Databricks

Founded Year

2013Stage

Series K | AliveTotal Raised

$20.252BValuation

$0000Last Raised

$1B | 1 mo agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+40 points in the past 30 days

About Databricks

Databricks operates within the technology sector and provides data and artificial intelligence (AI) solutions. The company offers a platform that integrates data management, analytics, and AI for data-centric applications and services. Databricks serves industries such as communications, financial services, healthcare, manufacturing, media and entertainment, public sector, and retail. It was founded in 2013 and is based in San Francisco, California.

Loading...

ESPs containing Databricks

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The Large language model (LLM) developers market offers foundation models and APIs that enable enterprises to build natural language processing applications for multiple functions. These include content creation, summarization, classification, chat, and sentiment analysis. Companies in this market develop and train their own large-scale language models — which are pre-trained on vast amounts of te…

Databricks named as Leader among 15 other companies, including Google, IBM, and Meta.

Loading...

Research containing Databricks

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Databricks in 31 CB Insights research briefs, most recently on Sep 11, 2025.

Sep 11, 2025

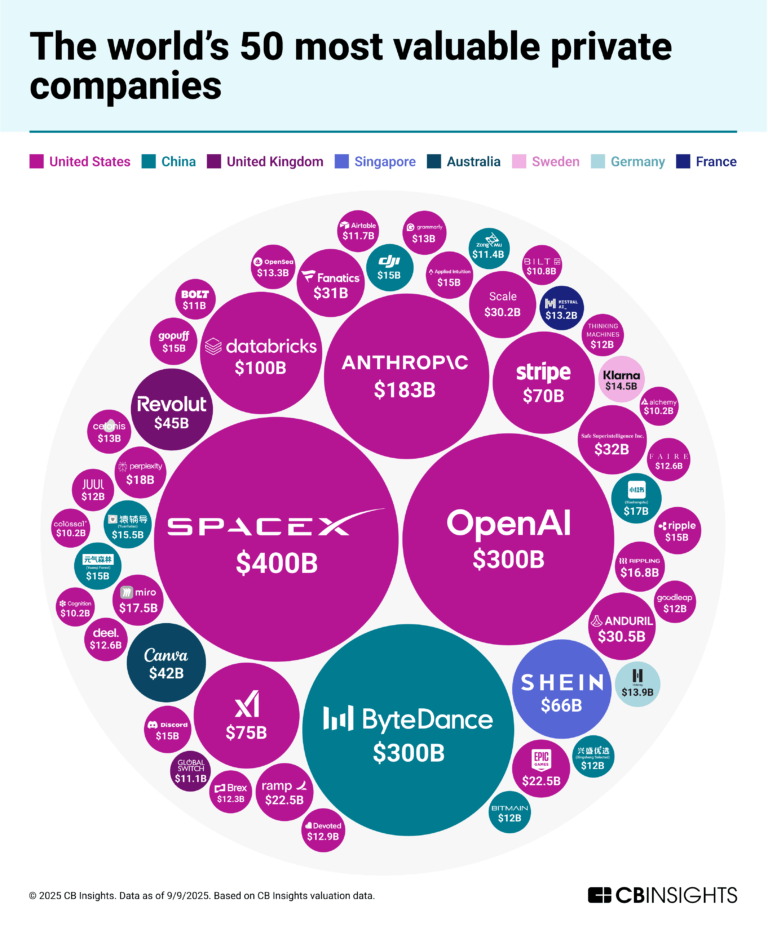

The world’s 50 most valuable private companies

Sep 5, 2025 report

Book of Scouting Reports: The AI Agent Tech Stack

Aug 25, 2025 report

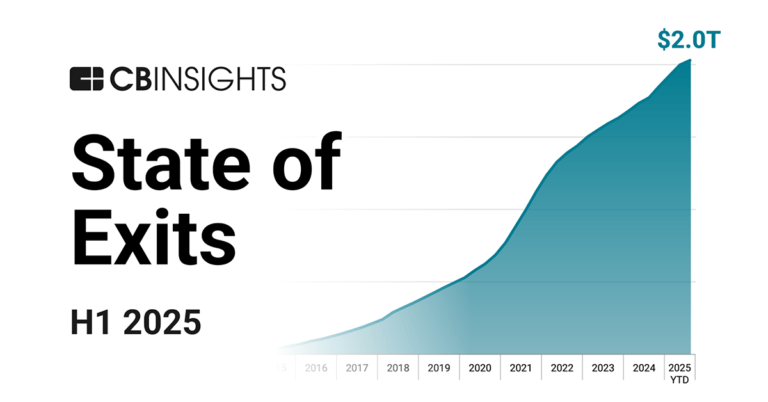

State of Tech Exits H1’25

Jul 31, 2025 report

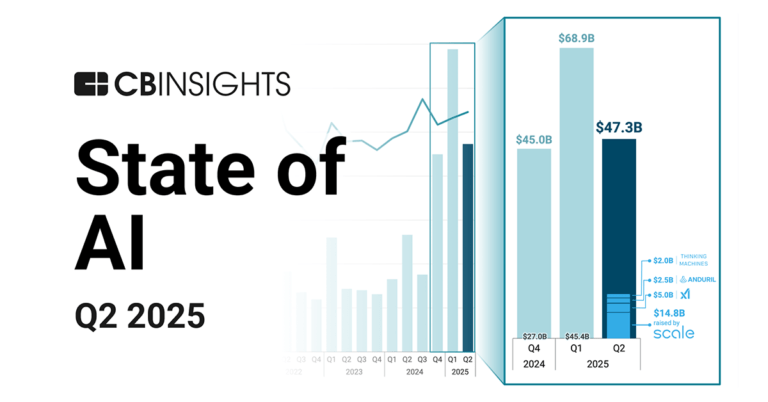

State of AI Q2’25 ReportExpert Collections containing Databricks

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Databricks is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,287 items

Tech IPO Pipeline

825 items

Advanced Manufacturing

6,887 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

Generative AI

2,826 items

Companies working on generative AI applications and infrastructure.

AI 100 (2024)

100 items

Artificial Intelligence

10,402 items

Databricks Patents

Databricks has filed 98 patents.

The 3 most popular patent topics include:

- data management

- database management systems

- diagrams

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/26/2023 | 3/25/2025 | Data management, Data security, Parallel computing, Computer security, Information technology management | Grant |

Application Date | 9/26/2023 |

|---|---|

Grant Date | 3/25/2025 |

Title | |

Related Topics | Data management, Data security, Parallel computing, Computer security, Information technology management |

Status | Grant |

Latest Databricks News

Sep 16, 2025

Databricks finds itself in an awkward situation following the departure of Naveen Rao, its head of artificial intelligence, as rivals like Snowflake, Teradata, and hyperscalers such as AWS, Azure, and Google Cloud, intensify their push to develop offerings for building generative AI applications. Rao's exit comes at a time when Databricks is aggressively trying to expand its offerings inside the Data Intelligence Platform, mainly with Lakebase and Agent Bricks , thanks to the infusion of capital from this week's US$1 billion Series K funding round that saw its valuation surge past US$100 billion. As a result, Rao's departure introduces uncertainty and raises questions about the company's ability to sustain innovation velocity and technical leadership in a fiercely competitive market. “Databricks is in a tricky spot with Naveen Rao stepping back. He was not just a figurehead, but deeply involved in shaping their AI vision, particularly after MosaicML,” said Robert Kramer, principal analyst at Moor Insights & Strategy. “Rao's absence may slow the pace of new innovation slightly, at least until leadership stabilises. Internal teams can keep projects on track, but vision-driven leaps, like identifying the ‘next