Hippocratic AI

Founded Year

2023Stage

Corporate Minority | AliveTotal Raised

$276MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+81 points in the past 30 days

About Hippocratic AI

Hippocratic AI develops large language models for the healthcare sector, focusing on safety in generative artificial intelligence (AI). The company provides AI agents aimed at supporting healthcare accessibility and addressing health outcomes, integrating healthcare expertise. These AI solutions are applicable to different segments in the healthcare industry, including payors, pharmaceuticals, dental, and providers. It was founded in 2023 and is based in Palo Alto, California.

Loading...

ESPs containing Hippocratic AI

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The healthcare AI model developers market creates specialized AI models and foundational language models for clinical and administrative healthcare applications. These companies develop AI systems including large language models, computer vision models, and multimodal AI solutions that address healthcare-specific challenges such as medical imaging analysis, clinical documentation, revenue cycle ma…

Hippocratic AI named as Challenger among 15 other companies, including Amazon, Microsoft, and Google.

Loading...

Research containing Hippocratic AI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Hippocratic AI in 16 CB Insights research briefs, most recently on Aug 22, 2025.

Aug 22, 2025 report

Book of Scouting Reports: Generative AI in Healthcare & Life Sciences

Jul 3, 2025 report

$1B+ Market Map: The world’s 1,276 unicorn companies in one infographic

May 16, 2025 report

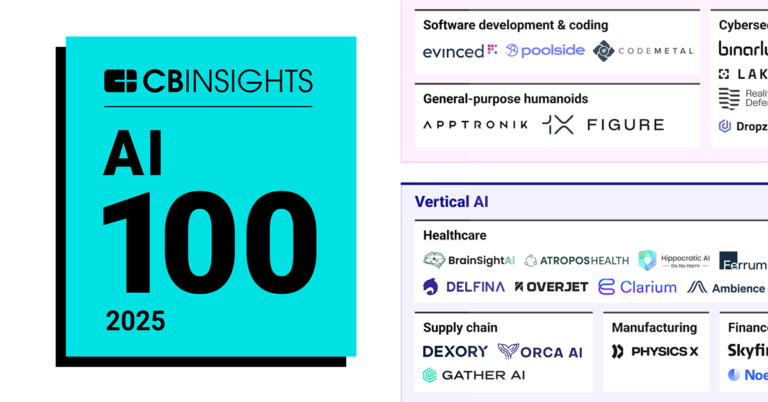

Book of Scouting Reports: 2025’s AI 100

May 1, 2025 report

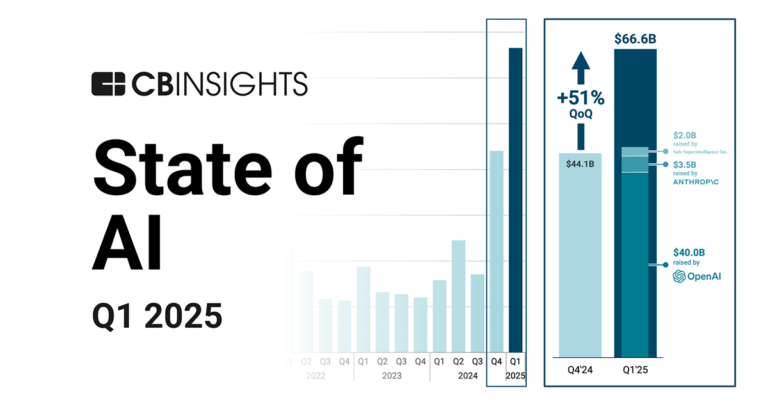

State of AI Q1’25 Report

Apr 24, 2025 report

AI 100: The most promising artificial intelligence startups of 2025

Apr 17, 2025 report

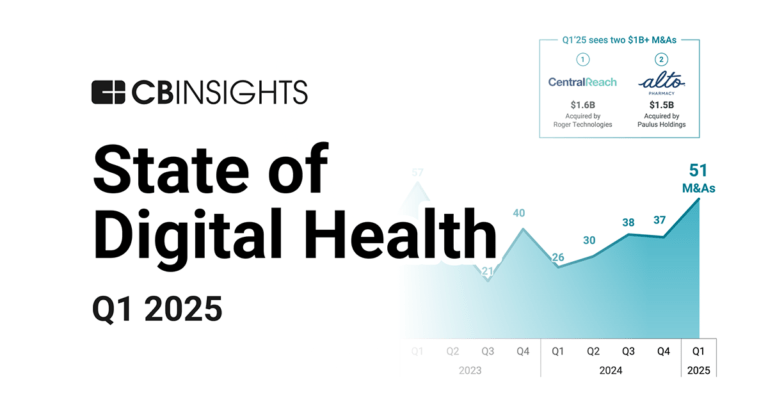

State of Digital Health Q1’25 Report

Mar 6, 2025

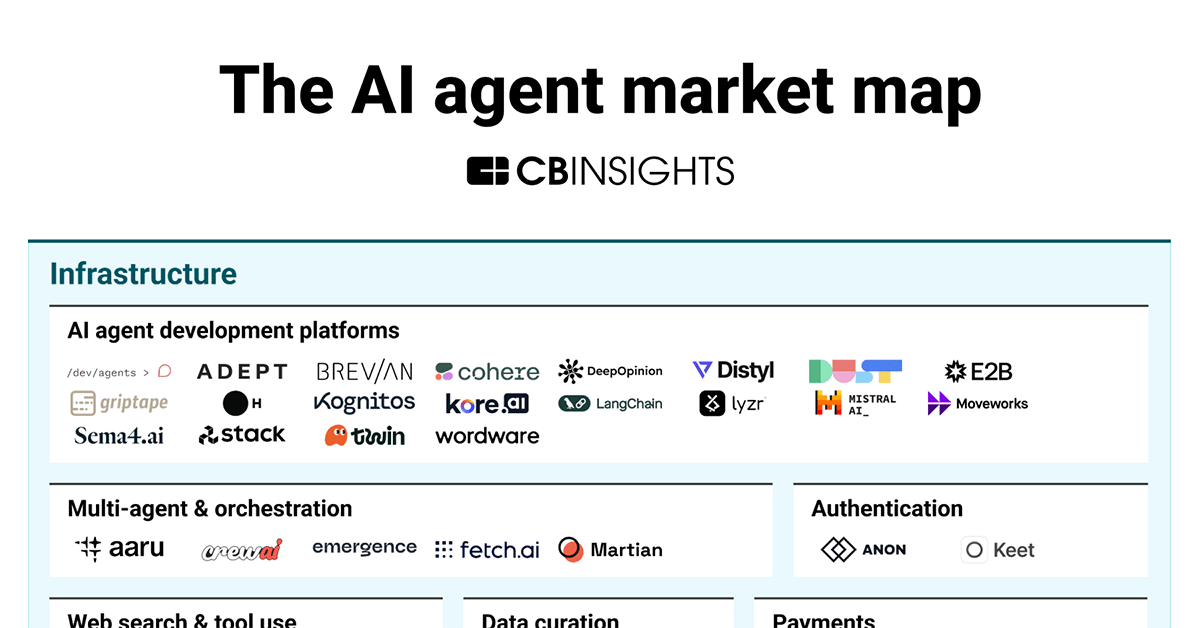

The AI agent market mapExpert Collections containing Hippocratic AI

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Hippocratic AI is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,286 items

Digital Health

11,422 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Generative AI 50

50 items

CB Insights' list of the 50 most promising private generative AI companies across the globe.

Generative AI

2,793 items

Companies working on generative AI applications and infrastructure.

