Life & health (L&H) insurtechs dominated Q2’25, outraising property & casualty (P&C)-focused counterparts for the first time in nearly 4 years.

Individual coverage health reimbursement arrangement (ICHRA)-focused deals nudged L&H deal count upward, in part driving the highest deal share among US-based insurtechs since Q3’17.

Below, we break down the key takeaways from this quarter’s report, including:

- Quarterly insurtech deal count dips below 100 again

- Funding to P&C insurtechs plummets from Q2’21 peak

- $100M+ mega-round deals lead to a surge in L&H insurtech funding

- ICHRA startups capture nearly 20% of insurtech funding

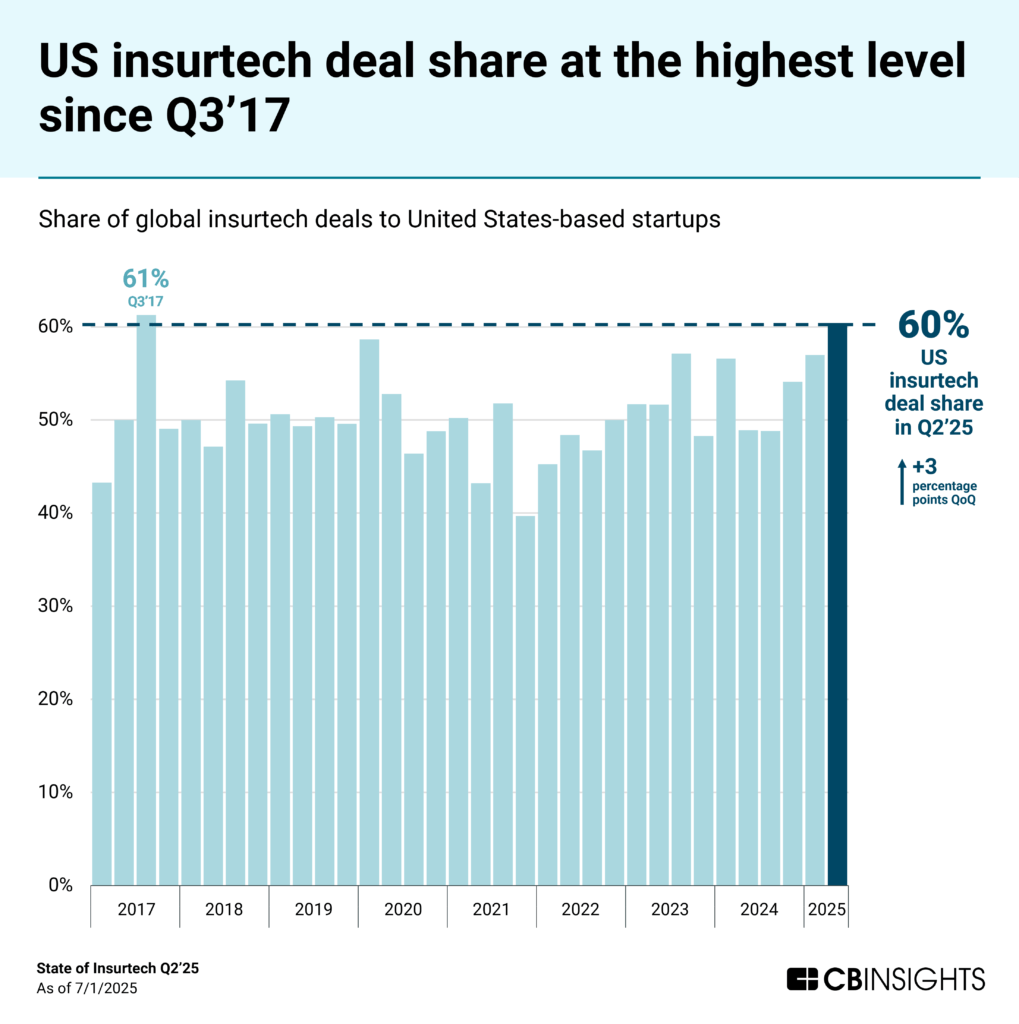

- US-based startups raise 3 in 5 global insurtech deals

Download the full report to access comprehensive data and charts on the evolving state of insurtech.