MosaicML', may be harder without someone like Rao at the helm,” Kramer added. Rao became a part of Databricks in 2023 after the data lakehouse provider acquired MosaicML, a company Rao co-founded , for US$1.3 billion. During his tenure, Rao was instrumental in leading research for many Databricks products, including Dolly DBRX , and Agent Bricks. That leadership gap, the analyst warned, could give its rivals a convenient narrative to draw away customer attention. “To counter any such narrative, Databricks needs to prove quickly that AI remains central to its Data Intelligence Platform and not just a layer on top. If they falter, rivals, specifically hyperscalers, will use their speed and bundled services to lure customers,” Kramer said. And rivals such as Snowflake are not sitting idle either. While Snowflake has continued to add features that rival most of Databricks' AI and ML offerings, others such as Teradata and Cloudera are using strategies such as repositioning with AI factories and leaning into open standards such as Iceberg and the Model Context Protocol (MCP) to strengthen their AI approaches. However, The Futurum Group's lead for data intelligence and analytics Bradley Shimmin, unlike Kramer, doesn't foresee trouble for Databricks after Rao's departure. The AI market has shifted from building frontier models to integrating them, and technology vendors now compete by how well they apply these models, not by owning them, Shimmin said, pointing out that MosaicML's contribution is passé. Further, the analyst believes that Databricks will not lose ground to rivals like Snowflake or Teradata, as “the company already enjoys a comfortable lead, technologically speaking, in both building and running AI.” No immediate successor While analysts remain divided over the impact of Rao's departure, the company is yet to name his successor despite the role of head of AI being central to its future product roadmap. An email sent by sister publication InfoWorld to Databricks specifically asking about succession did not elicit a response. However, Kramer said that the company is more likely to rely on internal leaders who already know the platform, rather than rushing into an external hire. “This approach helps maintain continuity but also risks leaving a gap in outward-facing thought leadership. External recruitment could happen down the line, but in the short term, it looks like they'll tap existing product and research teams to carry forward Rao's priorities,” Kramer said. Offering a different view, Shimmin said that Databricks might not immediately feel the vacuum left by Rao, and can rely on CEO Ali Ghodsi and CTO Matei Zaharia. After all, he said, “you've got two technology-first executives with steady hands on the steering wheel. With Matei in particular, you've got someone who literally created and open-sourced much of the technology upon which Databricks is built, not just Apache Spark , but also MLflow, and Delta Lake .” Another fork in the road for Databricks? Rao's departure, according to Kramer, also presents Databricks with a critical choice: focus more on execution, making steady progress on the AI capabilities already underway, or chase the next big bet. For Databricks, the next big bet could be innovating on balancing the cost and efficiency of its offerings, Kramer said, adding that one way to achieve that would be specialised hardware for AI. Targeted hardware for AI can bring down the cost of training models or running complex queries to generate insights. Databricks is also investing in Rao's startup, CEO Ali Ghodsi wrote on LinkedIn, and confirmed that, as Rao had already hinted in a post, it would focus on the AI hardware space. Rao, when asked directly by InfoWorld about his startup, said that he would provide more details next week. For now, especially after Rao's departure, Databricks may have to lean more on partnerships, although, given the company's history of acquisitions and all the tell-tale signs, Rao and his new startup may in the future become part of the company again.

