Corvus Insurance

Founded Year

2017Stage

Acquired | AcquiredTotal Raised

$161MValuation

$0000Revenue

$0000About Corvus Insurance

Corvus Insurance offers cyber insurance and risk management services within the insurance industry. The company provides Cyber Insurance and Tech E&O products, which include cyber underwriting, risk services, incident response, and claims management. Corvus serves the insurance sector and provides cyber risk prevention tools and threat monitoring. It was founded in 2017 and is based in Boston, Massachusetts. In November 2023, Corvus Insurance was acquired by Travelers.

Loading...

Corvus Insurance's Product Videos

ESPs containing Corvus Insurance

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurtech managing general agents — cyber market comprises insurtech managing general agents (MGAs) that provide cyber insurance. Also included in this market are insurtech managing general underwriters (MGUs) and other insurtech entities that operate under a delegated authority arrangement from one or more carriers. In addition to insurance policies, these companies offer cyber security servi…

Corvus Insurance named as Leader among 10 other companies, including Eye Security, Resilience, and Converge.

Corvus Insurance's Products & Differentiators

Smart Cyber Insurance

Data-informed coverage built for evolving threats. We combine our underwriting expertise with technology for personalized quotes, optimal pricing, and broad coverage.

Loading...

Research containing Corvus Insurance

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Corvus Insurance in 5 CB Insights research briefs, most recently on Feb 29, 2024.

Feb 9, 2024 report

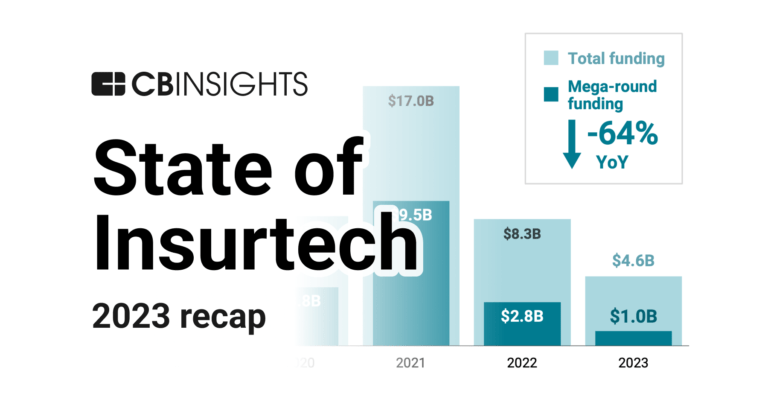

State of Insurtech 2023 Report

Feb 1, 2024 report

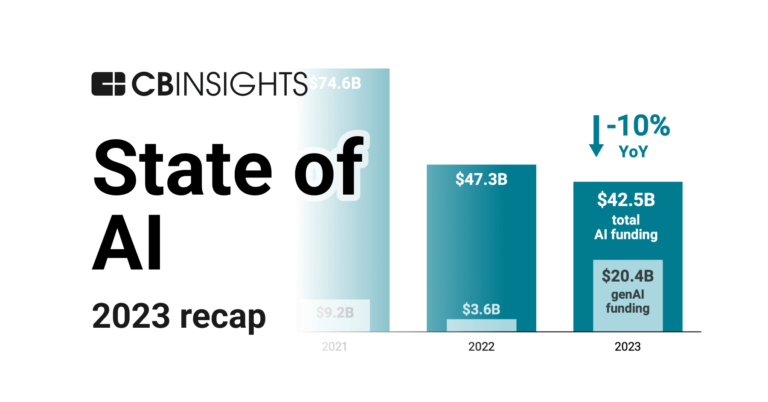

State of AI 2023 Report

Jan 18, 2024 report

State of Fintech 2023 ReportExpert Collections containing Corvus Insurance

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Corvus Insurance is included in 7 Expert Collections, including Insurtech.

Insurtech

4,596 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Cybersecurity

11,029 items

These companies protect organizations from digital threats.

Fintech

9,685 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

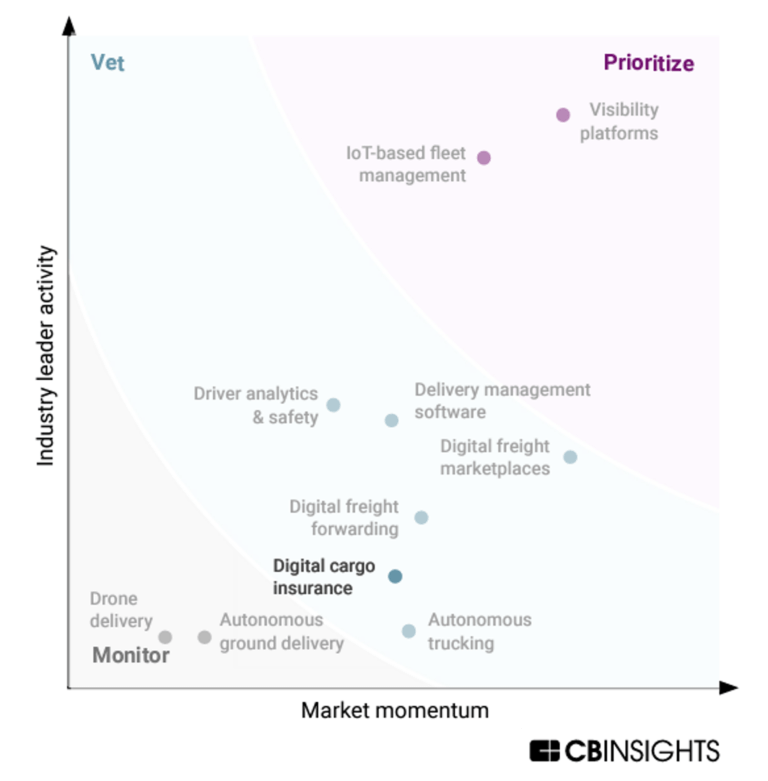

Supply Chain & Logistics Tech

347 items

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Latest Corvus Insurance News

