Avalon Labs

Founded Year

2024Stage

Series A - II | AliveTotal Raised

$2.012BMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+254 points in the past 30 days

About Avalon Labs

Avalon Labs focuses on decentralized finance within the blockchain and cryptocurrency sector. It offers a CeDeFi lending platform that allows Bitcoin holders to access liquidity while maintaining a fixed borrowing rate, allowing them to manage their Bitcoin assets without selling. Avalon Labs primarily serves the cryptocurrency and blockchain investment community. Avalon Labs was formerly known as Avalon Finance. It was founded in 2024 and is based in Road Town, Virgin Islands (British).

Loading...

Loading...

Research containing Avalon Labs

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Avalon Labs in 2 CB Insights research briefs, most recently on Jul 10, 2025.

Jul 10, 2025 report

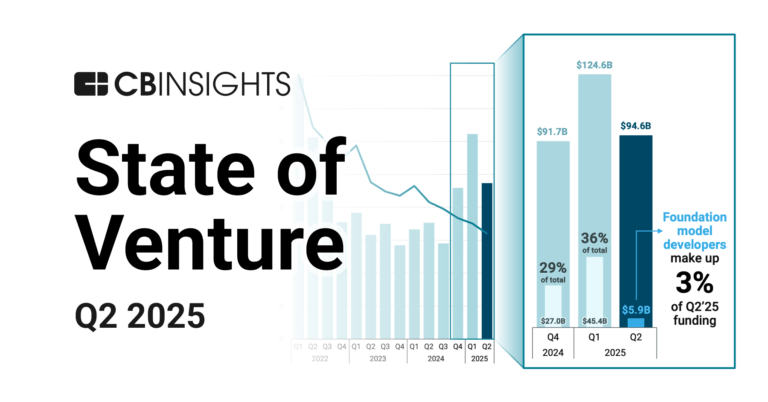

State of Venture Q2’25 Report

May 29, 2025

The stablecoin market mapExpert Collections containing Avalon Labs

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Avalon Labs is included in 4 Expert Collections, including Blockchain.

Blockchain

9,147 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

23,745 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Lending

2,464 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Stablecoin

450 items

Latest Avalon Labs News

Sep 11, 2025

Avalon Labs Burns 93.9M $AVL, Cuts Circulating Supply by 37% Avalon Labs (@avalonfinance_) has completed a massive buyback and burn of $AVL tokens, permanently removing 93.9 million AVL from circulation. The move wipes out 37% of the total circulating supply. The announcement triggered an immediate market reaction. According to CoinMarketCap, $AVL jumped 9% today to $0.15, pushing its market momentum higher after weeks of sideways trading. Funded by Protocol Revenue The $1.88 million buyback wasn’t just a headline move. It was fully funded by Avalon Labs’ monthly protocol revenue. That detail underscores the platform’s consistent usage and financial stability. The company deposited 1.88 million USDT into Bybit in June 2025, executing strategic buys of $AVL at an average price of $0.1347 per token. In total, 13,955,164 AVL were repurchased during this round and permanently burned. We’re pleased to announce the successful completion of a $1.88 million AVL token buyback and burn, reinforcing our long-term commitment to creating sustainable value for our community and ecosystem. As part of this program, Avalon Labs deposited 1.88 million USDT into Bybit… pic.twitter.com/ADzrrfjfaM Strengthening Long-Term Value Avalon Labs said the initiative is a reflection of its commitment to sustainable growth. In a statement, the team emphasized that aligning protocol expansion with token holder interests remains at the core of its mission. “This buyback and burn reinforces our long-term commitment to creating sustainable value for our community and ecosystem,” Avalon Labs noted. The firm’s approach is designed not just to deliver immediate price impact but also to provide a deflationary mechanism that strengthens $AVL’s long-term fundamentals. 93.9M AVL Gone Since June This latest move builds on an ongoing effort. Since June 2025, Avalon Labs has burned a total of 93,955,164 AVL tokens, permanently reducing supply. The team says this equates to 37% of the circulating supply being wiped out in just a few months, a pace that sets Avalon apart from other DeFi protocols experimenting with token burns. Mission to Build On-Chain Capital Markets Avalon Labs is positioning itself as a leading on-chain capital market for Bitcoin. With this latest buyback and burn, the protocol signals confidence not only in its business model but also in its ability to deliver sustainable token economics. The team added that it will continue exploring new, sustainable mechanisms to reinforce the Avalon ecosystem and reward long-term holders. Community Response and Market Outlook The buyback and burn program has been met with optimism across the Avalon community. Traders and holders see the initiative as a clear alignment of incentives. Market watchers also note that burns of this magnitude can create positive supply-side pressure, particularly if demand for $AVL continues to climb with protocol growth. At today’s price of $0.15, with supply cut by more than a third, the token’s long-term value proposition looks stronger than before the buyback campaign began. Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services. Follow us on Twitter @themerklehash to stay updated with the latest Crypto, NFT, AI, Cybersecurity, and Metaverse news! About The Author

Avalon Labs Frequently Asked Questions (FAQ)

When was Avalon Labs founded?

Avalon Labs was founded in 2024.

Where is Avalon Labs's headquarters?

Avalon Labs's headquarters is located at Road Town.

What is Avalon Labs's latest funding round?

Avalon Labs's latest funding round is Series A - II.

How much did Avalon Labs raise?

Avalon Labs raised a total of $2.012B.

Who are the investors of Avalon Labs?

Investors of Avalon Labs include CE Innovation Capital, YZi Labs, Mirana Ventures, GSR Capital, SNZ Capital and 22 more.

Loading...

Loading...