Conduit

Founded Year

2021Stage

Series A | AliveTotal Raised

$59MLast Raised

$36M | 4 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+168 points in the past 30 days

About Conduit

Conduit specializes in facilitating international business payments within the financial technology sector. The company offers a platform for cross-border transactions, enabling businesses to manage global cash flows and accounts payable without the need for a US bank account or credit card. Conduit primarily serves businesses engaged in international trade and financial transactions. It was founded in 2021 and is based in Kalispell, Montana.

Loading...

Loading...

Research containing Conduit

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Conduit in 3 CB Insights research briefs, most recently on Jul 10, 2025.

Jul 10, 2025 report

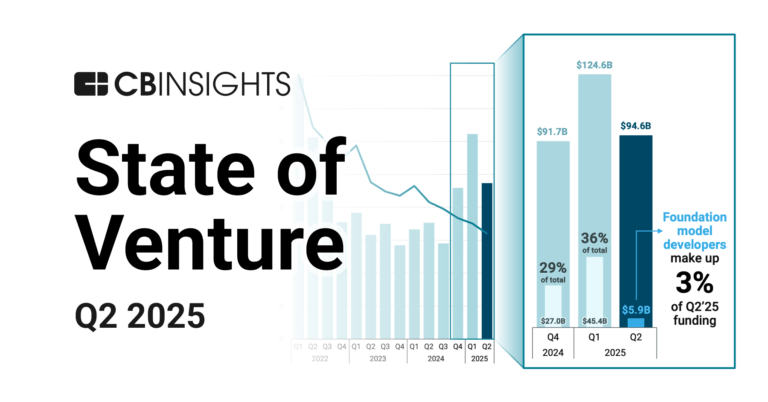

State of Venture Q2’25 Report

May 29, 2025

The stablecoin market map

May 23, 2025 report

Book of Scouting Reports: Stablecon 2025Expert Collections containing Conduit

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Conduit is included in 4 Expert Collections, including Blockchain.

Blockchain

13,056 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Payments

3,199 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,685 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Stablecoin

450 items

Latest Conduit News

Aug 26, 2025

The search for faster and cheaper global payments is leading many companies to consider the use of stablecoins for remittances. Published Aug. 26, 2025 First published on Digital currencies are proving to be a draw for cross-border payments as companies begin exploring stablecoins for faster, cheaper settlements relative to more traditional international payment providers such as Swift and MoneyGram. PayPal Holdings’ global payments service has begun using its PYUSD stablecoin to settle Xoom cross-border payments, escaping what PayPal has called “ traditional banking hours .” PayPal has also begun marketing digital currencies, including PYUSD, as a means for lower transaction costs at both Xoom and its new crypto payments tool . Companies are beginning to understand that stablecoins can enable “cheaper remittances, lower transaction costs, less friction, more open access,” said Mark Nichols, a principal at consulting firm Ernst & Young, who specializes in financial services and capital markets strategy. Finance executives are also keen to learn more about how stablecoins can help manage their corporate treasury functions more efficiently, Nichols said in an interview Aug. 15. “There's certainly a play there — cheaper, quicker, and we’re seeing that [stablecoin] adoption happen.” Legacy global payment networks take as long as five business days to complete a transaction, owing to multiple intermediaries, different business time zones and periodic processing of batches, McKinsey & Co. said in a July report on stablecoins . Most payments also require manual or semi-automated regulatory checks for money laundering, sanctions screening and identity confirmation, the report noted. Because of the increased volume of transactions that cross borders, “demand has grown in the past decade for more-responsive, real-time, low-cost, secure, and inclusive global payment solutions,” according to the report. Cross-border accounted for about $179 trillion in payments last year, McKinsey said in a separate payments report . Stablecoins’ appeal for cross-border transactions comes in three areas: real-time settlements 24/7, security and lower cost, said Bam Azizi, chief executive of cryptocurrency payments network Mesh Connect. “The killer app for stablecoin is going to be payment, whether it’s cross-border payment, B2B [business-to-business payment] or [a] payout,” he said in an Aug. 13 interview. For leaders of companies that have “a presence in more than five or 10 countries, you have to embrace stablecoins because you’re leaving money on the table, or you're losing money, if you don’t,” Azizi said, citing the yield benefits of holding the underlying reserves of a stablecoin, such as Treasury bills. EY strategists expect corporate stablecoin operations to develop over the next 18 months, Nichols said. “We’ll see firms use that time to feel comfortable and adopt, but adopt relatively slowly on the whole,” he said. The exception is “early adopters” moving rapidly today in areas such as e-commerce, payroll and merchant services, he said. “These sectors are moving a lot faster, obviously, because they’ve got customers that need them,” Nichols said. While settlement lags are often cited as a primary frustration for legacy cross-border payment systems, the expense of sending money abroad remains high for many companies and consumers, despite efforts to make cross-border payments more efficient via technology upgrades such as the industry’s recent shift to the ISO 20022 standard . Globally, it cost 4.26% on average to send $500 internationally in the first quarter, declining about 0.26 percentage point over the past five years, according to the World Bank’s most recent quarterly report in March on worldwide remittance prices. Earlier this year, one of the industry’s primary players, Swift, the international payments messaging firm, began trials involving digital currencies. The testing leverages Swift’s “unique position at the heart of the financial system to interlink these disparate networks with each other as well as with existing fiat currencies, enabling its global community to seamlessly transact using digital assets and currencies alongside traditional forms of value, using their existing infrastructure,” the cooperative said in an October press release . Swift had no further comment on the trials, a spokesperson said Friday. “Swift does not advocate for one settlement model over another and remains agnostic when it comes to forms and ways of moving value,” the company said in an emailed statement. “The organization is focused on enabling its network to support multiple types of settlement models based on the evolving needs of its community.” Late last year, Swift said it had concluded a successful test program with UBS Asset Management and the Chainlink blockchain to demonstrate the transfer of tokenized funds across public and private blockchains using Swift’s infrastructure. Stablecoins’ role is also growing rapidly in corporate payroll, especially for remote workers in places where the local currency may not be as desirable as U.S. dollars or euros, said Kirill Gertman, chief executive of Boston-based Conduit Technology, which uses stablecoins in its cross-border payments network. “You work maybe for an American company, but you’re in Argentina,” Gertman said in an interview last month, by way of example. “You don't want to receive Argentine pesos most of the time, you want to receive your dollars [but] you can’t actually receive dollars. So, what's going to happen is, there’s a bunch of companies essentially offering a service of converting your payroll into stablecoins, depositing into your wallet.” In emerging markets, remittance payments are a major cross-border use case for stablecoins, and are growing for corporate payments, Kevin Lehtiniitty, CEO of Borderless Innovation Labs, said at the Stable SF 2025 conference earlier this year. New York-based Borderless operates a cross-border stablecoin payments network to connect money transmitters with regulated companies in a local market where they have customers wanting to send funds. Despite the growth of stablecoins crossing borders, the specific geographies will matter greatly, he said. “Even in cross-border remittance, which is one of the best use cases of stablecoin today, it’s really corridor-dependent where it actually makes sense and is better, faster, cheaper,” he said. Recommended Reading