Aug 22, 2025

“We developed the Risk Analyzer Suite to help organizations navigate an increasingly complex and interconnected risk landscape,” said Sean Rider, New York area-based head of risk analytics, North America at Aon. Recognizing the need for greater clarity and data-driven decision-making, Mr. Rider said, “We integrated advanced modeling tools and analytics platforms that engage clients in exploring their exposure, quantifying their risk and performance-testing their options.” In essence, the suite offers quantitative analytics within a decision-making framework. Since its launch, the platforms have helped more than 1,000 clients improve their risk outcomes and deliver cost savings. Analyzers for property risk, casualty risk, directors and officers liability and cyber risk offer insights to brokers and their clients and align risk strategies with their clients' priorities, Mr. Rider said. The property risk analyzer is a digital application for assessing risk and optimizing a property insurance program. It gives Aon broking teams the technical capability to give clients “an improved understanding of risk tolerance, optimized insurance programs and reduced total cost of risk.” For casualty, the suite offers a digital platform designed to help buyers navigate their potential for catastrophic risk, understand their total cost of risk and identify their optimal insurance program. The D&O risk analyzer delivers real-time, quantifiable insights for strategic discussions at the highest levels of decision-making, Mr. Rider said. By simulating probable exposures and loss scenarios, it allows for testing of insurance options and supports data-driven decisions that protect directors, officers and organizations. Involving more experts helps financial leaders and risk managers evaluate risk scenarios, shifting the focus from cost to calculated value. This leads to more productive discussions and better alignment of corporate priorities, Mr. Rider said. The ability to make better decisions translates complex risks into clear, actionable insights for risk and financial leaders. Clarity promotes the alignment of key decisions and improves overall decision-making. The suite speaks to the needs of finance executives who are focused on risk and facing significant uncertainty driven by the convergence of complex risks across trade, technology, weather and workforce, he said. FINALISTS • Corvus, a unit of Travelers — The company's cyber risk prevention tools provide intelligence on cyber threats and incident response support. • Insight Risk — Its Alert Response Credit deductible is structured to deploy technology to monitor water damage risks, respond to incidents and provide premium credits. • USI Insurance Services — The brokerage's USI PATH uses a six-step process to turn complex data into actionable insights. • Zurich — The insurer teamed with geospatial analytics company KorrAI to improve subsidence risk assessments.

Corvus Insurance Frequently Asked Questions (FAQ)

When was Corvus Insurance founded?

Corvus Insurance was founded in 2017.

Where is Corvus Insurance's headquarters?

Corvus Insurance's headquarters is located at 100 Summer Street, Boston.

What is Corvus Insurance's latest funding round?

Corvus Insurance's latest funding round is Acquired.

How much did Corvus Insurance raise?

Corvus Insurance raised a total of $161M.

Who are the investors of Corvus Insurance?

Investors of Corvus Insurance include Travelers, SiriusPoint, Aquiline Capital Partners, FinTLV, .406 Ventures and 8 more.

Who are Corvus Insurance's competitors?

Competitors of Corvus Insurance include Coalition and 7 more.

What products does Corvus Insurance offer?

Corvus Insurance's products include Smart Cyber Insurance and 2 more.

Loading...

Compare Corvus Insurance to Competitors

Cowbell Cyber provides adaptive cyber insurance coverage to small and medium-sized enterprises within the insurance sector. The company offers cyber insurance products that include continuous risk assessment and underwriting, using AI to manage and mitigate cyber risks. Cowbell Cyber serves the insurance industry with a focus on SMEs. It was founded in 2019 and is based in Pleasanton, California.

Coalition serves as a provider of active Insurance in the cybersecurity domain. It offers cyber insurance products, including coverage for ransomware and email compromise, as well as cybersecurity tools and services. It serves a diverse range of sectors by providing insurance and security solutions to manage digital risks. It was founded in 2017 and is based in San Francisco, California.

Resilience operates in the field of cybersecurity risk management and insurance within the financial services and technology sectors. Its offerings include cyber insurance policies, cyber risk quantification, and a risk operations center. Resilience provides solutions that include risk quantification software, cybersecurity expertise, and cyber insurance for middle and large organizations. Resilience was formerly known as Arceo AI. It was founded in 2016 and is based in San Francisco, California.

Hiscox USA specializes in small business insurance across various industries, offering a range of specialty risk solutions. The company provides essential coverage such as general liability, professional liability, and business owner policies, as well as cyber security and workers' compensation insurance. Hiscox USA caters to a diverse clientele, including professions in architecture, engineering, health and wellness, consulting, and artisan subcontracting. It was founded in 1901 and is based in Atlanta, Georgia.

Eye Security offers cybersecurity solutions, including threat detection and mitigation across various sectors. The company provides managed extended detection and response (XDR), incident response, security awareness training, and cyber insurance to support business operations. It serves small to medium-sized enterprises in sectors such as logistics, manufacturing, professional services, and healthcare. The company was founded in 2020 and is based in The Hague, Netherlands.

Embroker offers digital insurance brokerage specializing in business insurance solutions across various industries. The company offers a range of commercial insurance packages, including professional liability, cybersecurity, and directors and officers insurance, tailored to meet the specific needs of businesses. It primarily serves sectors such as startups, law firms, tech companies, and financial services. It was founded in 2015 and is based in San Francisco, California.

Loading...