Mesh

Founded Year

2020Stage

Series B - II | AliveTotal Raised

$114.25MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+41 points in the past 30 days

About Mesh

Mesh focuses on financial connectivity, specifically within the cryptocurrency sector. It offers services that facilitate transfers and payments of digital assets from various exchanges and wallets without the need to leave the user's platform. It primarily serves sectors such as neobanks, personal finance and investing, and both centralized and decentralized finance. It was formerly known as Front Financing. The company was founded in 2020 and is based in San Francisco, California.

Loading...

Mesh's Products & Differentiators

Front Score

proprietary algorithm that scored both individual stocks and your aggregated portfolios-similar to a FICO score that gives you health score of your portfolio

Loading...

Research containing Mesh

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Mesh in 3 CB Insights research briefs, most recently on May 29, 2025.

May 29, 2025

The stablecoin market map

May 23, 2025 report

Book of Scouting Reports: Stablecon 2025

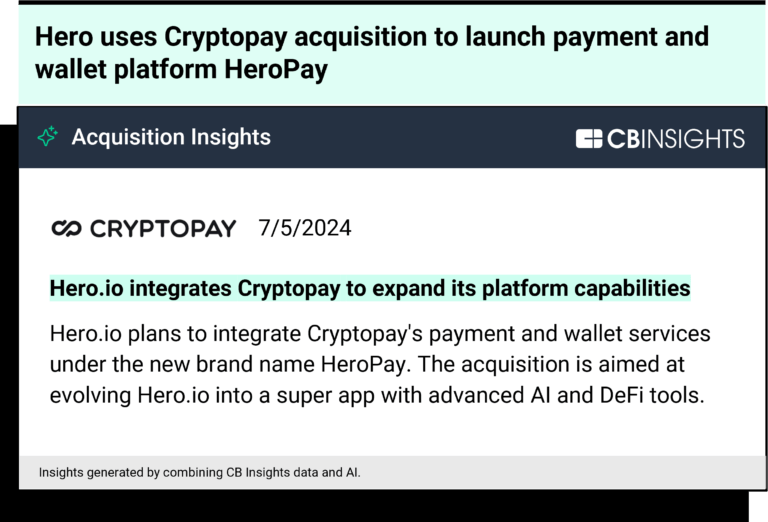

Aug 14, 2024

Crypto is showing signs of life in paymentsExpert Collections containing Mesh

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Mesh is included in 4 Expert Collections, including Blockchain.

Blockchain

9,147 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,696 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Payments

