Circle

Founded Year

2013Stage

IPO | IPOTotal Raised

$1.199BDate of IPO

6/5/2025Market Cap

23.29BStock Price

117.49About Circle

Circle operates as a financial technology firm involved in the issuance and management of regulated stablecoins and a platform for digital currency transactions. The company provides services including stablecoin issuance (USDC and EURC), a tokenized money market fund (USYC), and developer services such as secure wallet integration, smart contract management, and cross-chain transfer solutions. Circle serves sectors that require digital currency payments, trading, and liquidity services. It was founded in 2013 and is based in New York, New York.

Loading...

ESPs containing Circle

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The stablecoin settlement & payouts market refers to the use of stablecoins, which are cryptocurrencies designed to maintain a stable value, for settling transactions and making payouts. This market offers a fast and cost-effective way to move money across borders and provides access to financial services in emerging markets. Technology vendors in this market offer solutions for digital asset cust…

Circle named as Leader among 13 other companies, including Coinbase, Ripple, and BitGo.

Circle's Products & Differentiators

Circle Account

The Circle Account is a full stack solution that replaces a fractured system for business banking. Securely custody funds, send and receive payments globally and streamline treasury operations all connected through USD Coin (USDC) and integrated with a suite of APIs.

Loading...

Research containing Circle

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Circle in 15 CB Insights research briefs, most recently on Aug 4, 2025.

Aug 4, 2025

3 markets fueling the shift to agentic commerce

Jul 17, 2025 report

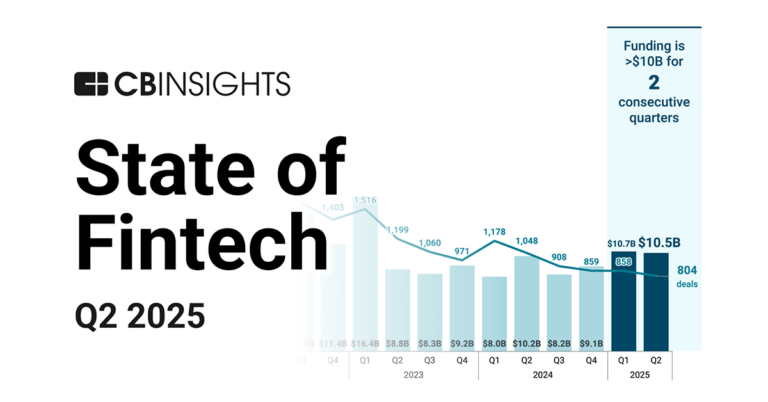

State of Fintech Q2’25 Report

Jul 10, 2025 report

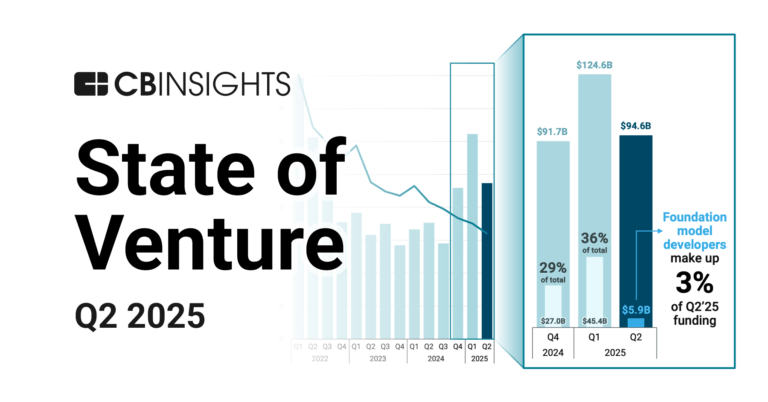

State of Venture Q2’25 Report

May 29, 2025

The stablecoin market map

May 23, 2025 report

Book of Scouting Reports: Stablecon 2025

Aug 23, 2024

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

Cross-border payments market mapExpert Collections containing Circle

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Circle is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,286 items

Blockchain

13,908 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

498 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

286 items

Fintech

9,685 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Circle Patents

Circle has filed 70 patents.

