Aspire

Founded Year

2018Stage

Series C | AliveTotal Raised

$300.18MLast Raised

$100M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-14 points in the past 30 days

About Aspire

Aspire develops a full-stack operating financial operation system. It enables accounting, payment, lending, expense management, and more. It provides business credit lines to help solve their working capital needs. It offers users access to funding and financial tools to manage bank accounts, credit cards, invoicing, and expenses, among others. The company was founded in 2018 and is based in Singapore.

Loading...

Aspire's Products & Differentiators

Incorporation

Simple and 100% digital incorporation

Loading...

Research containing Aspire

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Aspire in 2 CB Insights research briefs, most recently on Mar 29, 2024.

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Aspire

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Aspire is included in 5 Expert Collections, including Digital Lending.

Digital Lending

2,522 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

1,231 items

Fintech

14,153 items

Excludes US-based companies

Fintech 100

200 items

Fintech 100 (2024)

100 items

Latest Aspire News

Sep 15, 2025

Founded in 2018 and headquartered in Singapore, Aspire serves over 50,000 businesses across 30+ markets, helping them save time and reduce costs by consolidating financial operations into a single, user-friendly platform. The platform offers multi-currency business accounts, corporate cards, global payments, yield products, expense management, and AI-powered insights, giving companies real-time visibility and control over their finances. Aspire caters to businesses of all sizes from startups and SMEs to mid-sized enterprises, and supports a variety of industries, including eCommerce, consulting, Web3, and venture capital. On The Right Business, Hongbin Jeong speaks to Holly Fang, Global Head of Network, Aspire , to find out more.

Aspire Frequently Asked Questions (FAQ)

When was Aspire founded?

Aspire was founded in 2018.

What is Aspire's latest funding round?

Aspire's latest funding round is Series C.

How much did Aspire raise?

Aspire raised a total of $300.18M.

Who are the investors of Aspire?

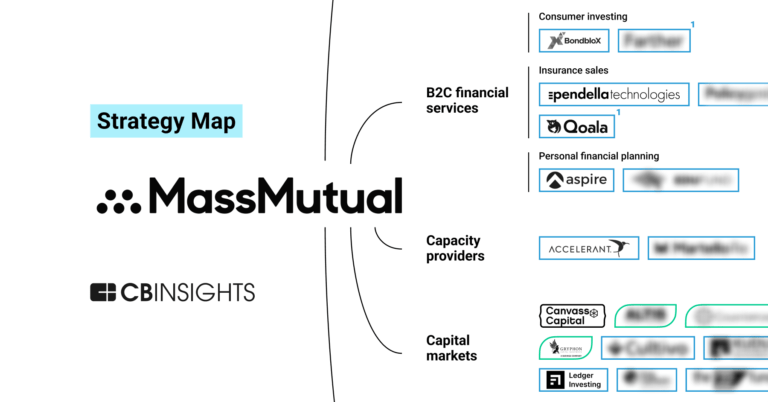

Investors of Aspire include MassMutual Ventures, Picus Capital, PayPal Ventures, Peak XV Partners, Lightspeed Venture Partners and 27 more.

Who are Aspire's competitors?

Competitors of Aspire include Funding Societies and 4 more.

What products does Aspire offer?

Aspire's products include Incorporation and 4 more.

Loading...

Compare Aspire to Competitors

RABC is a high-tech enterprise specializing in R&D, production, manufacturing, sales, and service of various solid-state power lithium batteries.

CrediLinq develops a credit lending platform powered by its proprietary artificial intelligence and machine learning algorithms. It aims to create a digital platform for businesses to get quicker access to growth capital. It primarily caters to the e-commerce industry, providing tools for both buyers and sellers. It was founded in 2021 and is based in Singapore.

Minterest is a licensed moneylender that provides financing services within the real estate and luxury asset sectors. The company offers products including property financing solutions, home equity loans, and options such as crypto-backed loans and luxury watch financing. Minterest serves individuals looking to improve their loan eligibility and finance luxury purchases. It was founded in 2016 and is based in Singapore.

Zetl is a financial services company that provides financing solutions for asset-light businesses in the Asia-Pacific region. The company offers products including payroll financing, working capital loans, and invoice financing, aimed at helping businesses with their operating expenses. Zetl primarily serves asset-light SMEs such as recruitment agencies, consultancies, and digital media providers. It was founded in 2018 and is based in Sheung Wan, Hong Kong.

Spenmo specializes in spend management and accounts payable automation within the SaaS industry. The company's services include providing smart corporate cards, streamlining bill payments, and facilitating employee reimbursements, all designed to enhance visibility and control over business spending. Spenmo's solutions cater to businesses looking to automate their financial processes and gain better insight into their expenditures. It was founded in 2019 and is based in Singapore.

Funding Societies offers a digital financing platform that provides financial solutions for small and medium-sized enterprises (SMEs) within the fintech industry. It offers products including microloans, business term loans, and revolving credit lines to address the financing needs of SMEs. It has an investment platform for individual and institutional investors to fund these business loans in Southeast Asia. It was founded in 2015 and is based in Singapore.

Loading...