BVNK

Founded Year

2020Stage

Series B - II | AliveTotal Raised

$91.7MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+146 points in the past 30 days

About BVNK

BVNK is a company that provides stablecoin payments infrastructure within the fintech sector. The company offers a platform for businesses to send, receive, store, and convert fiat and stablecoins, connecting traditional banking and blockchain technology. BVNK serves sectors including fintech, payment service providers, CFD and forex trading, iGaming, and digital asset businesses. It was founded in 2020 and is based in London, United Kingdom.

Loading...

BVNK's Product Videos

_thumbnail.png?w=3840)

ESPs containing BVNK

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The crypto payment processing market enables businesses to accept, process, and convert cryptocurrency payments. These platforms provide payment gateway services, instant crypto-to-fiat conversion, and multi-currency support for Bitcoin, Ethereum, stablecoins, and other digital assets. Companies in this market serve e-commerce merchants, online businesses, and service providers by offering APIs, p…

BVNK named as Outperformer among 15 other companies, including Coinbase, PayPal, and Ripple.

BVNK's Products & Differentiators

Global Settlement Network

BVNK enables fast, reliable, cost-effective settlement in less than 24 hours. We're strong in emerging markets where growing businesses are underserved.

Loading...

Research containing BVNK

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned BVNK in 6 CB Insights research briefs, most recently on May 29, 2025.

May 29, 2025

The stablecoin market map

May 23, 2025 report

Book of Scouting Reports: Stablecon 2025

Aug 23, 2024

The B2B payments tech market map

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

Cross-border payments market map

Oct 20, 2022

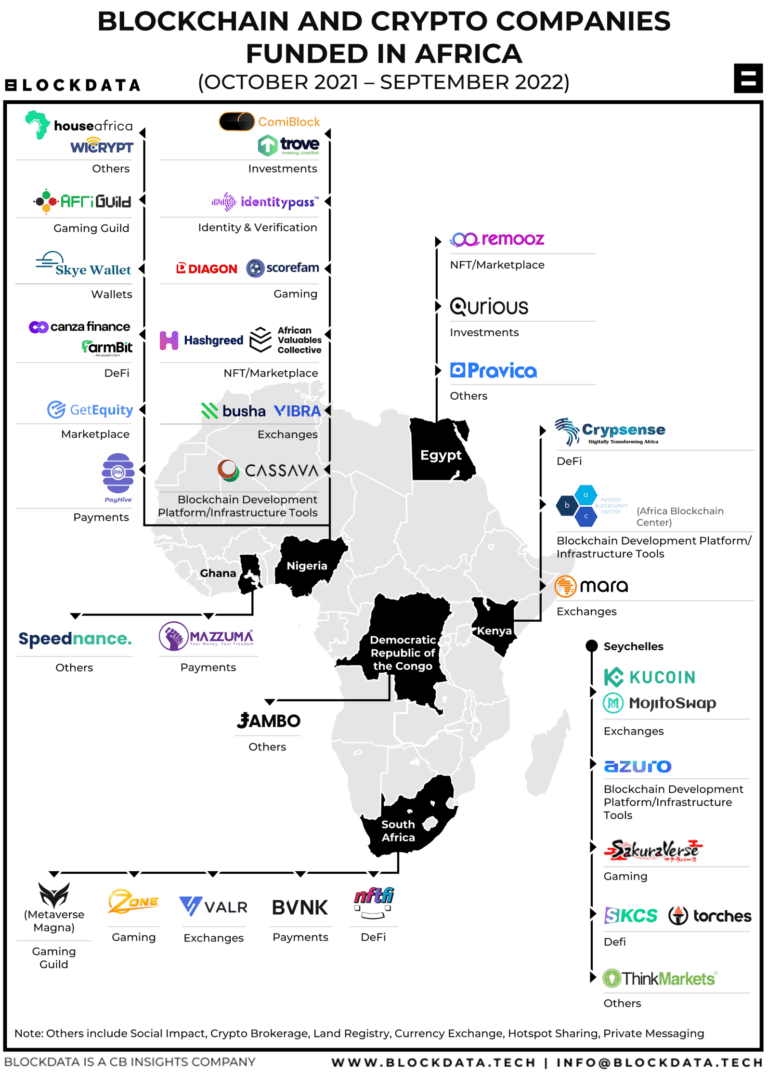

30+ blockchain and crypto companies based in AfricaExpert Collections containing BVNK

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

BVNK is included in 5 Expert Collections, including Blockchain.

Blockchain

9,781 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

14,013 items

Excludes US-based companies

Fintech 100 (2024)