Conduit Frequently Asked Questions (FAQ)

When was Conduit founded?

Conduit was founded in 2021.

Where is Conduit's headquarters?

Conduit's headquarters is located at 1001 Street Main Street, Kalispell.

What is Conduit's latest funding round?

Conduit's latest funding round is Series A.

How much did Conduit raise?

Conduit raised a total of $59M.

Who are the investors of Conduit?

Investors of Conduit include Portage Ventures, Sound Ventures, Dragonfly, Digital Currency Group, Circle Ventures and 18 more.

Who are Conduit's competitors?

Competitors of Conduit include UPTIQ and 7 more.

Loading...

Compare Conduit to Competitors

Zepz is a company in the financial technology sector that facilitates international payments. It provides digital solutions for sending money across borders, including options for bank deposits, cash collections, and mobile money services. Zepz serves the ecommerce industry by offering online money transfers. The company was formerly known as WorldRemit. It was founded in 2021 and is based in London, United Kingdom.

PaySend provides a global payment ecosystem that operates in the financial services industry. The company's main service is to enable consumers and businesses to pay and send money online, supporting cross-network operability globally across major card networks and providing over 40 payment methods for online SMEs. PaySend primarily serves the e-commerce industry. It was founded in 2015 and is based in London, United Kingdom.

BitPay provides cryptocurrency payment processing and digital wallet services within the financial technology (fintech) sector. It offers a platform for individuals and businesses to buy, store, swap, sell, and spend cryptocurrencies and tools for merchants to accept cryptocurrency payments. Its services are available to various sectors, including e-commerce and real estate technology. It was founded in 2011 and is based in Atlanta, Georgia.

Capi facilitates international payments for businesses in Africa that operate within the financial technology sector. The company provides foreign currency exchange services and enables payments to international suppliers in EUR, USD, or GBP. Capi serves importers in Africa who need methods to settle overseas invoices. It was founded in 2023 and is based in Wilmington, Delaware.

Veem offers a payment platform for businesses to send and receive money globally. It provides flexible digital payments, competitive exchange rates, payment tracking, and workflow automation. It serves various industries such as e-commerce, freelancers, manufacturing, and others. The company was formerly known as Align Commerce. It was founded in 2014 and is based in San Francisco, California.

Diameter Pay is a financial technology company that provides embedded payment solutions for banks and financial institutions. The company offers APIs for global and local payments across different payment systems and currencies, as well as compliance automation for transaction processing. It was founded in 2017 and is based in Jersey City, New Jersey.

Loading...