3,255 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Stablecoin

450 items

Latest Mesh News

Aug 20, 2025

Just as gold and cash coexist, stablecoin will serve payments while volatile cryptocurrencies remain an investment vehicle, the CEO of crypto-transfer firm Mesh says. Published Aug. 20, 2025 A Bitcoin sign is displayed on the wall of developers Ciprés and Rilea Group on July 16, 2025, in Miami. Joe Raedle via Getty Images The proliferation of digital currencies presents their users an important task: How to convert one to another and into stablecoins. Mesh, a startup building a digital assets payments network, joins a field of firms offering a solution. PayPal Holdings is using Mesh’s technology to power a new pay-with-crypto conversion tool to connect dozens of cryptocurrencies and stablecoins for shoppers and merchants. The capability will be rolled out in the U.S. in time for the 2025 holiday shopping season, a PayPal spokesperson said Wednesday in an email. PayPal and Mesh, a startup in which PayPal’s venture arm has invested, touting savings for merchants below current international credit card conversion costs, in a July 28 press release announcing the new tool. “You need to bridge the gap between what users have and what the merchant’s supposed to receive,” Mesh CEO Bam Azizi said in an Aug. 13 interview. The technology allows merchants to accept more than eight dozen flavors of crypto for payment, converting them into fiat. In the future, PayPal said it will let merchants settle with its PYUSD stablecoin, launched two years ago . Stablecoins “are not made equal,” Azizi said. “So if you have USDC and the merchant wants USDT, you still need to convert it as an end user. That's not the most optimal way for users to pay for things.” (USDC is Circle Internet Group’s stablecoin while Tether issues USDT.) For example, if numerous customers held Tether USDT and a seller wants another stablecoin, “they just simply click and pay, and we abstract all the complexity” of the transaction for a shopper and the conversion for a merchant, Azizi explained. Stablecoins are typically pegged to a fiat currency such as the euro or U.S. dollar, making their value more stable than other digital assets like Bitcoin that frequently surge and decline. San Francisco-based Mesh is building a payments network to connect crypto exchanges, digital wallets and financial services platforms to simplify digital currency payments and conversions. The company has about 100 employees. “Don't forget that we have 650 million crypto owners (globally) and they have all sorts of assets, whether it’s NFT (non-fungible tokens) or tokenized real estate or collectibles or Bitcoin, Ethereum – you cannot ignore that population,” Azizi said. “They’re not going anywhere.” The U.S. Genius Act, signed into law last month, has triggered a corporate race towards stablecoins and lofty IPO valuations for stablecoin companies such as Circle and Bullish. Companies from Amazon to Bank of America, Expedia Group and Walmart are mulling whether to issue stablecoins . President Donald Trump’s election last year, along with the rise of a contingent of Congress members receptive to the cryptocurrency industry, has given the industry new momentum after years of chafing under strict crypto regulation by the Biden administration. As stablecoins enter the financial mainstream, Azizi sees a future in which they dominate digital payments while their more volatile crypto cousins — such as Bitcoin, Dogecoin and Shiba Inu — remain largely the domain of investors. “The killer app for stablecoin is going to be payment, whether it’s cross border payment, B2B payment or [a] payout,” said Azizi, who co-founded Mesh five years ago. The company said last week it has raised about $130 million , including from PayPal Ventures, Coinbase Ventures and Kingsway Capital. The creation of more on-and-off ramps for crypto-fiat conversion will also further stablecoin adoption, he said. Mesh faces competition from companies such as Bastion, Binance, Stripe-owned Bridge and Coinbase to provide crypto users pathways for exchanging coins and fiat. “Stablecoin is going to be what crypto wanted to be, what Bitcoin wanted to be: Peer-to-peer payment without any centralized authority sitting in the middle,” Azizi said. “Stablecoin has all the beauty, all the upside of crypto and blockchain networks, and none of the downside. It’s not volatile. Some people might like volatility for investment reasons … but it’s not the best way to pay.” Recommended Reading

Mesh Frequently Asked Questions (FAQ)

When was Mesh founded?

Mesh was founded in 2020.

Where is Mesh's headquarters?

Mesh's headquarters is located at 2325 3rd Street, San Francisco.

What is Mesh's latest funding round?

Mesh's latest funding round is Series B - II.

How much did Mesh raise?

Mesh raised a total of $114.25M.

Who are the investors of Mesh?

Investors of Mesh include PayPal Ventures, Moderne Ventures, Overlook VC, Coinbase Ventures, Kingsway Capital Partners and 43 more.

Who are Mesh's competitors?

Competitors of Mesh include Keabank, Atom Finance, Kraken, Bitwala, Blockmate and 7 more.

What products does Mesh offer?

Mesh's products include Front Score and 3 more.

Loading...

Compare Mesh to Competitors

Metallicus works as a company building a digital asset banking network using blockchain technology. Its offerings include digital asset banking services, a stablecoin index treasury called Metal Dollar and a proprietary blockchain named Proton that allows for payment solutions. Metallicus serves individual users, corporations, and banks seeking integration with digital assets and blockchain. It was founded in 2016 and is based in San Francisco, California.

Blockchain.com specializes in blockchain technology and cryptocurrency-related solutions. The company offers a platform where users can buy, sell, and swap cryptocurrencies like Bitcoin and Ethereum, as well as earn rewards on their cryptocurrency assets. It also provides a cryptocurrency wallet for the self-custody of digital assets and an exchange for trading in fiat currencies. It was founded in 2011 and is based in London, United Kingdom.

Crypto.com is a cryptocurrency trading platform and financial services provider in the fintech sector. The company provides services for buying, selling, and trading Bitcoin, Ethereum, and over 350 other cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. Crypto.com serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

CoinZoom is a fintech company that provides a cryptocurrency debit card enabling users to spend their crypto and cash, buy, sell, and trade cryptocurrencies. The company serves individuals interested in incorporating cryptocurrency into their financial transactions. It was founded in 2018 and is based in Salt Lake City, Utah.

BurjX provides cryptocurrency trading exchange and broker-dealer solutions. It develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in New York, New York.

AlphaPoint specializes in white label cryptocurrency exchange software and operates within the financial technology sector. The company provides products including digital asset exchanges, brokerage platforms, and wallet solutions to facilitate the trading and management of digital assets. AlphaPoint also offers services for asset digitization and liquidity solutions, catering to clients such as banks, brokers, and payment companies. It was founded in 2013 and is based in New York, New York.

Loading...