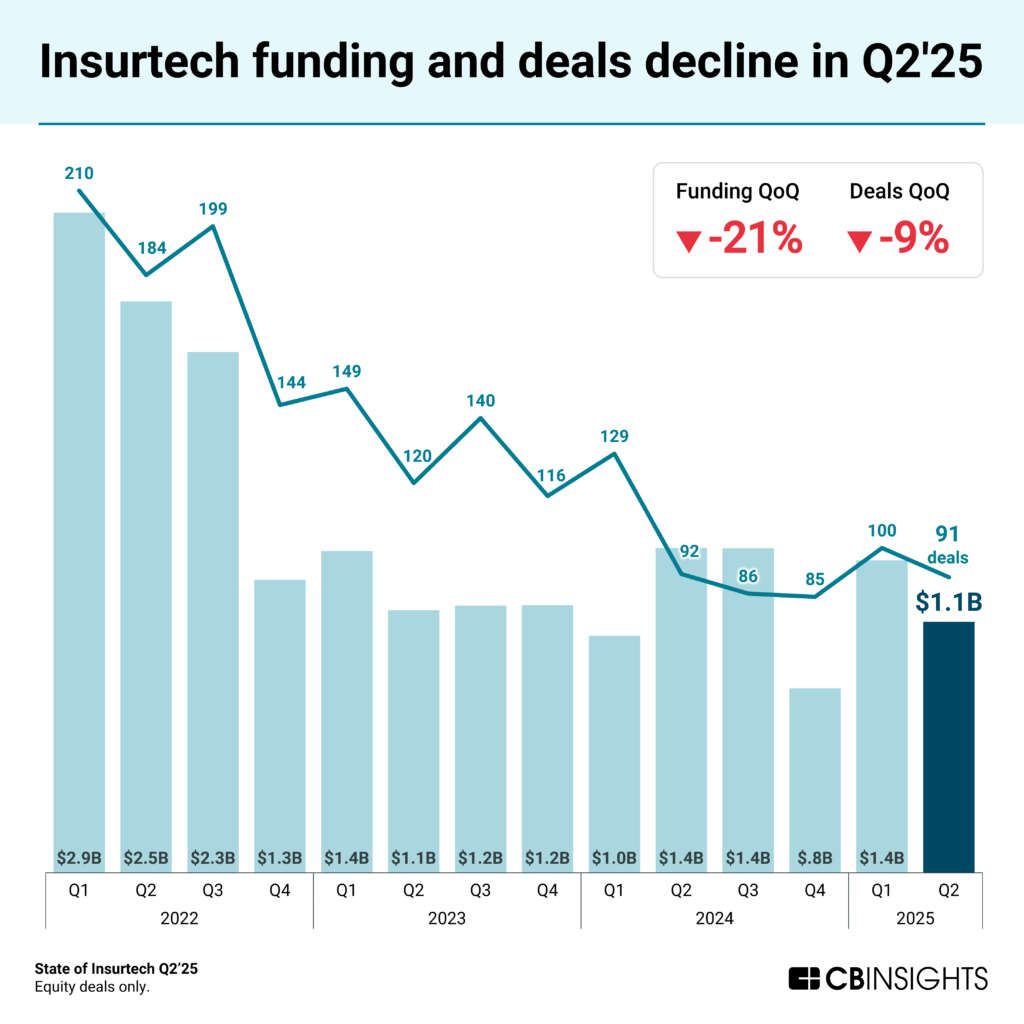

Quarterly insurtech deal count dips below 100 again

Insurtech deal count fell 9% quarter-over-quarter (QoQ), from 100 deals in Q1’25 to 91 in Q2’25. This decrease mirrors the broader venture environment, which also saw QoQ deal count decline by the same percentage.