Databricks Frequently Asked Questions (FAQ)

When was Databricks founded?

Databricks was founded in 2013.

Where is Databricks's headquarters?

Databricks's headquarters is located at 160 Spear Street, San Francisco.

What is Databricks's latest funding round?

Databricks's latest funding round is Series K.

How much did Databricks raise?

Databricks raised a total of $20.252B.

Who are the investors of Databricks?

Investors of Databricks include Andreessen Horowitz, Insight Partners, MGX, Thrive Capital, WCM Investment Management and 89 more.

Who are Databricks's competitors?

Competitors of Databricks include Domino, Amini, OpenTeams, Datahub, Physis Investment and 7 more.

Loading...

Compare Databricks to Competitors

Alteryx is a company specializing in enterprise analytics, providing a platform that facilitates data preparation and analytics processes. The company's products allow users to conduct data analysis, develop predictive models, and visualize data insights. Alteryx serves sectors that require data analytics capabilities, including financial services, retail, healthcare, and manufacturing. Alteryx was formerly known as SRC. It was founded in 1997 and is based in Irvine, California.

DataRobot provides artificial intelligence (AI) applications and platforms within the enterprise AI suite and agentic AI platform domains. Its offerings include a suite of AI tools that integrate into business processes, allowing teams to manage AI, along with AI governance, observability, and foundational tools. DataRobot serves sectors including finance, supply chain, energy, financial services, government, healthcare, and manufacturing. It was founded in 2012 and is based in Boston, Massachusetts.

Qlik specializes in data integration, quality assurance, and analytics, operating within the data technology sector. The company provides tools and solutions that allow organizations to manage their data effectively. Qlik serves sectors that require data management and analytics, such as various business enterprises looking to utilize artificial intelligence (AI). It was founded in 1993 and is based in King of Prussia, Pennsylvania.

Tableau specializes in business intelligence and analytics. The company offers a platform that allows users to connect to various databases, create visualizations, and share insights, making data more understandable and actionable. It primarily serves the business intelligence and data analytics industry. It was founded in 2003 and is based in Seattle, Washington.

2021.AI focuses on the development and governance of artificial intelligence platforms in the enterprise AI sector. The company's key offering is the GRACE AI Platform, which centralizes AI operations and facilitates management and governance. 2021.AI serves sectors including legal, finance, software and tech, manufacturing, life sciences, transportation, and the public sector. It was founded in 2016 and is based in Copenhagen, Denmark.

Chalk is a data platform for inference that provides tools for feature engineering, real-time data processing, and scalable model deployment. The company serves various sectors including credit, fraud and risk management, and predictive maintenance. It was founded in 2022 and is based in San Francisco, California.

Loading...