Fireblocks

Founded Year

2018Stage

Unattributed VC | AliveTotal Raised

$1.039BRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+5 points in the past 30 days

About Fireblocks

Fireblocks provides infrastructure for digital asset operations in the financial technology sector. It offers services including custody and management of cryptocurrency operations, wallet solutions, token creation and distribution, and facilitation of blockchain payments. It serves trading firms, financial technologies, financial institutions, and web3 companies. It was founded in 2018 and is based in New York, New York.

Loading...

ESPs containing Fireblocks

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The asset tokenization market enables the conversion of ownership rights in various assets such as real estate, artwork, or securities into digital tokens tradable on blockchain networks. This technology allows for more efficient asset management, enhanced security, and increased liquidity through secondary trading markets. Asset tokenization solutions provide investors with fractional ownership o…

Fireblocks named as Leader among 15 other companies, including Digital Asset, Securitize, and Sygnum.

Loading...

Research containing Fireblocks

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Fireblocks in 6 CB Insights research briefs, most recently on May 29, 2025.

May 29, 2025

The stablecoin market map

May 23, 2025 report

Book of Scouting Reports: Stablecon 2025

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Fireblocks

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Fireblocks is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,286 items

Blockchain

13,459 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,715 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

100 items

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Fireblocks Patents

Fireblocks has filed 5 patents.

The 3 most popular patent topics include:

- alternative currencies

- cryptocurrencies

- cryptography

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/29/2021 | 8/20/2024 | Data security, Cryptography, Computer security, Key management, Cryptographic protocols | Grant |

Application Date | 11/29/2021 |

|---|---|

Grant Date | 8/20/2024 |

Title | |

Related Topics | Data security, Cryptography, Computer security, Key management, Cryptographic protocols |

