Boosted.ai

Founded Year

2017Stage

Series C - II | AliveTotal Raised

$61.01MLast Raised

$10.71M | 10 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-16 points in the past 30 days

About Boosted.ai

Boosted.ai provides artificial intelligence (AI) solutions for the finance sector, focusing on investment management and research processes. The company has an AI platform named Alfa, which automates financial analytics, investment research, and portfolio management. Boosted.ai serves the capital markets industry and offers tools for decision-making and compliance. It was founded in 2017 and is based in Toronto, Canada.

Loading...

ESPs containing Boosted.ai

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The AI investment intelligence platforms market develops AI-powered solutions that assist investors in research, analysis, and decision-making. These platforms leverage generative AI, copilots, machine learning, and advanced algorithms to analyze financial data, generate investment insights, predict market movements, and provide personalized investment strategies. By automating research processes …

Boosted.ai named as Outperformer among 15 other companies, including Bloomberg, BlackRock, and Morningstar.

Loading...

Research containing Boosted.ai

Get data-driven expert analysis from the CB Insights Intelligence Unit.

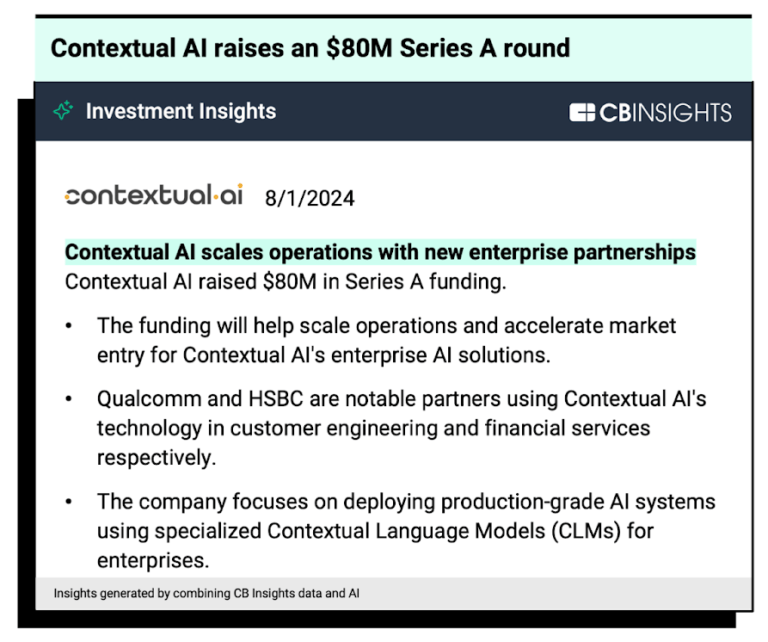

CB Insights Intelligence Analysts have mentioned Boosted.ai in 7 CB Insights research briefs, most recently on Aug 29, 2025.