Insurtech funding fell 21% QoQ, from $1.4B in Q1’25 to $1.1B in Q2’25 — also in line with the broader venture environment (-24% QoQ). However, unlike the rest of venture, insurtech has not experienced an AI-driven funding boom in recent quarters. The median venture deal size reached a new high of $3.5M in 2025 YTD, largely due to AI, while the median insurtech deal size has fallen by 19% to $4.2M over the same period.

Future implication: Given investors’ appetite for billion-dollar deals, insurance incumbents should prepare for potential disruption if an AI-focused insurtech secures major funding.

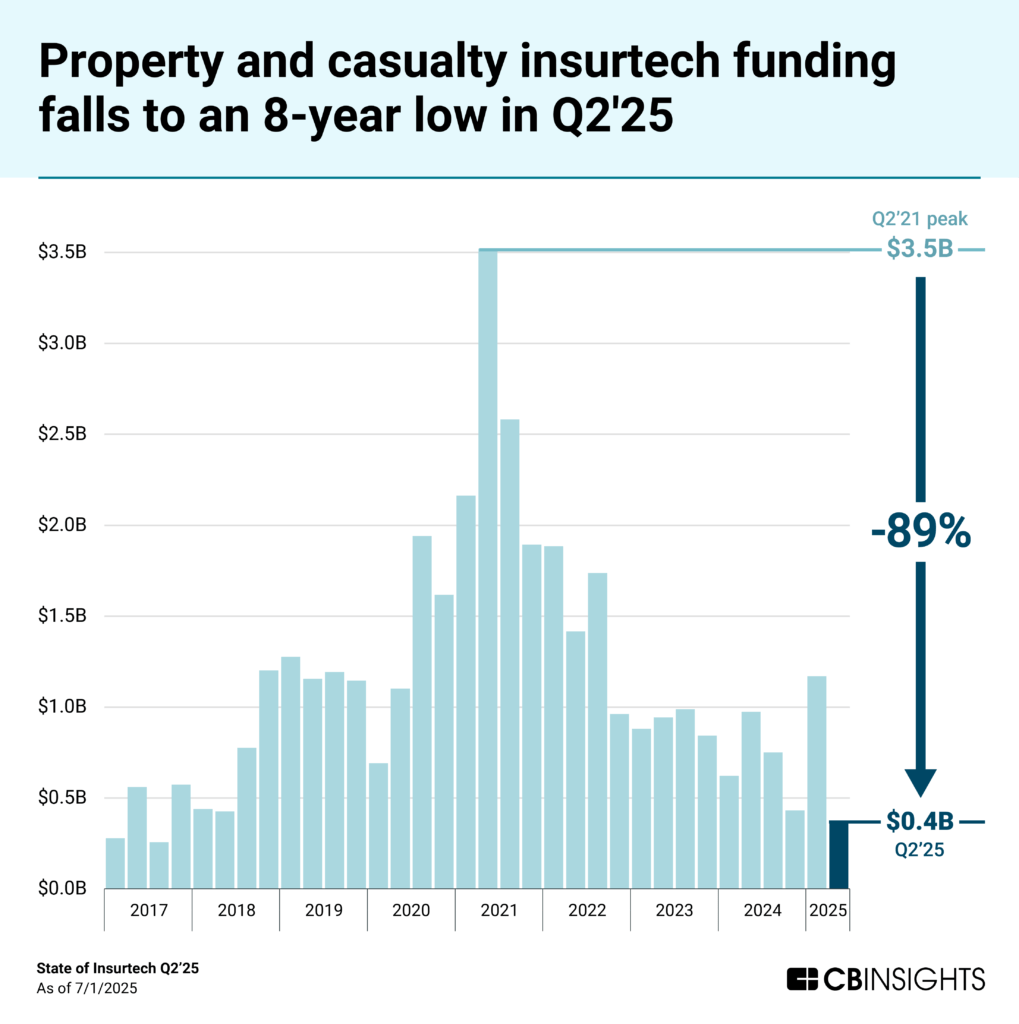

Funding to P&C insurtech falls 89% from Q2’21 peak

P&C insurtech funding plummeted from $1.2B in Q1’25 to $0.4B in Q2’25, falling well below the quarterly average of $0.8B over the past 2 years. As a result, P&C insurtech funding reached an 8-year low for the quarter (Q3’17 was the last quarter with less P&C insurtech funding).

The decline in P&C insurtech funding comes as no P&C insurtechs raised a Series D+ deal in Q2’25. Comparatively, 3 P&C insurtechs raised $100M+ mega-rounds across Series D+ deals in Q1’25.

P&C insurtech deal count also declined, falling from 72 in Q1’25 to 57 in Q2’25. Just 5 startups raised over half of the quarter’s P&C insurtech funding:

- Ledgebrook, a professional liability MGA ($65M Series C)

- Marshmallow, an auto insurer ($45M Series B)

- Steadily, a landlord insurer ($30M Series C)

- Orus, a small business insurance broker ($29M Series B)

- Reserv, a third-party administrator ($25M Series B)

Even so, the P&C insurtech space did see its first IPO since Q2’24: Florida-based home insurer Slide Insurance completed its IPO at a $2.1B valuation.

Future implication: Despite the broader P&C funding decline, 3 of the top 5 P&C insurtech deals by funding amount in Q2’25 went to startups focused on small and midsize businesses (SMBs) — signaling that targeted growth opportunities within this segment remain attractive to investors.

