H2O.ai

Founded Year

2012Stage

Series E - II | AliveTotal Raised

$246.12MValuation

$0000Last Raised

$100M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-58 points in the past 30 days

About H2O.ai

H2O.ai specializes in generative AI and machine learning. It provides a comprehensive AI cloud platform for various industries. The company offers a suite of AI cloud products, including automated machine learning, distributed machine learning, and tools for AI-driven data extraction and processing. H2O.ai caters to sectors such as financial services, healthcare, insurance, manufacturing, marketing, retail, and telecommunications. H2O.ai was formerly known as 0xdata. It was founded in 2012 and is based in Mountain View, California.

Loading...

H2O.ai's Product Videos

ESPs containing H2O.ai

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

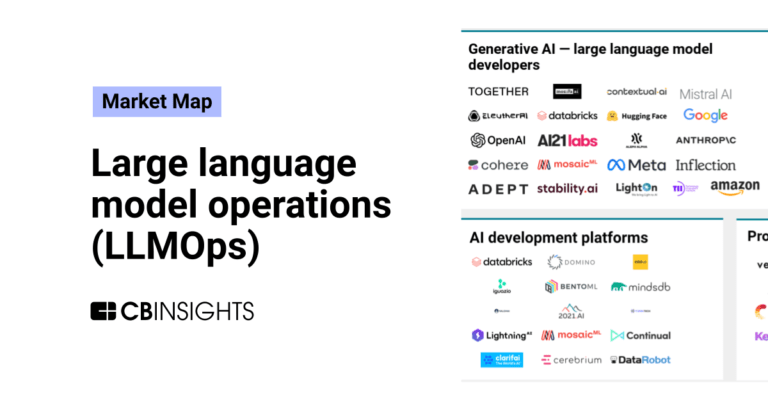

The AI development platforms market offers solutions that serve as one-stop shops for enterprises that want to develop and launch in-house AI projects. Vendors in this space enable organizations to manage aspects of the AI lifecycle — from data preparation, training, and validation to model deployment and continuous monitoring — through a single platform to facilitate end-to-end model development.…

H2O.ai named as Outperformer among 15 other companies, including Scale, Weights & Biases, and Dataiku.

H2O.ai's Products & Differentiators

h2oGPTe Agentic AI

h2oGPTe Agentic AI converges generative AI and predictive with purpose-built SLMs The industry’s first multi-agent Generative AI platform to bring together the strengths of Generative AI and Predictive AI with airgapped, on-premise deployment options.

Loading...

Research containing H2O.ai

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned H2O.ai in 8 CB Insights research briefs, most recently on Jul 2, 2024.

Jul 2, 2024 team_blog

How to buy AI: Assessing AI startups’ potential

Sep 29, 2023

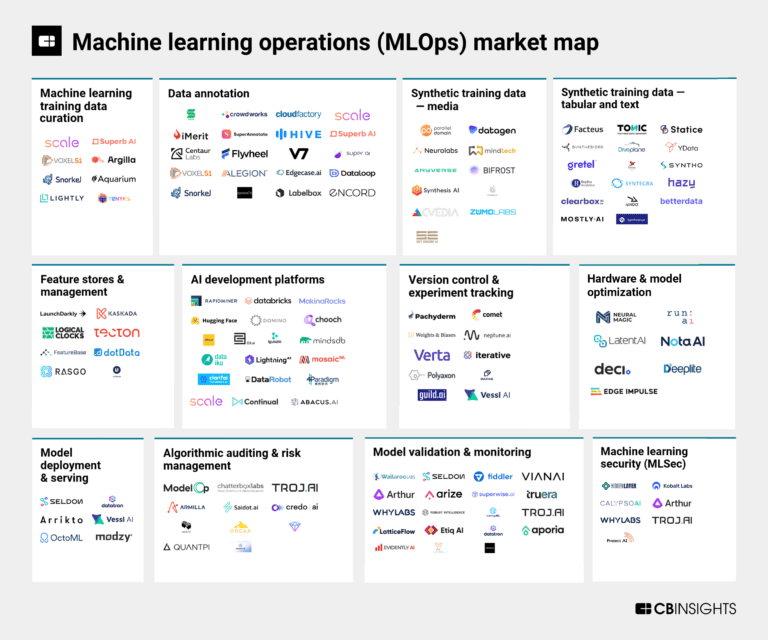

The machine learning operations (MLOps) market mapExpert Collections containing H2O.ai

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

H2O.ai is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,286 items

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

AI 100 (All Winners 2018-2025)

200 items

Conference Exhibitors

5,302 items

Fintech

9,685 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Generative AI

2,793 items

Companies working on generative AI applications and infrastructure.

