Investments

37Portfolio Exits

2About CVS Health Ventures

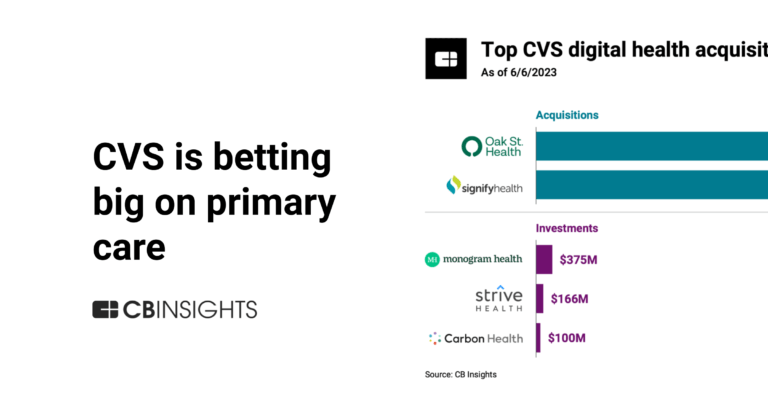

CVS Health Ventures is a venture capital investment platform focused on health care innovation and digital disruption within the health sector. The company partners with startups to support health care developments, utilizing CVS Health's capabilities and connections to assist these companies in scaling. CVS Health Ventures invests in areas such as care delivery, whole person care, consumer health, and technology. It was founded in 2021 and is based in Woonsocket, Rhode Island. CVS Health Ventures operates as a subsidiary of CVS Health.

Research containing CVS Health Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned CVS Health Ventures in 4 CB Insights research briefs, most recently on Sep 13, 2024.

