Investments

615Portfolio Exits

54Funds

24Partners & Customers

5About 8VC

8VC is a venture capital firm with a focus on technology and life sciences sectors. The company primarily invests in and builds ambitious and innovative companies, with a particular emphasis on creating technology platforms that generate lasting economic and societal value. 8VC's investments span a range of industries including life sciences, healthcare, manufacturing, enterprise, logistics, defense, AI, IT infrastructure, government, and financial services. It was founded in 2016 and is based in Austin, Texas.

Expert Collections containing 8VC

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find 8VC in 6 Expert Collections, including Restaurant Tech.

Restaurant Tech

20 items

Hardware and software for restaurant management, bookings, staffing, mobile restaurant payments, inventory management, and more.

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Synthetic Biology

382 items

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Education Technology (Edtech)

58 items

CB Insights Insurtech Smart Money Investors - 2020

25 items

Track the world's top-performing VC investors in insurtech. Firms are presented in unranked order.

Research containing 8VC

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned 8VC in 1 CB Insights research brief, most recently on Apr 10, 2025.

Apr 10, 2025

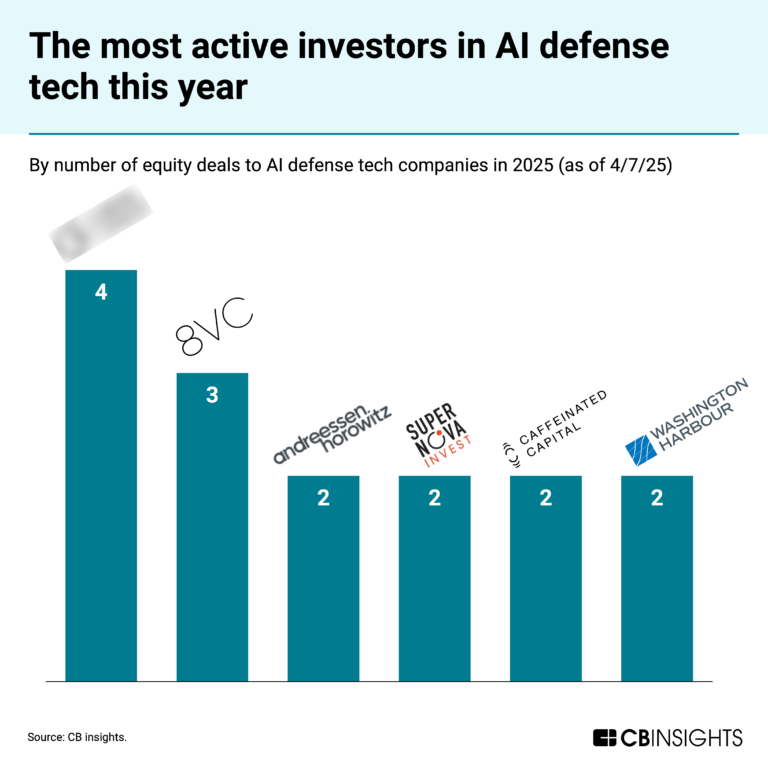

AI GI Joe: Defense tech goes on the offensiveLatest 8VC News

Sep 9, 2025

AI 新創 Cognition 完成募資、躋身百億美元估值俱樂 Now Translating... CNBC 報導,今年 7 月出手收購 Windsurf 的人工智慧(AI)新創企業 Cognition 9 月 8 日宣布完成最新一輪的 4 億美元募資,新資金到位後的公司估值達到 102 億美元,躋身百億美元估值俱樂部。 Cognition最新一輪募資由彼得提爾(Peter Thiel)共同創辦的Founders Fund領投,其他投資方包括Lux Capital、8VC以及Bain Capital Ventures。知情人士7月透露,Google 支付24億美元 以換取Windsurf創辦人加入及Windsurf部分技術的非獨家授權。 Cognition執行長Scott Wu 8日在 官方部落格文章 中提到,AI軟體工程師Devin去年3月問世時只是一位非常資淺的工程師,但AI代理現已能與個人開發者並肩合作,並在大型企業工程團隊中完成實質性工作。 Wu指出,在收購Windsurf之前,Cognition Devin年化經常性營收(ARR)從2024年9月的100萬美元暴增至2025年6月的7,300萬美元。他說,自Cognition兩年前成立以來、累計淨燒錢總額一直控制在2,000萬美元以下。 Wu表示,收購Windsurf讓Cognition ARR增加一倍以上,Cognition將繼續大舉投資Devin、Windsurf,客戶已看到這個產品組合的強大威力。 彭博社8日報導,Cognition今年稍早才以40億美元的估值完成募資。Cognition指出,在收購Windsurf後的近兩個月時間,企業ARR成長超過30%。Cognition的企業用戶包括高盛(Goldman Sachs)、花旗(Citigroup)、Palantir Technologies Inc.以及Dell Technologies Inc.。 Cognition向部分Windsurf員工提出離職方案,並在其他領域進行招聘。Cognition共同創辦人兼執行長Scott Wu 8日接受彭博電視台訪問時表示,Cognition的企業文化非常高壓,顯然不適合每個人。 官網資料顯示,Cognition創辦團隊成員合計贏得10面國際資訊奧林匹亞競賽(IOI)金牌,並且匯聚了曾在Cursor、Scale AI、Lunchclub、Modal、Google DeepMind、Waymo與Nuro等頂尖企業的開發者。