H2O.ai Patents

H2O.ai has filed 12 patents.

The 3 most popular patent topics include:

- machine learning

- artificial intelligence

- classification algorithms

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/21/2023 | 10/15/2024 | Machine learning, Diagrams, Complex analysis, Scientific modeling, Artificial intelligence | Grant |

Application Date | 4/21/2023 |

|---|---|

Grant Date | 10/15/2024 |

Title | |

Related Topics | Machine learning, Diagrams, Complex analysis, Scientific modeling, Artificial intelligence |

Status | Grant |

Latest H2O.ai News

Aug 28, 2025

Aun así, su CEO sigue esperando una demanda alta, aunque con cierta desaceleración después del boom de gasto en IA de los últimos dos años. El principal punto negativo sigue siendo la incertidumbre sobre las ventas de chips H20 a China, que siguen bloqueadas por temas geopolíticos aunque se espera que se reanuden (a cambio de un 15% de los ingresos para el gobierno estadounidense). En Japón, subasta de deuda a 2 años con la menor demanda en 16 años (bid-to-cover 2,84x vs 4,47x anterior y 4x de media del último año), ante el temor a una nueva subida de tipos por parte del Banco de Japón este año. Para la jornada de hoy, en el plano macro destacamos la primera revisión del PIB 2T25 en EE.UU., donde recordamos que la lectura preliminar mostró una recuperación (+3% i.t. anualizado vs -0,5% en 1T25) al no recoger ya el impacto negativo del adelanto de compras en el primer trimestre del año para evitar los aranceles. Aún así, el componente de consumo privado siguió mostrando cierta debilidad (+1,4% vs +0,5% en 1T). En la revisión primera que se publica hoy se espera ligera mejora respecto a las lecturas preliminares, hasta PIB +3,1% y consumo privado +1,6%. Comentario de Apertura: Los inversores pendientes de la política en Francia, y de la "decepción" por los resultados de Nvidia De ayer destacamos también el peor comportamiento de índices como el italiano Ftse MIB (-0,72%) ante los rumores de un nuevo impuesto a la banca (1.500 mln eur) con el objetivo de proporcionar ingresos al gobierno italiano que permitan financiar recortes de impuestos previstos para 2026. Esta noticia provocó cierto contagio a los bancos españoles (-2% en promedio), que lideraron las caídas del selectivo Ibex (-0,65%), aunque también en un movimiento de lógica toma de beneficios tras las fuertes revalorizaciones experimentadas en lo que llevamos de año, y con un trasfondo de limitadas preocupaciones por las caídas de deuda francesa (no contagiadas a la deuda española) y tipos de interés (el BCE mantiene su actitud de dejar los tipos de intervención sin cambios en el resto del año tras la fuerte rebaja ya acometida, -200 pb hasta un tipo de depósito actual del 2%). En el plano político, los problemas no se limitan a Francia (cuya prima de riesgo se sitúa ya en 82 pb, a sólo un 5% de su máximo anual vs -20% en el caso de España o -30% en Italia y Portugal, y con el riesgo adicional de una rebaja de rating cuando Fitch revise la calificación francesa el 12-septiembre y en caso de que no haya avances en la consolidación fiscal que permitan alcanzar el objetivo de 4,6% déficit público/PIB), sino que en Países Bajos también habrá una moción de confianza al gobierno del primer ministro Schoof, un gobierno ya interino tras el colapso en junio de la coalición de cuatro partidos, y que actuamente cuenta sólo con dos partidos y una minoría cada vez más pequeña (32/150 escaños) ante divergercias sobre temas varios (Israel, inmigración). Esta situación, de no resolverse, podría llevar al país a una crisis política sin precedentes. Aunque hay elecciones previstas para octubre, la elevada fragmentación política dificulta la formación de un gobierno estable. La inestabilidad política europea (Francia, Países Bajos), junto a la debilidad de Alemania, complica los esfuerzos de la UE para hacer frente a los aranceles americanos (el ministro de comercio holandés también ha dimitido) y apoyar los esfuerzos de paz para Ucrania. En cuanto al dólar, el intervencionismo de Trump en la Fed con el intento de destituir a Lisa Cook no está teniendo un impacto depreciador (1,164 vs euro) tras la decisión de Cook de plantar batalla legal contra las acusaciones del presidente de EE.UU., a la vez que el euro se ve en cierta medida presionado por la difícil situación política de Francia. Mientras tanto, en el plano comercial, la UE intentará sacar adelante por la vía rápida (para finales de semana) la legislación necesaria para eliminar todos los aranceles a los productos estadounidenses, una de las peticiones principales de Trump para a su vez reducir los aranceles sobre las exportaciones de automóviles europeos (del 27,5% actual al 15%). Por el contrario, la UE no parece dispuesta a ceder en lo que respecta a las tasas sobre los servicios digitales que afectan a grandes tecnológicas americanas.