Digital Health 50

100 items

Artificial Intelligence

10,195 items

Latest Hippocratic AI News

Aug 26, 2025

The Trump Administration's AI Action Plan , unveiled July 23, marks a decisive shift in how America approaches artificial intelligence, from cautious regulation to strategic acceleration. For founders building with AI, the plan isn't just another policy document. It's a compass for understanding how massive government investment, procurement opportunities, and regulatory tailwinds will reshape markets over the next four years. The General Catalyst Institute (GCI) was invited to attend the official rollout of the plan in Washington, DC, where we heard from various government leaders, including the director of the White House Office of Science and Technology Policy, Michael Kratsios, who led the policy effort. AI and Crypto Czar David Sacks, Vice President JD Vance, and several cabinet members also attended to share their thoughts on the importance of the plan and America's global leadership on AI. The day's events were capped off with remarks from President Donald Trump and his signing of key executive orders. At General Catalyst, we've been backing ambitious founders for this moment since 2017, investing billions in companies using applied AI to transform core industries. We believe the AI Action Plan validates our thesis that AI isn't just another technology wave; it's a fundamental transformation of how our society will operate in the years ahead. Companies that understand and align with these national priorities will have unprecedented advantages in scaling their solutions. After analyzing the plan, here are three strategic imperatives for founders to know: Move from Product to Platform: The government's shift toward comprehensive AI adoption favors companies that can deliver end-to-end solutions. Single-point solutions will struggle to navigate the new procurement frameworks. Build Security In, Not On: With an emphasis on high-security deployments and protection against adversarial actors, security can't be an afterthought. Companies need to architect for zero-trust environments from day one. Think Beyond Borders: The plan’s international component creates opportunities for rapid global scaling with government support. Companies should develop international strategies now, not after achieving domestic product-market fit. Below, we dive into what the AI Action Plan means for different sectors and how founders can strategically position themselves for the opportunities ahead. From Friction to Flow: How Policy Changes Enable AI Innovation The administration's pro-growth agenda creates asymmetric opportunities depending on your sector and business model. For Enterprise AI and Defense Tech Companies: The rescinding of President Biden's Executive Order 14110 fundamentally changes the game for companies building dual-use technologies. Companies like Anduril are already positioned to capitalize on streamlined procurement processes and the Pentagon's new mandate to give every employee access to frontier language models. The new "AI procurement toolbox" managed by the U.S. General Services Administration (GSA) isn't just bureaucratic streamlining, it represents a shift from lengthy request-for-proposal cycles to rapid deployment frameworks, favoring companies with proven, scalable solutions. Government contracts are shifting from capability demonstrations to operational deployments. Companies need to move beyond pilots to production-ready systems that can scale across agencies. Strategic Takeaways: Build relationships with program offices, not just innovation labs Align product roadmaps with the GSA's new procurement frameworks Focus on solutions that can scale across multiple agencies For Healthcare AI: The plan's emphasis on regulatory sandboxes presents a unique opportunity for companies navigating the complex regulatory landscape. Hippocratic AI , which has developed AI agents for low-risk patient services, exemplifies the approach that will thrive in this environment: targeting specific, bounded use cases that can demonstrate clear ROI while navigating evolving regulations. The administration's focus on state-level regulatory environments means companies should strategically choose their initial markets and accelerate from there. Health Assurance Transformation Company (HATCo), a subsidiary of General Catalyst, provides another example. Particularly through its investment in Summa Health and partnership with 20+ health systems, it is functioning as a health innovation sandbox that brings together health networks, our portfolio companies, and payers to transform how healthcare is delivered. Strategic Takeaways: Focus on bounded, low-risk use cases that demonstrate immediate ROI Build relationships with health departments at all levels of government, not just those in Washington, DC Position solutions as complementing, not replacing, healthcare workers For Foundational AI Platforms: The plan's explicit support for both open-source and proprietary models reflects a sophisticated understanding of the AI ecosystem. Companies like Anthropic are positioned to become critical infrastructure as the government seeks alternatives to closed models for sensitive applications. The commitment to improving financial markets for compute could fundamentally change the economics of model training for startups. Strategic Takeaways: Leverage new compute financing mechanisms to reduce training costs Build partnerships with government labs and research institutions Develop clear narratives, with technical substance, around transparency and control advantages Infrastructure as Destiny: The Physical Layer of AI Dominance The administration's infrastructure vision goes far beyond data centers. It's about creating an integrated stack from energy generation to chip fabrication to model deployment. This presents distinct opportunities across the value chain. Energy and Power Infrastructure: The plan's energy provisions include streamlined permitting for data centers, new categorical exclusions under National Environmental Policy Act (NEPA), increased development access to federal lands, and the National Energy Dominance Council. These actions represent the most aggressive federal intervention in energy markets since the 1970s. This creates a massive tailwind for companies building at the intersection of AI and energy infrastructure, like Mainspring Energy , whose innovative linear generators provide distributed, high-efficiency, dispatchable electricity that can be used to power data centers and commercial