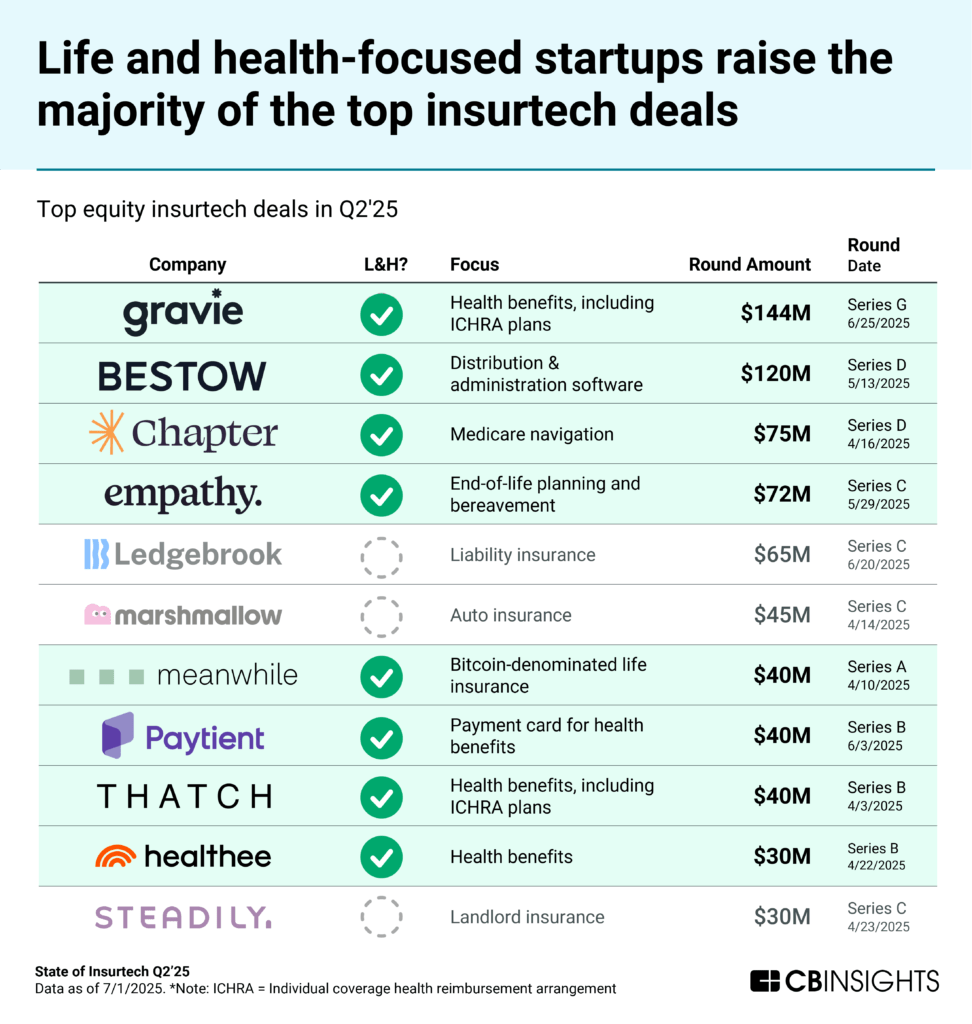

$100M+ mega-round deals lead to a surge in L&H insurtech funding

L&H insurtech funding surged from $0.2B in Q1’25 to $0.7B in Q2’25, well above the quarterly average of $0.4B over the past 2 years.

Eight of the quarter’s top 11 deals went to L&H insurtechs, including both of the quarter’s $100M+ mega-round deals:

- Gravie, a late-stage benefits platform ($144M Series G, and later amended to $150M in a filing on July 9)

- Bestow, a former insurer that has since pivoted to become a software provider ($120M Series D)

L&H insurtechs raised 32 deals in Q2’25, an increase from 28 in the quarter prior. Unlike P&C insurtech, the median L&H insurtech deal size ($6.0M) is up in 2025 YTD.

69% of L&H insurtech deals went to US-based companies, the highest amount since Q3’15, underscored by a focus on health benefits across the US market.

In addition, L&H insurtech saw its first unicorn since Q2’22 and its first IPO since Q3’22:

- Chapter, a Medicare navigation platform, became the quarter’s only new insurtech unicorn after raising its $75M Series D round at a $1.5B valuation.

- Xiaoyusan Insurance, a broker focused on diversified life and health products, went public.

Future implication: As nearly half of the quarter’s top deals by funding amount went to health and benefits-focused startups, insurers should prioritize expanding employer-focused sales channels for the upcoming open-enrollment season.

