Clara

Founded Year

2020Stage

Series B - IV | AliveTotal Raised

$550MLast Raised

$40M | 5 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+60 points in the past 30 days

About Clara

Clara operates a management platform in the business payments sector. It offers corporate credit cards, bill payment services, cross-border payments, and a software platform for expense management and financial operations. Clara primarily serves large and growing companies across various industries. The company was founded in 2020 and is based in Sao Paulo, Brazil.

Loading...

Clara's Product Videos

Clara's Products & Differentiators

Card

Clara-issued charge card (have premium, business, and virtual offerings)

Loading...

Research containing Clara

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Clara in 4 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

Oct 5, 2023 report

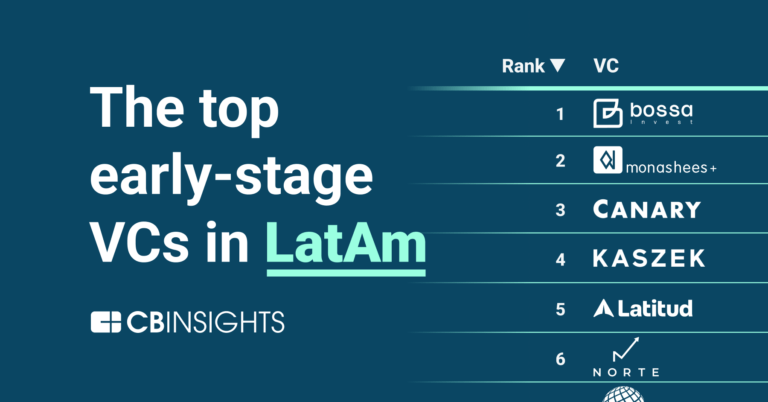

The top 25 early-stage LatAm VCs

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Clara

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Clara is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,286 items

Payments

3,199 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

14,013 items

Excludes US-based companies

Fintech 100

100 items

Latest Clara News

Aug 7, 2025

August 7, 2025 Brazil’s venture capital scene has taken a big hit. KPMG’s official figures show that in the second quarter of 2025, only $322 million poured into Brazilian startups. That’s a steep 65% drop from the start of the year and the lowest level in two years. For anyone watching Brazil’s tech market, this is a sudden and serious setback. Several factors are at play. The U.S. government imposed new tariffs of up to 50% on key Brazilian exports in 2025, officially confirmed by Brazilian government communications and U.S. trade data. This made things harder for Brazil’s exporters and spooked investors, leading big funds to move their money out of Brazil to safer havens like the U.S. At the same time, Brazil’s central bank kept interest rates high to control inflation, making loans costlier and leaving less room for risky bets on new businesses. The numbers tell the real story. In just three months, investment dropped from $927 million to $322 million, with one deal—an $80 million investment in fintech company Clara—making up a quarter of the total. Brazil’s Startup Funding Plummets to Two-Year Low as Global Investors Pull Back. (Photo Internet reproduction) Without these rare large checks, the market looks even weaker. Brazil also saw Mexico outpace it, raising $833 million the same quarter, bolstered by a major single investment. Globally, venture capital investments dropped from $128 billion at the start of the year to $101 billion by mid-2025, based on KPMG’s audited industry tracking. Brazil’s Startup Squeeze Still, the U.S. captured over 70% of all that global money, leaving other countries, like Brazil, with far less to fuel smaller firms and fresh ideas. Why does this matter? Brazil depends on outside money to help its young businesses grow. When global risk or new trade rules pull that money away, the most promising startups get hit hardest. Those sectors that do receive funds—AI, fintech, and logistics—have strong records and clearer paths to profits. But hundreds of other companies, especially small and new ones, may struggle or disappear. The story behind these numbers is about fragile growth. Brazil ’s startup funding relies on a few big deals, not a steady pipeline. When those deals vanish, the whole system feels it. For now, only the strongest companies will survive the squeeze. If these trends continue, Brazil risks falling behind its neighbors—and many future jobs and solutions could simply never see the light of day. For outsiders and insiders alike, these figures send a wake-up call: any country that relies on outside investment and a handful of oversized deals stands on shaky ground. Today’s downturn could shape Brazil’s tech market for years to come. Check out our other content

Clara Frequently Asked Questions (FAQ)

When was Clara founded?

Clara was founded in 2020.

Where is Clara's headquarters?

Clara's headquarters is located at R. Dr. Renato Paes de Barros. 33, Sao Paulo.

What is Clara's latest funding round?

Clara's latest funding round is Series B - IV.

How much did Clara raise?

Clara raised a total of $550M.

Who are the investors of Clara?

Investors of Clara include General Catalyst, DST Global, Picus Capital, Monashees+, Coatue and 37 more.

Who are Clara's competitors?

Competitors of Clara include ComunidadFeliz and 8 more.

What products does Clara offer?

Clara's products include Card and 2 more.

Who are Clara's customers?

Customers of Clara include Banco Sabadell, Enseña por México, OnFly and Gulf.

Loading...

Compare Clara to Competitors

Mendel is a technology company that focuses on streamlining and optimizing financial management for large enterprises in the finance and technology sectors. The company offers an integrated solution for intelligent expense management and control, providing real-time reporting, automated workflows, and smart corporate Visa cards. Mendel primarily serves large corporations seeking to digitize their financial processes and increase payment transparency. It was founded in 2021 and is based in Mexico City, Mexico.

Jeeves operates a financial platform providing payment and expense management solutions within the financial services industry. The company offers a suite of tools that streamline global finance operations, including multi-currency accounts, corporate card issuance, cross-border payments, and integrated expense management. Jeeves primarily serves businesses looking to manage their financial operations across multiple countries. It was founded in 2019 and is based in Orlando, Florida.

ASAAS focuses on financial process automation for businesses. It provides a digital account for billing management, invoicing, receivables anticipation, and supplier payments. It serves freelancers, microentrepreneurs, and large companies. It was founded in 2010 and is based in Joinville, Brazil.

Brex provides spend management solutions across various sectors. The company offers products including corporate cards, expense management, travel, bill pay, and banking services aimed at assisting businesses in managing spending and financial processes. Brex serves startups, mid-size companies, and enterprises with its range of financial products. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Pluto is a spend management and corporate card platform that provides financial workflow automation across various industries. The company offers services, including corporate cards with budget controls, employee reimbursements, digital petty cash management, procurement and accounts payable solutions, accounting automation, and invoice management. Pluto primarily serves sectors such as retail and e-commerce, agencies, trucking and fleet, consulting firms, small to medium-sized businesses, and large enterprises. Pluto was formerly known as Pluto Technologies. It was founded in 2021 and is based in Dubai, United Arab Emirates.

Kastor specializes in community management software within the real estate tech industry. The company offers a comprehensive suite of tools for the efficient management, accounting, and transparency of common expenses in residential and business communities. Kastor's software is designed to improve the satisfaction of co-owners by providing easy access to administrative information and facilitating their daily lives in their residences or businesses. It is based in Santiago, Chile.

Loading...