and industrial facilities. It also provides a pro-innovation framework for novel energy sources, like the pulsed magnetic fusion energy being developed by Pacific Fusion . Strategic Takeaways: Prioritize partnerships with energy providers and data center operators Align with federal permitting timelines to accelerate deployment Focus on resilience and security features for government applications Manufacturing Revival: The emphasis on AI-enabled manufacturing and robotics signals a broader industrial strategy. Companies applying AI to manufacturing processes, like Re:Build Manufacturing and Senra Systems , should align their narratives with the administration’s reshoring agenda. The CHIPS Program Office's renewed focus on ROI means companies can access funding in a more streamlined, less bureaucratic fashion, thus unlocking access to markets and pathways to scale. Strategic Takeaways: Target CHIPS Act funding for manufacturing-related AI applications Build partnerships with traditional manufacturers seeking modernization Emphasize job creation and workforce augmentation, not replacement The Talent Transformation: Workforce as Competitive Advantage The administration's worker-first AI agenda represents more than national necessity. It's recognition that talent constraints could throttle AI adoption and harm our geopolitical competitiveness. The executive orders on AI education and skilled trades training create specific opportunities for companies building in workforce development and augmentation. Companies creating AI-powered training platforms or workforce analytics tools should position themselves as enablers of the AI-enabled workforce transformation, not job replacers. One pathway to leveraging AI’s productivity gains is through AI-enabled roll-ups. This strategy can embed AI-powered automation into the core of business operations, resulting in efficiency gains that compound across ecosystems. We’ve been deploying this strategy for nearly three years with companies like Titan MSP , which is automating routine IT tasks that enable technicians to resolve high-complexity issues at dramatically faster rates. Strategic Implications: Companies developing AI tools for specific trades (e.g. construction, manufacturing, logistics) can tap into new federal workforce development funding streams The clarification that AI training qualifies for tax-free educational assistance under Section 132 creates incentives for enterprise customers to invest in AI adoption The emphasis on Senior Military Colleges as AI research hubs creates new talent pipelines for defense-focused companies International Expansion: The Geopolitical Dimension The plan's international strategy, which includes full-stack AI export packages, technology diplomacy, and allied coordination, creates structured pathways for global expansion that didn't exist before. For B2B SaaS and Applied AI Companies: The administration's push to export American AI to allies is ultimately about creating sturdy economic interdependencies with the U.S. technology stack. Companies should think beyond traditional go-to-market strategies to align with government-backed expansion initiatives. The U.S. Embassy network abroad and U.S. Trade and Development Agency (USTDA) are actively seeking to showcase technologies for allied nations. Companies expanding internationally should leverage these capabilities and programs strategically. For instance, companies in our European portfolio working with the EU AI Champions Initiative (which GC is co-leading with 70+ companies) have a direct bridge to U.S. government support for transatlantic AI collaboration. Strategic Takeaways: Prioritize Five Eyes and NATO allies for initial international expansion Position products as alternatives to Chinese technology dependencies Leverage government trade missions and showcase opportunities For Defense and Dual-Use Technologies: The emphasis on strengthening AI compute export controls while promoting allied adoption creates a "walled garden" effect. Companies like Saronic , building autonomous naval systems, can leverage government backing to establish themselves as the default choice for allied nations seeking to modernize their defense capabilities without relying on Chinese technology. Strategic Takeaways: Build relationships with allied defense attachés and procurement offices Position as trusted alternatives to adversarial nation technologies Leverage DoD's allied partnership programs for market entry The Path Forward: Execution in the Age of Acceleration The AI Action Plan represents a bet that America can out-innovate and out-build its competitors through a strategic pro-growth agenda and targeted investment. For founders, success requires more than understanding the policy. It requires anticipating second-order effects and positioning accordingly. At GCI, we are not passive observers of these policy shifts; we're active participants in shaping them. Our recent fly-in program brought portfolio founders directly to Washington to engage with policymakers crafting these initiatives. We work closely with our portfolio companies to find opportunities to leverage policy changes like the AI Action Plan. This includes: Direct Government Access: Our legislative fly-in programs and policy engagement create direct channels between founders and decision-makers, helping companies understand not just what's in the policy but what's coming next. Strategic Partnerships: Our relationships with AWS, Anthropic, and other infrastructure providers align with the administration's emphasis on public-private partnerships. We're facilitating connections that go beyond vendor relationships to strategic collaboration that meets the policy momentum. Sector-Specific Initiatives: Through partnerships with the Health Assurance Transformation Company (HATCo) and others, we’re creating integrated ecosystem solutions rather than point products that government procurement will increasingly favor. International Bridge-Building: Our leadership in the EU AI Champions Initiative and presence in key markets positions our companies to be first movers as the administration's export initiatives roll out. At General Catalyst, we're committed to being more than capital providers. We're strategic partners helping founders navigate this new landscape where technology, policy, and geopolitics intersect. The runway hasn't just gotten longer; it's gotten wider, with multiple paths to scaled impact. The race is on. The question now isn't whether to participate, but how to position yourself at the front of the pack.