The 3 most popular patent topics include:

- cryptocurrencies

- blockchains

- alternative currencies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/25/2021 | 4/8/2025 | Parasites of fish, Monopisthocotylea, Geoplanidae, Animal equipment, Dog training and behavior | Grant |

Application Date | 10/25/2021 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Parasites of fish, Monopisthocotylea, Geoplanidae, Animal equipment, Dog training and behavior |

Status | Grant |

Latest Circle News

Sep 5, 2025

2025年8月,毕马威(KPMG)发布了最新一期的《金融科技脉搏》报告(Pulse of Fintech H1’2025),对2025年上半年全球金融科技产业发展进行了回顾。 报告指出,2025年上半年全球金融科技产业共完成2216笔,交易融资总额达447亿美元。投资者在交易决策上表现出极高的选择性,期间的关键趋势包括:1)全球数字资产投资激增;2)对金融科技AI赋能的关注度日益提升——无论是原生AI企业还是现有平台的AI转型;3)美国IPO退出活动增加,预计下半年将有更多重大上市项目;4)随着机构寻求降低成本,监管科技(Regtech)发展势头增强。 全球金融科技投资遭遇五年来最低半年期水平 2025年上半年,全球金融市场录得447亿美元投资——这是自2020年上半年以来的最低半年期水平。高利率对资本成本和回报预期的影响,淘汰了更多投机性投资,使金融科技投资回归至新的基准线。尽管金融科技投资者在进入2025年时持谨慎乐观态度,但新一轮地缘政治紧张局势叠加美国关税和贸易政策的转变,令投资者难以对交易活动建立信心。2025年第二季度(Q2’25)表现尤为疲软,仅完成972笔交易,投资额187亿美元——交易量创下自2017年第三季度(Q3’17)以来的新低。 美洲吸引超半数金融科技投资,但最大单笔交易则来自欧洲、中东和非洲(EMEA)地区 2025年上半年,美洲地区吸引金融科技投资267亿美元。主要交易包括:慕尼黑再保险(Munich Re)旗下核心保险业务安顾集团(Ergo Group)以26亿美元收购美国Next Insurance公司。相比之下,欧洲、中东和非洲(EMEA)地区投资额为137亿美元,其中包括本年度迄今最大的金融科技交易——BlackRock以32亿美元收购英国Preqin公司,以及Bridgepoint以17亿美元将法国Esker公司私有化。亚太(ASPAC)地区金融科技投资仅为43亿美元,最大交易为三菱日联金融集团(MUFG)以5.713亿美元收购日本WealthNavi公司。 数字资产与货币投资有望创下三年新高 从细分领域看,数字资产与货币在上半年吸引了最多的全球金融科技投资,目前总额为84亿美元(2024年全年为107亿美元)。截至年中,数字资产领域有望实现全球投资额的三年新高——尽管可能仍远低于2021年310亿美元的峰值水平。投资者对稳定币表现出浓厚兴趣,尤其是在交易、汇款以及作为新兴市场支付手段等应用场景。其他投资领域包括数字资产市场基础设施和代币化平台。2025年上半年,数字资产领域还见证了USDC稳定币发行方Circle公司IPO大获成功:其在纽交所(NYSE)融资11亿美元,首日股价暴涨168%。预计下半年将有更多美国本土的数字资产平台上市。 支付领域投资大幅下滑,投资者聚焦韧性模式 支付领域投资额从2023年的176亿美元激增至2024年的308亿美元后,业界对2025年曾抱有一定乐观预期。然而,这种乐观并未实现,实际数据显示,支付行业投资额在2025年上半年骤降至仅46亿美元——这是十多年来的最低水平,投资者纷纷避开10亿美元以上的并购交易。EMEA地区包揽了上半年两笔最大支付交易——均发生在英国:包括金融科技即服务(FaaS)支付平台Rapyd Financial Network获得5亿美元风险投资,以及由TowerBrook基金、JC Flowers基金和Railsr股东组成的财团以3.663亿美元收购可扩展支付解决方案公司Equals Group。美洲地区最大交易是阿根廷数字银行Ualá Bank融资3.66亿美元,而新加坡Airwallex公司融资3.01亿美元,成为亚太地区最大支付交易。 保险科技吸引投资48亿美元,超2024年全年水平 2025年上半年,全球保险科技总投资额大幅上升,共完成141笔交易,投资额达48亿美元——远高于2024年全年的29亿美元,并有望成为自2021年以来保险科技投资表现最强劲的一年。该总额主要由安顾集团(Ergo)以26亿美元收购美国聚焦中小企业的数字保险公司Next Insurance所推动。美洲地区占据了五大保险科技交易中的四笔——均发生在美国:除Next Insurance交易外,数字化家庭保险提供商Openly融资1.93亿美元,Fentura Financial被ChoiceOne以1.804亿美元收购,以及聚焦人寿保险的技术提供商Bestow融资1.25亿美元。亚太地区最大交易来自新加坡嵌入式保险平台提供商Bolttech,融资总额1.47亿美元,而EMEA地区最大交易来自英国保险平台公司Marshmallow,融资总额9000万美元。 网络安全领域交易放缓 监管科技投资在2024年上半年巨额交易后放缓 尽管2025年上半年总投资额下降,但截至年中,交易量已达190笔——远超2023年全年(361笔)和2024年全年(360笔)交易量所需的增速。这凸显了该领域(监管科技)的活跃度——尽管交易活动主要集中在早期阶段,而非更成熟的金融科技细分领域。 AI驱动财富科技兴趣升温 上半年,财富科技领域的主要交易包括:三菱日联金融集团(MUFG)以5.713亿美元收购日本资产管理平台及智能投顾服务WealthNavi;瑞士宝盛集团(Julius Baer Group)将其巴西财富管理资产以1.061亿美元出售给BTG Pactual;以及法国加密货币投资产品公司Bitwise融资6990万美元。 否