Aug 29, 2025 report

Book of Scouting Reports: Generative AI in Financial Services

Mar 6, 2025

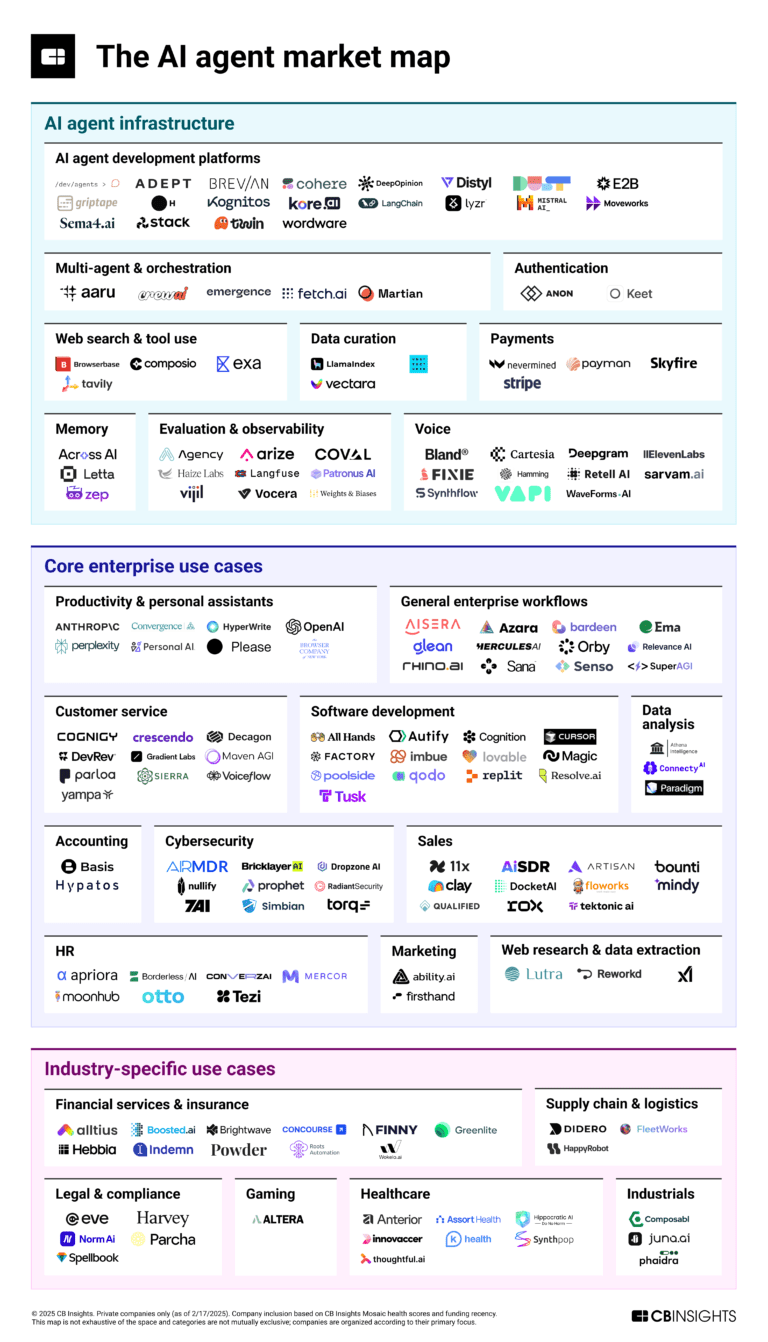

The AI agent market map

May 24, 2024

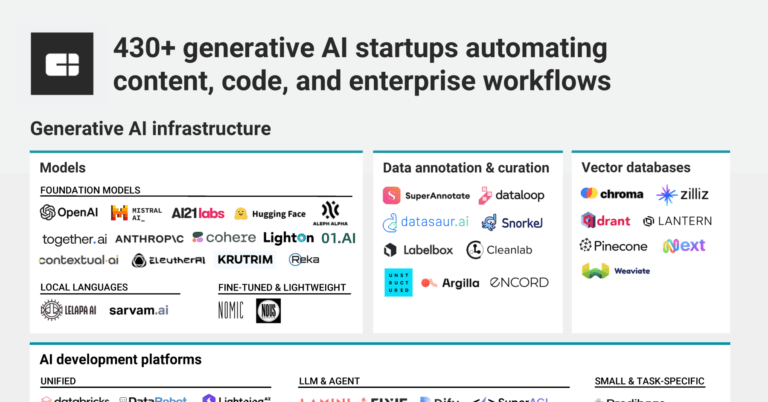

The generative AI market map

Oct 6, 2023

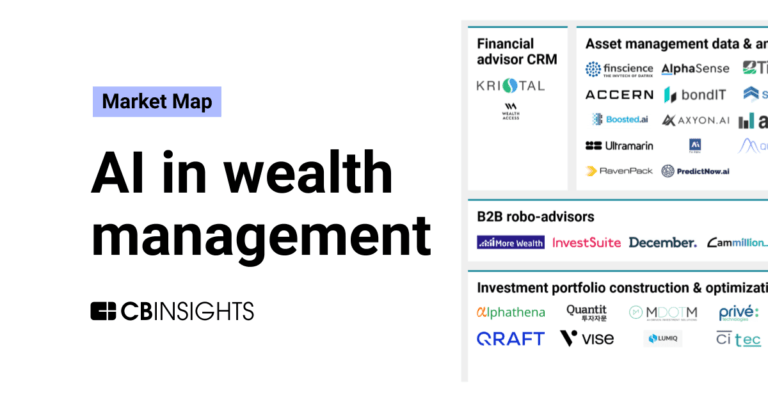

The AI in wealth management market mapExpert Collections containing Boosted.ai

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Boosted.ai is included in 11 Expert Collections, including Wealth Tech.

Wealth Tech

2,470 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Capital Markets Tech

1,062 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Artificial Intelligence

12,998 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

14,155 items

Excludes US-based companies

Canadian fintech

345 items

AI 100 (All Winners 2018-2025)

100 items

Boosted.ai Patents

Boosted.ai has filed 1 patent.

The 3 most popular patent topics include:

- automotive technologies

- battery electric vehicle manufacturers

- car classifications

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/10/2020 | 8/10/2021 | Automotive technologies, Battery electric vehicle manufacturers, Electrical engineering, Electrical generators, Car classifications | Grant |

Application Date | 1/10/2020 |

|---|---|

Grant Date | 8/10/2021 |

Title | |

Related Topics | Automotive technologies, Battery electric vehicle manufacturers, Electrical engineering, Electrical generators, Car classifications |