Hippocratic AI Frequently Asked Questions (FAQ)

When was Hippocratic AI founded?

Hippocratic AI was founded in 2023.

Where is Hippocratic AI's headquarters?

Hippocratic AI's headquarters is located at 435 Portage Avenue, Palo Alto.

What is Hippocratic AI's latest funding round?

Hippocratic AI's latest funding round is Corporate Minority.

How much did Hippocratic AI raise?

Hippocratic AI raised a total of $276M.

Who are the investors of Hippocratic AI?

Investors of Hippocratic AI include EUCALIA, General Catalyst, Andreessen Horowitz, SV Angel, NVentures and 13 more.

Who are Hippocratic AI's competitors?

Competitors of Hippocratic AI include Beam Health, Iodine Software, mpathic, Hume, Abridge and 7 more.

Loading...

Compare Hippocratic AI to Competitors

Abridge focuses on generative artificial intelligence (AI) for clinical conversations within the healthcare sector. The company provides AI solutions that create AI-generated notes intended for use in patient-clinician interactions. It serves healthcare systems, intending to enhance clinician efficiency and nursing documentation. Abridge was formerly known as Intelligible.AI. It was founded in 2018 and is based in Philadelphia, Pennsylvania.

Suki operates as a technology company that develops voice solutions for the healthcare sector. The company offers Suki Assistant, which supports healthcare documentation and administrative tasks, and Suki Platform, enabling healthcare technology companies to integrate artificial intelligence (AI) features. Suki serves the healthcare industry, providing tools for clinician efficiency and electronic health record (EHR) integration. Suki was formerly known as Robin AI. It was founded in 2017 and is based in Redwood City, California.

Corti develops artificial intelligence models for the healthcare sector. Its offerings include AI models that understand medical terminology and patient interactions, designed to integrate into healthcare applications via an application programming interface. The company was founded in 2016 and is based in Copenhagen K, Denmark.

Abstractive Health focuses on artificial intelligence solutions for the healthcare sector, particularly in the area of clinical note management. The company provides a physician AI assistant that summarizes medical records, allowing for the reading and writing of clinical notes. Abstractive Health's technology integrates with existing healthcare systems, facilitating chart retrieval and AI-generated clinical summaries. It was founded in 2022 and is based in New York, New York.

Hyro specializes in adaptive communications solutions utilizing artificial intelligence (AI) and computational linguistics technology. The company offers a full-stack conversational AI solution that automates repetitive tasks across various mediums and channels, including call center automation and conversational intelligence. It primarily serves the healthcare sector, providing solutions to improve patient engagement and overcome staffing shortages. Hyro was formerly known as Airbud. It was founded in 2018 and is based in New York, New York.

Beam Health focuses on healthcare technology, providing AI-based solutions for medical documentation. Its main product, Shine AI, automates the clinical documentation process by listening to consultations, transcribing them, and generating clinical notes that integrate with electronic medical records (EMR) systems. Its offerings are targeted at healthcare providers. It was founded in 2020 and is based in Red Bank, New Jersey.

Loading...