Status | Grant |

Latest Fireblocks News

Sep 13, 2025

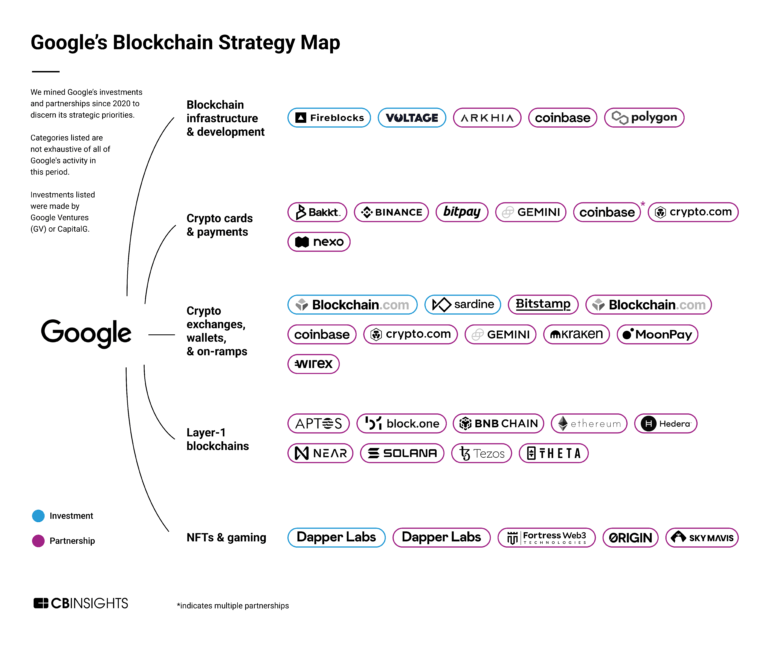

Lava Network Fireblocks will use Smart Router, an enterprise-grade RPC orchestration engine, to power the FRNT stablecoin with mission-critical uptime and seamless multi-chain performance. TEL AVIV, Israel, Sept. 13, 2025 (GLOBE NEWSWIRE) -- Lava Network , the data infrastructure protocol for enterprise blockchain, unveils its end-to-end RPC engine to power the next generation of stablecoins and tokenization use cases, starting with Fireblocks and Wyoming’s state-sponsored stablecoin . Fireblocks processes $200B in monthly stablecoin payments and an estimated 15% of global volume. Blockchain RPC (Remote Procedure Call) is the data interface that is essential for any wallet, application, or AI agent to access blockchain data. The RPC engine is designed to provide institutional and permissionless blockchains with unified, accessible, and low-latency access to on-chain data and transaction submission. According to the State of Stablecoins 2025 report published by Fireblocks, 41% of decision makers rank speed and reliability as the top considerations when selecting stablecoin infrastructure. As stablecoin payments fuel tokenized real-world assets (RWAs) with a reported growth rate of 380% over three years , traditional blockchain infrastructure is hitting critical bottlenecks. RPC must scale to support mass consumer demand, while maintaining low-latency, high throughput, secure node connections, and smooth on-chain/off-chain integrations. With corporations like Google and Amazon, and Walmart exploring USD-backed stablecoins to reduce costs and expedite settlements, robust and dependable RPC infrastructure is helping to pave the way to blockchain adoption. The heart of Lava Network’s core technology is the RPC routing engine, which introduces a unified stack designed to improve blockchain connectivity and reliability across the network’s offering. Powered by the RPC Engine, the enterprise blockchain RPC Smart Router enables enterprises to deliver unprecedented uptime, complete with built-in failover, cross-validation, performance-based routing, and compliance-friendly audit trails. “Stablecoins are emerging as the new transaction standard, driving value for real-world assets. This demands enterprise-grade RPC infrastructure that is both resilient and regulation-ready,” said Yair Cleper, Co-founder & CEO at Magma Dev and Lava Network contributor. “By supporting Fireblocks' blockchain RPC infrastructure, Lava Network is standardizing access for mission-critical assets moving on-chain. Our platform provides institutions, apps, and chains a standardized framework to meet those expectations while maximizing uptime and mitigating the risk for a single point of failure.” ”For institutions seeking to adopt stablecoin payments, reliability and compliance are paramount,” said Pavel Berengoltz, Co-founder and CTO of Fireblocks. “Integrating the Lava-powered Enterprise Blockchain RPC Smart Router supports the resilient, multi-provider access layer that aligns with our mission to deliver secure, scalable payment and settlement infrastructure to our customers.” About Lava Network Lava Network is the permissionless and decentralized data infrastructure protocol for enterprise blockchain. We deliver a self-serve RPC API any developer can consume on-demand, a Public RPC ecosystem spanning 40+ chains, and a multi-provider RPC Smart Router solution for enterprises. The Lava Network ecosystem enables institutions, builders, and foundations to scale on-chain products with the resilience, observability, and governance modern production systems demand. Learn more at lavanet.xyz About Fireblocks Fireblocks is the world's most trusted digital asset infrastructure company, empowering organizations of all sizes to build, manage and grow their business on the blockchain. With the industry's most scalable and secure platform, we streamline stablecoin payments, settlement, custody, tokenization, and trading operations across the largest ecosystem of banks, payment providers, stablecoin issuers, exchanges and custodians. Thousands of organizations - including Worldpay, BNY Mellon, Galaxy, and Revolut - trust Fireblocks to secure more than $10 trillion in digital asset transactions across 100+ blockchains. Learn more at fireblocks.com Contact:

Fireblocks Frequently Asked Questions (FAQ)

When was Fireblocks founded?

Fireblocks was founded in 2018.

Where is Fireblocks's headquarters?

Fireblocks's headquarters is located at 500 Fashion Avenue, New York.

What is Fireblocks's latest funding round?

Fireblocks's latest funding round is Unattributed VC.

How much did Fireblocks raise?

Fireblocks raised a total of $1.039B.

Who are the investors of Fireblocks?

Investors of Fireblocks include Haun Ventures, Tenaya Capital, Paradigm, Coatue, BAM Elevate and 26 more.

Who are Fireblocks's competitors?

Competitors of Fireblocks include Utila, Tangany, Zero Hash, Turnkey, eSignus and 7 more.

Who are Fireblocks's customers?

Customers of Fireblocks include Customer Name: Revolut , Crypto.com and GMO Trust.

Loading...

Compare Fireblocks to Competitors

Copper is a technology company that focuses on providing secure digital asset services to institutional investors within the cryptocurrency sector. The company offers a suite of solutions, including institutional custody, prime brokerage services, and collateral management, all designed to facilitate secure and efficient digital asset transactions. Copper primarily caters to hedge funds, trading firms, foundations, exchanges, ETP providers, venture capital funds, and miners seeking advanced infrastructure for managing digital assets. It was founded in 2018 and is based in Zug, Switzerland.

BitGo provides digital asset custody and financial services within the cryptocurrency sector. It offers secure wallet solutions, qualified custody, and financial services including trading, financing, and wealth management. It serves institutional investors, trading firms, investment advisors, exchanges, retail platforms, and developers. It was founded in 2013 and is based in Palo Alto, California.

Ledger involved in the security and management of digital assets in the cryptocurrency domain. The company offers hardware wallets for storing cryptocurrencies, as well as a companion application for managing and interacting with digital assets. Ledger's products are available for individual consumers and institutional investors, focusing on storage, transaction, and portfolio management. It was founded in 2014 and is based in Paris, France.

Taurus is a company specializing in digital asset infrastructure within the financial technology sector. The company offers a platform for the custody, issuance, and management of cryptocurrencies, tokenized assets, and digital currencies. Taurus provides services including storage solutions, tokenization of various assets, and a trading platform for institutional investors. It was founded in 2018 and is based in Geneva, Switzerland.

Anchorage Digital offers a cryptocurrency platform that provides financial services and infrastructure solutions for institutions. It offers services including custody, staking, trading, and governance for digital assets. Anchorage Digital serves sectors such as wealth management, venture capital firms, governments, exchange-traded fund (ETF) issuers, and asset managers. It was founded in 2017 and is based in San Francisco, California.

Hex Trust offers services including custody, staking, and market services for digital assets. Hex Trust serves protocols, foundations, financial institutions, and the Web3 and Metaverse sectors. It was founded in 2018 and is based in Hong Kong.

Loading...