Framer

Founded Year

2013Stage

Series D | AliveTotal Raised

$160MValuation

$0000Last Raised

$100M | 22 days agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+54 points in the past 30 days

About Framer

Framer specializes in website builders that allow designers and teams to create and publish websites. The platform includes a design canvas for building websites, a content management system, SEO tools, and features for adding animations. It serves the web design and development sector, catering to individuals and teams with a website creation and management tool. Framer was formerly known as Motif Tools. It was founded in 2013 and is based in Amsterdam, Netherlands.

Loading...

Loading...

Research containing Framer

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Framer in 1 CB Insights research brief, most recently on Sep 3, 2025.

Expert Collections containing Framer

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Framer is included in 1 Expert Collection, including Work From Home Startups.

Work From Home Startups

91 items

Track startups and capture company information and workflow.

Framer Patents

Framer has filed 1 patent.

The 3 most popular patent topics include:

- chemical processes

- coatings

- metalworking

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/12/2022 | Coatings, Welding, Chemical processes, Thin film deposition, Metalworking | Application |

Application Date | 10/12/2022 |

|---|---|

Grant Date | |

Title | |

Related Topics | Coatings, Welding, Chemical processes, Thin film deposition, Metalworking |

Status | Application |

Latest Framer News

Sep 8, 2025

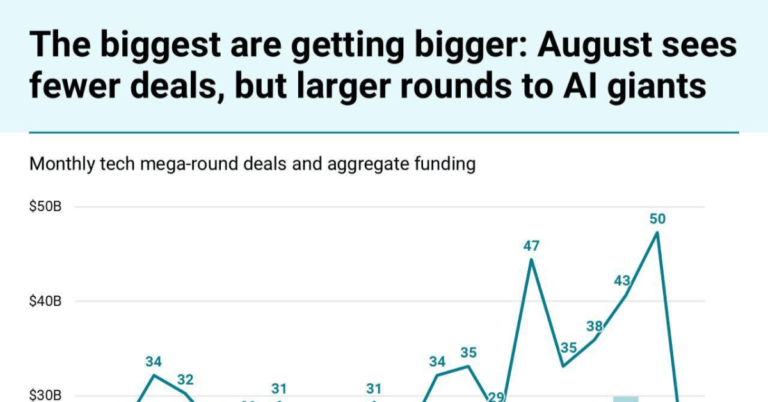

The tech sector is witnessing a significant shift, with private companies staying private longer and attracting late-stage funding, particularly in artificial intelligence. This, according to a report from CB Insights. August 2025 marked a pivotal moment for the industry, as mega-rounds— funding deals exceeding $100 million—continued to dominate, signaling investor confidence in AI-driven advancements. In addition to these developments, the team at CB Insights noted that the coding AI agent and copilot market is experiencing explosive growth, with a handful of companies carving out significant market share in this rapidly evolving sector. The trend of tech companies delaying public offerings in favor of private capital infusions has intensified, with August 2025 showcasing the enduring strength of late-stage funding. According to recent data , two AI powerhouses, OpenAI and Databricks, accounted for over half of the funds raised in mega-rounds last month. OpenAI secured an oversubscribed $8.3 billion raise, while Databricks closed a rare Series K round of $1 billion, one of only 16 such rounds in history. These valuations, reaching into the hundreds of billions, underscore a shift in the tech financing model, where private markets are increasingly capturing value creation. Notably, OpenAI is reportedly in discussions for a $500 billion secondary share sale, providing liquidity for early investors and employees without an IPO. Databricks, meanwhile, is leveraging its funds to expand into AI agent development and agentic databases, bolstered by its acquisition of Tecton to strengthen its position in the AI agent ecosystem. This concentration of capital reflects the growing influence of AI platforms. Over 60% of AI mega-round recipients in August are generating eight-figure revenues, with some, like Framer, projected to hit $100 million by 2026. Others, such as EliseAI, demonstrate capital efficiency, achieving $100 million in projected 2025 revenue with just $670,000 per employee—more than double Databricks ’ revenue-per-employee metric. These companies boast an average Commercial Maturity Score of 4 (indicating scaling solutions) and a Mosaic health score of 892, well above the 802 average for all August mega-round recipients, signaling both commercial success and robust growth potential. The rise of early-stage AI unicorns also highlights investor enthusiasm for specialized AI. August saw three new AI unicorns—Decart, Periodic Labs, and Field AI—each focusing on niche applications like real-time generative AI, materials science, and robotics. Despite lower commercial maturity, their valuations , ranging from $1 billion to $3.1 billion, reflect confidence in specialized AI’s future. Parallel to the funding surge, the coding AI agent and copilot market is scaling at an extraordinary pace, driven by tools that assist developers with code generation, debugging, and testing. These AI-powered solutions, which integrate with popular development environments or operate as standalone agents, are transforming software development . The market is highly concentrated, with the top three players—led by Microsoft-owned GitHub with an estimated $800 million in annual recurring revenue (ARR)—holding over 70% of the market share. GitHub’s dominance is attributed to its superior distribution channels in the agentic AI space. Other players, like Lovable, are projecting meteoric growth, expecting to reach $250 million in ARR by the end of 2025, up from $10 million at the year’s start, with plans or an aim to hit $1 billion by mid-2026—a 100x increase in just 18 months. However, challenges loom, including high inference costs and enterprise reluctance to adopt usage-based pricing, which could necessitate additional funding to sustain growth. With nearly 40% of players in this market showing low commercial maturity, the race is on for leaders to maintain their edge through product development or strategic acquisitions. The convergence of massive funding rounds and the rise of coding AI agents signals a transformative era for tech. As private companies like OpenAI and Databricks redefine growth trajectories, and coding AI-focused initiatives like GitHub and Lovable reshape software development, the AI sector is expected to expand steadily. Investors and enterprises appear to continue betting big on AI ’s potential, but the path forward will require navigating cost pressures and market consolidation to sustain this momentum. Sponsored Links by DQ Promote