100 items

Fintech 100

100 items

Stablecoin

450 items

Latest BVNK News

Sep 5, 2025

Elliptic , the global leader in digital asset decisioning, has partnered with BVNK to integrate Elliptic Lens into Layer1 , the firm's stablecoin infrastructure for self-managed payments, enabling financial institutions to embed stablecoin flows with built-in risk intelligence and screening. Layer1 powers BVNK's platform and processes billions in payments each year, establishing itself as a trusted partner to fintechs, stablecoin issuers, and global payment providers. Visa's strategic investment underscores the growing relevance of compliant, programmable stablecoin infrastructure, a vision that Elliptic's integration helps realize. Traditional setups often keep compliance checks separate from your main treasury system, creating delays when transactions require approval or extra review. High-value movements or flagged transactions can get stuck in limbo, frustrating customers and enterprises alike. With Elliptic Lens integrated directly into Layer1's treasury and payment workflows, compliance becomes seamless. Customers gain real-time, multi-asset wallet screening across any cryptoasset with tradable value, from stablecoins to ERC-20 tokens and major networks like Bitcoin and Ethereum. Custom rules let you trigger approvals based on transaction size or risk level, while Lens's customizable scoring, continuous behavioral monitoring, and instant entity identification across 70+ categories enable proactive risk detection without slowing down operations. The partnership comes during a period when stablecoin adoption is accelerating. In 2024, transfer volumes reached over $27.6 trillion, with projections indicating significant further growth as financial institutions increasingly adopt stablecoin-based flows. However, robust risk intelligence has often lagged in this adoption process. “Layer1 is a powerful example of the next generation of stablecoin infrastructure – where risk intelligence isn't an afterthought, but a core enabler of adoption,” said Jackson Hull , CTO at Elliptic. “By embedding our intelligence directly into the Layer1 platform, institutions will have the ability to move fast while meeting the highest standards of regulatory compliance. It's this seamless, scalable compliance that's needed to power a more secure, sustainable future for global payments.” “Partnering with Elliptic allows us to give our customers access to the risk detection and screening infrastructure, without the integration overhead,” s aid Sagar Sarbhai , Managing Director, Layer 1, at BVNK. “Layer1 is designed to deliver fast, flexible, and secure service to customers – Elliptic's intelligence helps us to ensure that compliance meets these key requirements.” Elliptic provides intelligence across 50+ blockchains and over 250 cross-chain bridges, covering 98% of active and liquid cryptoassets in the market – the broadest and deepest coverage available today. With more than a decade of experience, Elliptic's solutions enable proactive risk detection, real-time monitoring, and support for global AML and sanctions checks – all essential for institutions scaling into new jurisdictions and maintaining compliance under evolving global frameworks. To learn more about Elliptic, visit https://www.elliptic.co/ Gemini Launches Staking and Derivatives for EU Customers Gemini has unveiled a suite of new products for over 400 million EU & European Economic Area (EEA) investors Elliptic Powers Risk Intelligence for BVNK's Layer1 – Enabling Stablecoin Payments, Trading and Settlement at Scale Aave Integrates Self ZK Proof-of-Humanity, Offering Increased Yield to Verified Humans Trust Wallet Brings Tokenized Stocks & ETFs Onchain for 200M+ Users Worldwide

BVNK Frequently Asked Questions (FAQ)

When was BVNK founded?

BVNK was founded in 2020.

Where is BVNK's headquarters?

BVNK's headquarters is located at 89 Charterhouse Street, London.

What is BVNK's latest funding round?

BVNK's latest funding round is Series B - II.

How much did BVNK raise?

BVNK raised a total of $91.7M.

Who are the investors of BVNK?

Investors of BVNK include Visa Ventures, Avenir, Tiger Global Management, Scribble Ventures, DRW Venture Capital and 10 more.

Who are BVNK's competitors?

Competitors of BVNK include Zero Hash, CFX Labs, Ripple, OwlTing, Januar and 7 more.

What products does BVNK offer?

BVNK's products include Global Settlement Network and 3 more.

Loading...

Compare BVNK to Competitors

BitPay provides cryptocurrency payment processing and digital wallet services within the financial technology (fintech) sector. It offers a platform for individuals and businesses to buy, store, swap, sell, and spend cryptocurrencies and tools for merchants to accept cryptocurrency payments. Its services are available to various sectors, including e-commerce and real estate technology. It was founded in 2011 and is based in Atlanta, Georgia.

Triple-A provides digital currency payment solutions within the financial technology sector. It offers services that allow businesses to accept, send, and convert payments in digital currencies. It serves businesses looking to connect fiat and digital currencies. It was founded in 2017 and is based in Singapore.

Airwallex develops a global financial platform focusing on providing business payment solutions within the financial technology domain. The company offers an array of services, including global business accounts for managing finances, international transfers, multi-currency corporate cards, and online payment processing capabilities. It primarily serves the payment industry. The company was founded in 2015 and is based in Melbourne, Australia.

Zepz is a company in the financial technology sector that facilitates international payments. It provides digital solutions for sending money across borders, including options for bank deposits, cash collections, and mobile money services. Zepz serves the ecommerce industry by offering online money transfers. The company was formerly known as WorldRemit. It was founded in 2021 and is based in London, United Kingdom.

Fiat Republic provides a banking-as-a-service (BaaS) platform. The company offers a banking and payments application programming interface (API) allowing crypto platforms to automate and embed fiat flows for their end-users and internal treasury teams. Fiat Republic primarily serves the cryptocurrency industry. It was founded in 2021 and is based in London, United Kingdom.

OpenPayd focuses on providing global payments and banking-as-a-service (BaaS) solutions within the financial technology sector. The company offers a range of services, including international payments, card processing, virtual IBANs, multi-currency accounts, and foreign exchange management, all accessible through a single API. OpenPayd primarily serves businesses in the fintech, digital assets, marketplaces, payroll, remittance, and insurtech sectors. It was founded in 2015 and is based in London, United Kingdom.

Loading...