Status | Grant |

Latest Boosted.ai News

Sep 11, 2025

. Steve Kane, head of product marketing at Altruist, said standalone platform Hazel is now moving out of beta and into general availability. "The biggest value that you have is all that human stuff," he said. "It's connecting with clients and helping them transition through big life transitions. It's connecting with them and helping them make sense of all the market chaos. We think that we can help you do more of that human stuff when you have Hazel on your team." AgentSmyth Rob Burgess/Financial Planning AgentSmyth provides different AI agents for equity analysis and specific trading insights, said CEO Pulkit Jaiswal. The firm has been live for around nine months and is active with over 50 trading desks worldwide. "We are basically a family of five agents," he said. "You can think of them as traders on a trading floor. We have a macro agent, a sentiment agent, an earnings expert, a quant and an options trader." All five of these AI agents continuously "We basically model the personalities of these agents around these five different personalities," he said. On top of those, Jaiswal said his firm is debuting its new AI agent: Agent Wealth. "We built Agent Wealth because we want you advisors and wealth managers, not just to buy AI," he said. "We want you to buy back your time. And so we're giving you the same institutional-grade hedge fund level muscle, but now for going from a bunch of loose words to a full client-ready note in less than 30 seconds." Archive Intel Rob Burgess/Financial Planning Larry Shumbres, founder and CEO of Archive Intel, said his firm wants to solve the problem of advisors carrying two phones. AI-powered archiving and surveillance tool encompasses everything from text messages, social media, chats and email to website communications, he said. "We're going back to the old BlackBerry days," he said. "Whether you have another phone to communicate with your clients to capture that, or you're using another app with a different phone number, we're making it a lot easier for you today. You could use your own phone, your own phone number, but you can whitelist or block your client contact list, so you don't need another phone, you don't need another phone number." Boosted.ai and is focused on investment research, analytics and client servicing. "Alpha can look at your portfolios," said Geoff Clauss, chief revenue officer of Boosted.ai. "Alpha knows what things you've told it you're focused on." Alpha can monitor the world for what's going on and then provide either alerts to advisors or clients, depending on the settings, said Clauss. "You stay on top of this stuff so that your clients don't have to get concerned," he said. "You don't have to have that moment of fear and sweating when the client calls you and says, 'What happened over here? How's my portfolio reacting to it?' You're ahead of it." Wayvest Rob Burgess/Financial Planning Wayvest's agentic AI platform allows advisors to "vibe code" financial plans using natural language prompts said CEO Brendan King. "The software can just build whatever we tell it," he said. "You're giving the tool context, and on the back end, it's just writing a bunch of code. It's citing all its sources, but it's writing code to render the plan." Sherpas Wealth Technology

Boosted.ai Frequently Asked Questions (FAQ)

When was Boosted.ai founded?

Boosted.ai was founded in 2017.

Where is Boosted.ai's headquarters?

Boosted.ai's headquarters is located at 372 Bay Street, Toronto.

What is Boosted.ai's latest funding round?

Boosted.ai's latest funding round is Series C - II.

How much did Boosted.ai raise?

Boosted.ai raised a total of $61.01M.

Who are the investors of Boosted.ai?

Investors of Boosted.ai include Portage Ventures, HarbourVest Partners, Ten Coves Capital, Spark Capital, Royal Bank of Canada and 7 more.

Who are Boosted.ai's competitors?

Competitors of Boosted.ai include Unstructured, Axyon AI, Fintica, Aisot Technologies, causaLens and 7 more.

Loading...

Compare Boosted.ai to Competitors

PredictNow.ai is a company focused on enhancing human decision-making in the financial sector through its Corrective AI technology. The company offers a platform that provides machine learning predictions and optimizations to improve investment strategies and trading operations for hedge funds and financial institutions. PredictNow.ai's solutions are designed to integrate with existing prediction models, enabling firms to make data-driven decisions and optimize their trading performance without replacing established practices. It was founded in 2020 and is based in Niagara On The Lake, Ontario.

CredX.AI operates as an AI-first technology company specializing in financial services and risk analytics. The company offers AI-driven insights and analytics tools to institutional investors. CredX.AI primarily serves the financial sector, delivering solutions that cater to the needs of institutional investors and financial services firms. It was founded in 2017 and is based in Merritt Island, Florida.

RevFX provides artificial intelligence (AI) powered analytics and insights for funds and portfolios within the financial sector. The company offers solutions that track and analyze data to provide insights for go-to-market teams, predicting company engagement and supporting sales and marketing activities. RevFX's products are designed to integrate with existing sales and marketing tools, ensuring security and compliance. RevFX was formerly known as ActHQ. It was founded in 2024 and is based in San Francisco, California.

AlgoDynamix focuses on financial price forecasting analytics within the financial services sector. The company offers price forecasting that provides indications of market movements across various asset classes, without relying on historical data. AlgoDynamix's analytics support investment and trading strategies by delivering insights based on real-time order book data and mathematical analysis. It was founded in 2013 and is based in London, England.

Tano offers artificial intelligence (AI) influencer marketing within the marketing technology sector. It offers a platform that automates influencer marketing campaigns, enabling brands and agencies to partner with a larger number of influencers while reducing operational costs. It primarily serves the marketing and advertising industry, focusing on the efficiency of social media marketing and outreach. It was founded in 2025 and is based in London, United Kingdom.

Axyon AI provides solutions for the investment management industry. It offers asset managers asset rankings and investment strategies across various asset classes, using deep learning and machine learning technologies. Axyon AI serves the financial services sector, including asset managers, hedge funds, and institutional investors. It was founded in 2016 and is based in Modena, Italy.

Loading...