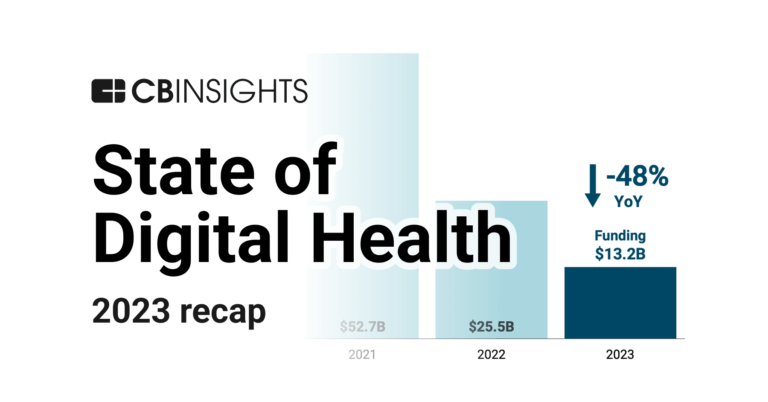

Jan 25, 2024 report

State of Digital Health 2023 ReportLatest CVS Health Ventures News

Aug 1, 2025

COLUMBIA, Md., July 22, 2025 /PRNewswire/ — AbsoluteCare , a leader in value-based integrated health care, has secured $135 million in equity financing from four investors: Kinderhook Industries CVS Health Ventures Pacific Life , and Lexington Partners . This funding bolsters AbsoluteCare's ability to optimize operations and expand into new markets and serve new member populations. “AbsoluteCare is setting a new standard for value-based care, delivering comprehensive health care to high-acuity Medicaid and Medicare members,” said Chris Michalik, Managing Director at Kinderhook. “We are thrilled with the company's success and recent expansion, and we look forward to supporting AbsoluteCare as it continues to scale its proven care model and improve patient lives across the country.” AbsoluteCare's Beyond Medicine™ model is designed to improve health outcomes for complex Medicaid and Medicare members through a whole-person approach that includes intense social determinants of health support, behavioral health care, primary and urgent care, and integrated pharmacy. Vijay Patel, Vice President and Managing Partner at CVS Health Ventures highlighted AbsoluteCare's impact, saying, “AbsoluteCare is delivering a unique, concierge-level of care to individuals who need it most, within their own community. Supporting the enhancement and expansion of this innovative care model aligns with our commitment to improve health outcomes for vulnerable populations.” With 25 years of experience serving marginalized populations and deep expertise in value-based care, AbsoluteCare is committed to improving quality outcomes by increasing interactions with primary care providers while reducing avoidable utilization and costs. Results include a 34% reduction in emergency department (ED) visits and a 20-30% decrease in total cost of care, along with 75-80% member engagement. This is for a member population that averages 13 diagnoses, 10+ medications and of which 60% have a behavioral health or substance use diagnosis. “This investment reflects deep confidence in AbsoluteCare's concierge, PCP-led care model and strengthens our ability to deliver outstanding health outcomes for our members and payer partners,” said Mike Radu, CEO of AbsoluteCare. “Due to its complexity, value-based care in Medicaid is rare at scale, but we are unwavering in our commitment to expanding our reach and deepening our presence in new communities. Our partners are seeing the results of that dedication with enhanced quality and demonstrated cost savings.” AbsoluteCare offers services within comprehensive care centers set in urban communities, near their member populations, and extends care into the community by rounding in hospitals and facilities and visiting members in their homes. Data Source: AbsoluteCare internal data (2025), Average annual performance across all members after year one. About Kinderhook Industries Founded in 2003, Kinderhook Industries, LLC is a private investment firm that has raised $8.5 billion of committed capital. We have made in excess of 500 investments and follow-on acquisitions since inception. Kinderhook's investment philosophy is predicated on matching differentiated, growth-oriented investment opportunities with financial expertise and our proprietary network of operating partners. Our focus is on middle market businesses with defensible niche market positioning in the healthcare services, environmental & industrial services, and light manufacturing & automotive sectors. For more information, please visit https://www.kinderhook.com About CVS Health Ventures CVS Health Ventures is a dedicated corporate venture capital fund that works with high-potential, early-stage and growth-stage companies focused on making health care more accessible, affordable, and simpler. The company focuses on investments that transform care delivery and focus on whole person care, consumer-centric health, and disruptive technology enablement. CVS Health Ventures' goal is to enable promising entrepreneurs to scale more quickly and effectively through access to their unmatched enterprise capabilities and consumer touchpoints, while offering expertise and insights from their company's unique perspective. For more information, visit cvshealthventures.com About AbsoluteCare Headquartered in Columbia, Maryland, AbsoluteCare is a leading value-based integrated health care provider. AbsoluteCare tends exclusively to the needs of the high-risk population who persistently represent a disproportionate amount of unnecessary utilization and cost. AbsoluteCare operates in 11 markets: Baltimore and Prince George's County, MD; Chicago, IL; Akron, Cincinnati, Cleveland, Columbus, and Dayton OH; New Orleans, LA; and Philadelphia and Pittsburgh, PA. For more information, visit absolutecare.com www.absolutecare.com | LinkedIn SOURCE AbsoluteCare Manager, LLC. Copyright © 2025 Cision US Inc.

CVS Health Ventures Investments

37 Investments

CVS Health Ventures has made 37 investments. Their latest investment was in Strive Health as part of their Series D on September 09, 2025.

CVS Health Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/9/2025 | Series D | Strive Health | $300M | No | BlackRock, CapitalG, Echo Health Ventures, New Enterprise Associates, Redpoint Ventures, Town Hall Ventures, and Undisclosed Investors | 2 |

8/21/2025 | Seed VC | Thrive Health Tech | $5M | No | 1 | |

7/22/2025 | Private Equity - II | AbsoluteCare | $135M | Yes | 2 | |

6/12/2025 | Series A - II | |||||

5/8/2025 | Series A |

Date | 9/9/2025 | 8/21/2025 | 7/22/2025 | 6/12/2025 | 5/8/2025 |

|---|---|---|---|---|---|

Round | Series D | Seed VC | Private Equity - II | Series A - II | Series A |

Company | Strive Health | Thrive Health Tech | AbsoluteCare | ||

Amount | $300M | $5M | $135M | ||

New? | No | No | Yes | ||

Co-Investors | BlackRock, CapitalG, Echo Health Ventures, New Enterprise Associates, Redpoint Ventures, Town Hall Ventures, and Undisclosed Investors | ||||

Sources | 2 | 1 | 2 |

CVS Health Ventures Portfolio Exits

2 Portfolio Exits

CVS Health Ventures has 2 portfolio exits. Their latest portfolio exit was SpectrumAi on August 18, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

8/18/2025 | Acquired | 4 | |||

Date | 8/18/2025 | |

|---|---|---|

Exit | Acquired | |

Companies | ||

Valuation | ||

Acquirer | ||

Sources | 4 |

CVS Health Ventures Team

230 Team Members

CVS Health Ventures has 230 team members, including current Founder, Managing Partner, Vijay Jun Patel.

Name | Work History | Title | Status |

|---|---|---|---|

Vijay Jun Patel | H.I.G. Growth Partners, Nike, Daktari Diagnostics, CVS Health, Bain Capital, Oliver Wyman, and Sankaty Advisors | Founder, Managing Partner | Current |

Name | Vijay Jun Patel | ||||

|---|---|---|---|---|---|

Work History | H.I.G. Growth Partners, Nike, Daktari Diagnostics, CVS Health, Bain Capital, Oliver Wyman, and Sankaty Advisors | ||||

Title | Founder, Managing Partner | ||||

Status | Current |

Loading...