H2O.ai Frequently Asked Questions (FAQ)

When was H2O.ai founded?

H2O.ai was founded in 2012.

Where is H2O.ai's headquarters?

H2O.ai's headquarters is located at 2307 Leghorn Street, Mountain View.

What is H2O.ai's latest funding round?

H2O.ai's latest funding round is Series E - II.

How much did H2O.ai raise?

H2O.ai raised a total of $246.12M.

Who are the investors of H2O.ai?

Investors of H2O.ai include Nexus Venture Partners, Wells Fargo Strategic Capital, NVIDIA, Celesta Capital, Cohen Circle and 20 more.

Who are H2O.ai's competitors?

Competitors of H2O.ai include Domino, Centific, Glean, Chalk, 2021.AI and 7 more.

What products does H2O.ai offer?

H2O.ai's products include h2oGPTe Agentic AI and 2 more.

Loading...

Compare H2O.ai to Competitors

DataRobot provides artificial intelligence (AI) applications and platforms within the enterprise AI suite and agentic AI platform domains. Its offerings include a suite of AI tools that integrate into business processes, allowing teams to manage AI, along with AI governance, observability, and foundational tools. DataRobot serves sectors including finance, supply chain, energy, financial services, government, healthcare, and manufacturing. It was founded in 2012 and is based in Boston, Massachusetts.

Dataiku is an artificial-intelligence (AI) platform that integrates technology, teams, and operations to assist companies in incorporating intelligence into their daily operations across various industries. The platform provides tools for building, deploying, and managing data, analytics, and AI projects, including Generative AI, Machine Learning, data preparation, insights generation, and AI governance. Dataiku serves banking, life sciences, manufacturing, telecommunications, insurance, retail, public sector, utilities, energy, and healthcare sectors. It was founded in 2013 and is based in New York, New York.

Domino provides an enterprise artificial intelligence platform for AI model development and deployment across various industries. The company's offerings include a platform for building, deploying, and managing AI models, with features that support collaboration and integration into enterprise workflows. Its platform is intended to support AI operations and knowledge sharing within organizations. The company was founded in 2013 and is based in San Francisco, California.

Alteryx is a company specializing in enterprise analytics, providing a platform that facilitates data preparation and analytics processes. The company's products allow users to conduct data analysis, develop predictive models, and visualize data insights. Alteryx serves sectors that require data analytics capabilities, including financial services, retail, healthcare, and manufacturing. Alteryx was formerly known as SRC. It was founded in 1997 and is based in Irvine, California.

Scale provides data labeling, model training, and curation services for artificial intelligence (AI) applications, along with a generative AI platform that uses enterprise data to improve AI models. Scale serves the technology sector, government agencies, and the automotive industry. It was formerly known as Scale Labs. The company was founded in 2016 and is based in San Francisco, California.

Abacus.AI offers generative artificial intelligence (AI) technology and the development of enterprise AI systems and agents. It offers products including AI super assistants, machine learning operations, and applied AI research, aimed at enhancing predictive analytics, anomaly detection, and personalization. It primarily serves sectors that require advanced AI solutions, such as finance, healthcare, and e-commerce. It was formerly known as RealityEngines.AI. It was founded in 2019 and is based in San Francisco, California.

Loading...