8VC Investments

615 Investments

8VC has made 615 investments. Their latest investment was in Harbor Health as part of their Series B on September 09, 2025.

8VC Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/9/2025 | Series B | Harbor Health | $130M | No | Alta Partners, Breyer Capital, DFO Management, General Catalyst, Health2047, Lemhi Ventures, Martin Ventures, and Undisclosed Angel Investors | 2 |

9/4/2025 | Series A | Hello Patient | $22.5M | No | 2 | |

9/4/2025 | Series A | Augment | $85M | No | Autotech Ventures, Redpoint Ventures, Shopify Ventures, and Undisclosed Investors | 2 |

9/4/2025 | Series A | |||||

9/4/2025 | Unattributed VC |

Date | 9/9/2025 | 9/4/2025 | 9/4/2025 | 9/4/2025 | 9/4/2025 |

|---|---|---|---|---|---|

Round | Series B | Series A | Series A | Series A | Unattributed VC |

Company | Harbor Health | Hello Patient | Augment | ||

Amount | $130M | $22.5M | $85M | ||

New? | No | No | No | ||

Co-Investors | Alta Partners, Breyer Capital, DFO Management, General Catalyst, Health2047, Lemhi Ventures, Martin Ventures, and Undisclosed Angel Investors | Autotech Ventures, Redpoint Ventures, Shopify Ventures, and Undisclosed Investors | |||

Sources | 2 | 2 | 2 |

8VC Portfolio Exits

54 Portfolio Exits

8VC has 54 portfolio exits. Their latest portfolio exit was CalypsoAI on September 11, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

9/11/2025 | Acquired | 7 | |||

9/8/2025 | Reverse Merger | Surfside Acquisition | 2 | ||

9/6/2025 | Acquired | 2 | |||

Date | 9/11/2025 | 9/8/2025 | 9/6/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Reverse Merger | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | Surfside Acquisition | ||||

Sources | 7 | 2 | 2 |

8VC Fund History

24 Fund Histories

8VC has 24 funds, including 8VC Fund V.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

3/1/2023 | 8VC Fund V | $880M | 1 | ||

4/23/2018 | 8VC Fund II | $640M | 6 | ||

5/12/2017 | 8VC Co-Invest Fund I | Co-Investment Fund | Closed | $256.8M | 3 |

12/31/2016 | 8VC Entrepreneurs Fund I | ||||

12/31/2016 | Eight Partners VC Fund I |

Closing Date | 3/1/2023 | 4/23/2018 | 5/12/2017 | 12/31/2016 | 12/31/2016 |

|---|---|---|---|---|---|

Fund | 8VC Fund V | 8VC Fund II | 8VC Co-Invest Fund I | 8VC Entrepreneurs Fund I | Eight Partners VC Fund I |

Fund Type | Co-Investment Fund | ||||

Status | Closed | ||||

Amount | $880M | $640M | $256.8M | ||

Sources | 1 | 6 | 3 |

8VC Partners & Customers

5 Partners and customers

8VC has 5 strategic partners and customers. 8VC recently partnered with Lineage on July 7, 2021.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

7/15/2021 | Licensee | United States | As Lineage 's Advisor , Medwell will bring to bear longstanding relationships and partnerships with Schneider National , Daimler , Koch Industries , and others . | 4 | |

4/13/2018 | Partner | ||||

4/10/2018 | Partner | ||||

Vendor | |||||

Vendor |

Date | 7/15/2021 | 4/13/2018 | 4/10/2018 | ||

|---|---|---|---|---|---|

Type | Licensee | Partner | Partner | Vendor | Vendor |

Business Partner | |||||

Country | United States | ||||

News Snippet | As Lineage 's Advisor , Medwell will bring to bear longstanding relationships and partnerships with Schneider National , Daimler , Koch Industries , and others . | ||||

Sources | 4 |

8VC Team

11 Team Members

8VC has 11 team members, including current Founder, Managing Partner, General Partner, Joseph T. Lonsdale.

Loading...