Circle Frequently Asked Questions (FAQ)

When was Circle founded?

Circle was founded in 2013.

Where is Circle's headquarters?

Circle's headquarters is located at 1 World Trade Center, New York.

What is Circle's latest funding round?

Circle's latest funding round is IPO.

How much did Circle raise?

Circle raised a total of $1.199B.

Who are the investors of Circle?

Investors of Circle include Coinbase, Fidelity Investments, Marshall Wace Asset Management, BlackRock, Fin Capital and 42 more.

Who are Circle's competitors?

Competitors of Circle include Zepz, Revolut, Binance, BitGo, Bitstamp and 7 more.

What products does Circle offer?

Circle's products include Circle Account and 3 more.

Who are Circle's customers?

Customers of Circle include FTX and CMS.

Loading...

Compare Circle to Competitors

BurjX provides cryptocurrency trading exchange and broker-dealer solutions. It develops a platform for trading digital assets, managing digital asset wallets, and facilitating financial transactions. It was founded in 2022 and is based in New York, New York.

CoinDCX is a cryptocurrency investment platform that operates in the financial technology sector. The company offers a crypto exchange with a focus on user experience and security, providing access to a variety of crypto-based financial products and services. CoinDCX caters to the needs of the Indian crypto community by offering solutions for crypto investing, trading, and literacy. It was founded in 2018 and is based in Mumbai, India.

Kraken focuses on digital currency exchange. The company provides a platform for trading various digital currencies, including bitcoin. Kraken primarily serves the financial technology industry. It was founded in 2011 and is based in San Francisco, California.

CoinZoom is a fintech company that provides a cryptocurrency debit card enabling users to spend their crypto and cash, buy, sell, and trade cryptocurrencies. The company serves individuals interested in incorporating cryptocurrency into their financial transactions. It was founded in 2018 and is based in Salt Lake City, Utah.

Crypto.com is a cryptocurrency trading platform and financial services provider in the fintech sector. The company provides services for buying, selling, and trading Bitcoin, Ethereum, and over 350 other cryptocurrencies, as well as decentralized finance services like staking and various crypto financial products. Crypto.com serves individuals and businesses involved in cryptocurrency transactions and investments. Crypto.com was formerly known as Monaco. It was founded in 2016 and is based in Singapore.

Blockchain.com specializes in blockchain technology and cryptocurrency-related solutions. The company offers a platform where users can buy, sell, and swap cryptocurrencies like Bitcoin and Ethereum, as well as earn rewards on their cryptocurrency assets. It also provides a cryptocurrency wallet for the self-custody of digital assets and an exchange for trading in fiat currencies. It was founded in 2011 and is based in London, United Kingdom.

Loading...