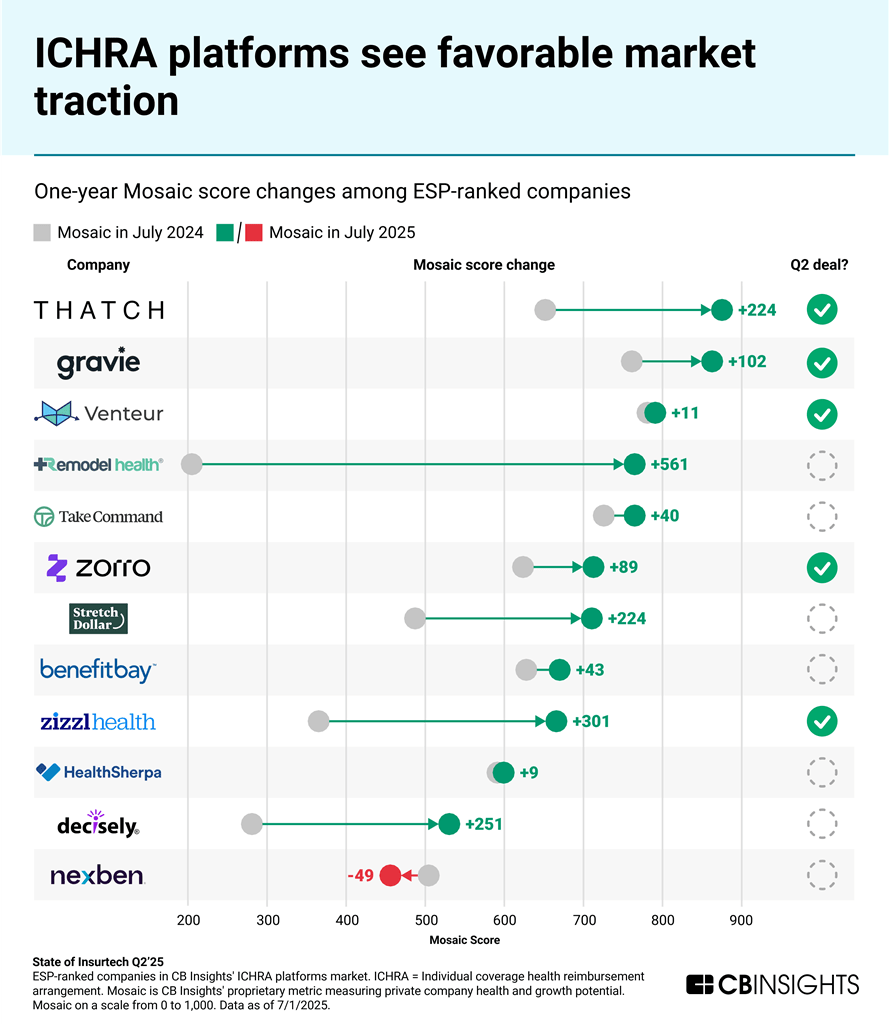

ICHRA startups capture nearly 20% of insurtech funding

The US federal government established ICHRA plans in 2019, spurring commercial traction in recent years. Notably, an ICHRA platforms market has since emerged, with 5 startups raising $234M in equity funding across 5 deals in Q2’25:

- Gravie ($144M, with participation from Atlantic Vantage Point)

- Thatch ($40M, with participation from ADP Ventures and SemperVirens Venture Capital)

- Venteur ($20M, led by American Family Ventures)

- Zorro ($20M)

- zizzl health ($10M)

An ICHRA is an alternative to traditional employer-selected health plans in the US, where employers instead allocate money for their employees to select their preferred qualified plan individually. ICHRA startups facilitate these payments, providing a central platform for benefits managers to administer their company’s ICHRA program.

The ICHRA platforms market is seeing favorable traction, evidenced by widespread increases in Mosaic score — measuring the overall health and growth potential of private companies — among companies assessed.

Most of these companies — Thatch, Gravie, Venteur, Remodel Health, Take Command Health, Zorro, StretchDollar, and BenefitBay — have Mosaic scores in the top 5% of all private companies tracked by CB Insights.

Future implication: Health insurers have the potential to increase enrollment by enhancing distribution channels to engage individuals employed by SMBs using ICHRAs.

US-based startups raise 3 in 5 global insurtech deals

60% of Q2’25 insurtech deals went to US-based startups — an 8-year high. Q3’17 was the last quarter to see a larger deal share among US-based startups (61%).

The increase was attributable to slight deal share increases across both L&H and P&C insurtech (from 68% to 69% and from 53% to 56%, respectively).

Within the US, Silicon Valley and the New York City metro areas led in Q2’25 insurtech deals — 11 and 9, respectively.

Europe-based startups raised 21% of Q2’25 insurtech deals: 6 of those deals went to France-based startups, and 5 went to UK-based startups.

Future implication: US insurtech deal share has increased each quarter since Q3’24, so companies should evaluate growth opportunities in global markets with less insurtech presence (i.e., less competition).

MORE INSURTECH RESEARCH FROM CB INSIGHTS

- 100 real-world applications of genAI across financial services and insurance

- Insurance’s new frontier: 3 innovation imperatives for 2025 and beyond

- Our 6 predictions for the insurance space in 2025