Framer Frequently Asked Questions (FAQ)

When was Framer founded?

Framer was founded in 2013.

Where is Framer's headquarters?

Framer's headquarters is located at Rozengracht 207B, Amsterdam.

What is Framer's latest funding round?

Framer's latest funding round is Series D.

How much did Framer raise?

Framer raised a total of $160M.

Who are the investors of Framer?

Investors of Framer include Accel, Atomico, Meritech Capital Partners, HV Capital, WiL and 7 more.

Who are Framer's competitors?

Competitors of Framer include Figma, Typedream, Selfprof, Elementor, Webflow and 7 more.

Loading...

Compare Framer to Competitors

Sketch App is a design and prototyping tool that includes features for vector editing and collaboration. The company provides tools for creating and sharing design projects. Sketch App is used by freelancers and corporations in the design community. It was founded in 2012 and is based in The Hague, Netherlands.

JustInMind is a company that provides a UI/UX design platform for web and mobile applications. Its offerings include tools for creating prototypes and simulations, as well as features for wireframing, UI design, interaction design, and collaboration. The company serves the software development and design industries with its prototyping and design tools. It is based in Barcelona, Spain.

HotGloo is a UX, wireframe, and prototyping tool that operates within the web design and development sector. The company provides a platform for creating wireframes for web, mobile, and wearable devices. HotGloo serves the web design and development industry, offering tools for designers, developers, and project managers to create prototypes. It is based in Hamburg, Germany.

Fluid UI focuses on interactive prototyping for web and mobile applications within the design and development industry. The company provides a platform that allows users to create, share, and collaborate on prototypes for Android, iOS, and web. Fluid UI's services include a set of pre-built UI kits and collaboration tools, with the ability to prototype in both high and low fidelity, accessible across devices. It is based in Dublin, Ireland.

Axure develops UX design and prototyping software in the technology sector. Its product, Axure RP, allows for the creation of UX prototypes that incorporate conditional logic and dynamic content without coding. Its software is used for web, mobile, and device interfaces, allowing for the visualization and testing of user experiences. It is based in San Diego, California.

Marvel Prototyping is a digital design platform that specializes in the creation and collaboration of digital products. The company offers a suite of tools for wireframing, prototyping, user testing, and developer handoff to streamline the design process. Marvel's services are utilized by a diverse range of sectors including Fortune 100 companies, startups, and educational institutions. It was founded in 2013 and is based in London, England.

Loading...