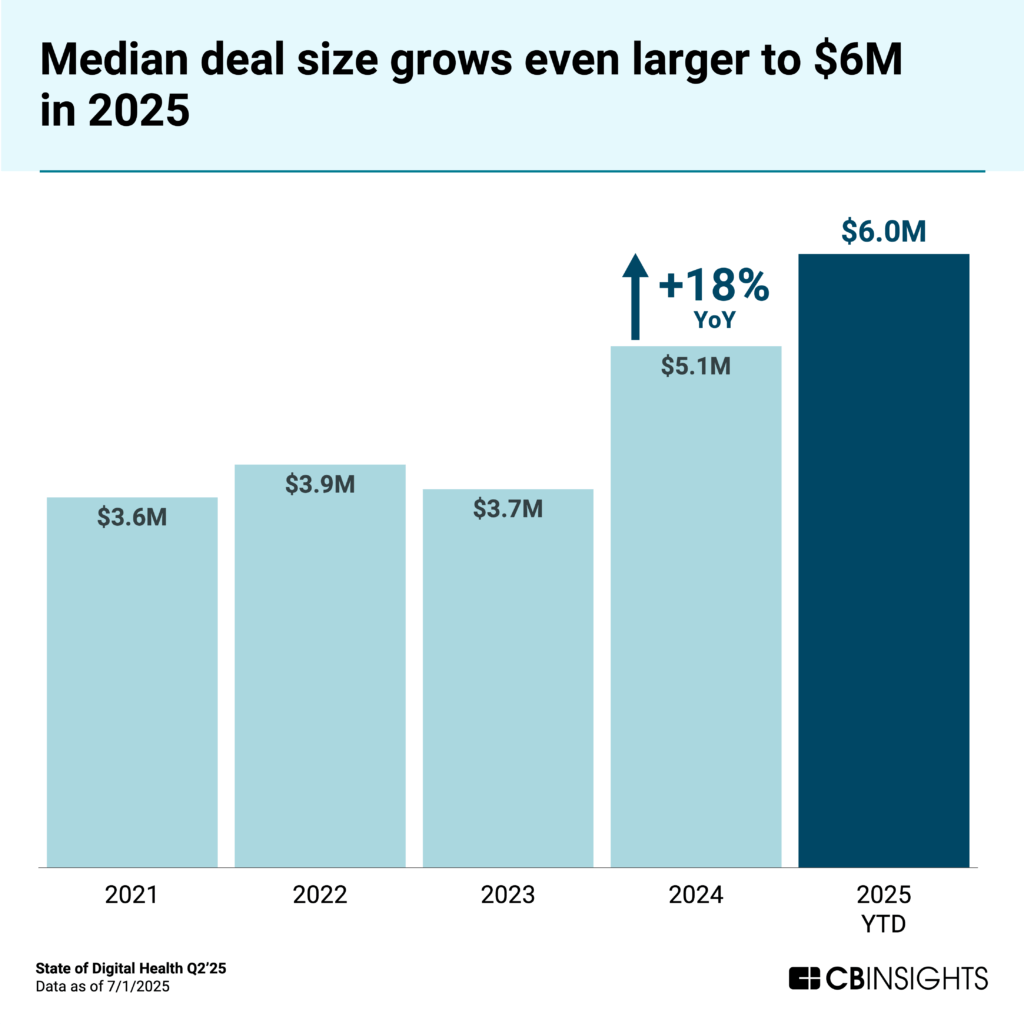

- Median deal size continues to rise in 2025 as investors prioritize larger rounds. The global median deal size reached $6M for the first half of the year, up from $5.1M in 2024. The U.S. led the increase with a median deal size of $9.3M.

We dive into the trends below.

Funding fell as deal volume hit a 5-year low

Digital health equity funding fell 21% QoQ in Q2’25, while deal volume dropped 18% to its lowest level in 5 years. This trend mirrors the broader venture landscape, where deal activity reached its lowest level since 2016.

Despite the pullback, Q2 produced 2 new unicorns this quarter. AI-driven oncology drug developer Pathos raised a $365M Series D round, one of the largest digital health funding rounds of the quarter. Telenutrition platform Nourish reached unicorn status after securing its $70M Series B round.

The funding landscape this quarter shows a clear preference for mature companies. Early-stage rounds averaged $7.7M in Q2, down from $11.7M in Q1. Meanwhile, late-stage deals averaged $137M, up 69% from the prior quarter.

This rise was powered by a few significant raises, most notably the Elon Musk co-founded Neuralink’s $650M Series E round – the largest digital health deal since 2021. The funding will advance the company’s AI-powered brain-computer interface platform, with applications aimed at neurological disorders.

AI companies captured more than two-thirds of digital health funding

AI-focused companies captured 69% of digital health funding in Q2’25 — up from 60% in Q1 — while deal share held steady at 41%. Notably, AI companies claimed 9 of the 10 largest deals this quarter, including 6 of the 7 mega-rounds ($100M+).

In fact, AI companies drove funding across multiple markets in Q2. The medical brain-computer interface market was the highest-funded market in digital health, driven solely by Neuralink’s $650M Series E round.

The second highest-funded market this quarter was clinical documentation solutions ($639M across 5 deals). This included Abridge ($300M), Commure ($200M), and Nabla ($70M), all of which are building AI-powered clinical note-taking tools. All three companies have CB Insights Mosaic scores above 900, indicating strong company health.

Two digital health companies went public with $1B+ valuations

Digital health saw its first significant IPO activity in over a year, with Hinge Health and Omada Health debuting in Q2’25 at valuations of $2.6B and $1.1B, respectively.

These are the first digital health IPOs to debut above the $1B mark in the last 4 quarters. Both companies target employer populations with chronic care programs, betting that access to commercially insured patients will attract payers seeking cost savings.

Hinge Health provides musculoskeletal therapy programs to employers and health plans, combining virtual physical therapy, motion tracking, and personalized coaching. Omada Health targets chronic conditions like diabetes, hypertension, and obesity through its AI-enhanced virtual care platform, which introduced a nutrition-focused agent this year.

Both companies went public after years of sustained growth and funding. Hinge Health raised $854M across 12 rounds before its IPO, including a $400M Series E round in October 2021. Omada Health raised $530M over 14 rounds. Its most recent financing was a $192M Series E round in February 2022.

Their IPOs break a multi-year drought as digital health companies delayed going public amid market volatility. As 2 of the sector’s most mature startups, these exits may be bellwethers for the industry.

Deal sizes continue to rise in 2025 as investors prioritize larger rounds

The global median digital health deal size reached $6M as of Q2’25, up from $5.1M in 2024, the highest level in the last 4 years. Also, the average deal size jumped to $22.2M, a 35% increase from 2024, reflecting a concentration of larger deals at the top.

In fact, 44% of total digital health funding in Q2 were from the 7 mega-rounds.

Late-stage median round size hit $49M in the first half of 2025, up 23% from $40M in 2024 — the highest since 2021’s $74M peak. These figures indicate that investors are consolidating capital around fewer, larger late-stage bets.

MORE DIGITAL HEALTH RESEARCH FROM CB INSIGHTS

- State of Digital Health Q1’25 Report

- State of Venture Q2’25 Report

- Pharma AI readiness: How the 50 largest companies by market cap stack up

- The AI in drug R&D market map

- The humanoid robots market map