Amazon Web Services

Founded Year

2006Revenue

$0000About Amazon Web Services

Amazon Web Services provides cloud computing services in sectors including technology, finance, and healthcare. AWS offers services such as virtual servers and data storage, as well as AI and machine learning capabilities. The company serves startups, enterprises, and public sector organizations that use cloud technology. It was founded in 2006 and is based in Seattle, Washington. Amazon Web Services operates as a subsidiary of Amazon.

Loading...

ESPs containing Amazon Web Services

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The oil and gas industrial IoT providers market delivers sensors, edge devices, connectivity, and software that monitor and control oil and gas assets in the field. Solutions span wellsite automation, artificial lift optimization, tank and chemical injection monitoring, pipeline and facility integrity (e.g., corrosion under insulation), and methane/emissions monitoring, with integration to SCADA a…

Amazon Web Services named as Leader among 11 other companies, including Emerson, Microsoft Azure, and Rockwell Automation.

Loading...

Research containing Amazon Web Services

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Amazon Web Services in 25 CB Insights research briefs, most recently on Sep 9, 2025.

Aug 22, 2025

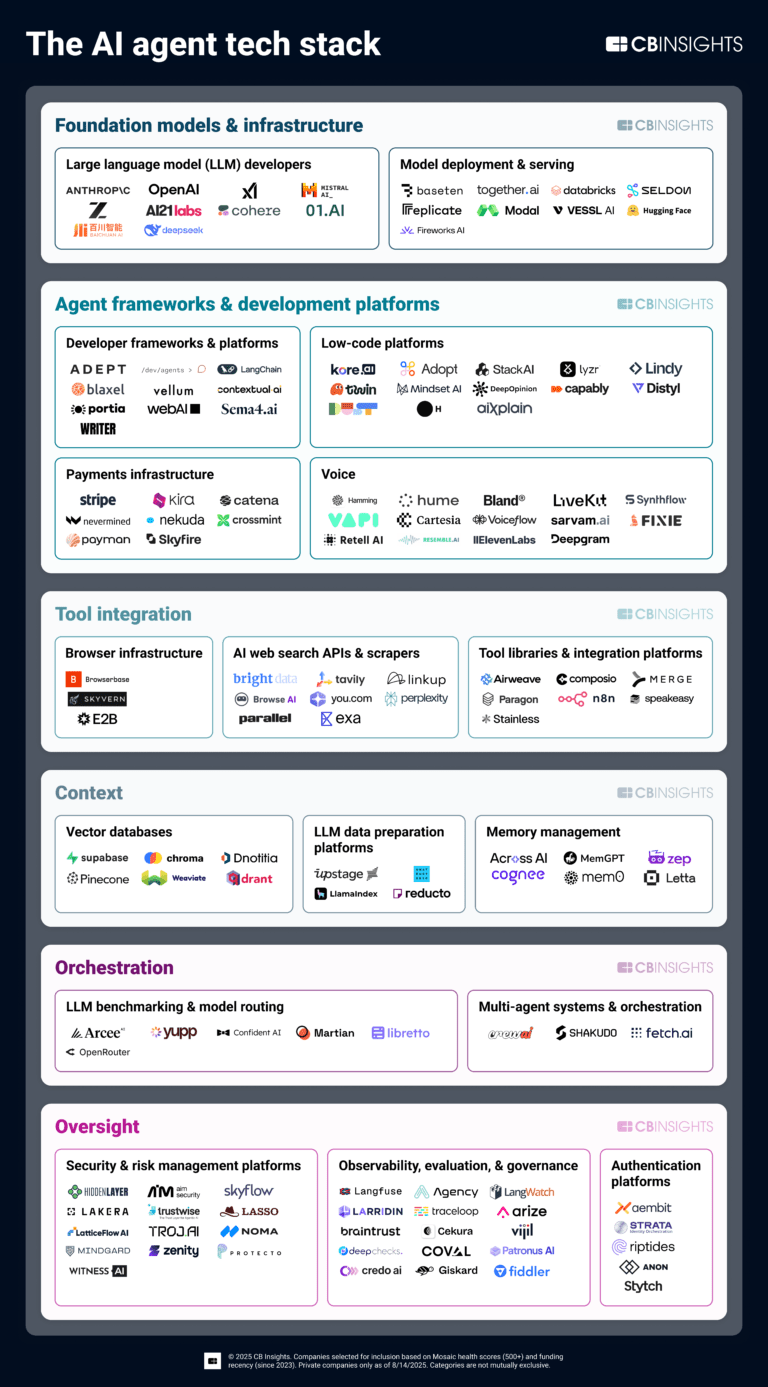

The AI agent tech stack

Aug 14, 2025

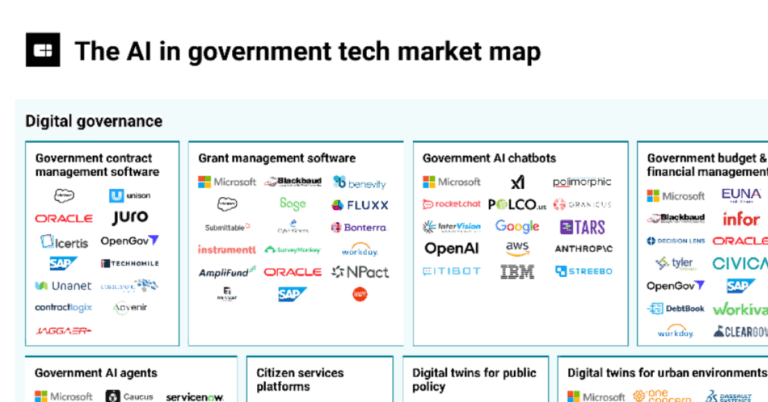

310+ AI companies transforming government

Jul 31, 2025 report

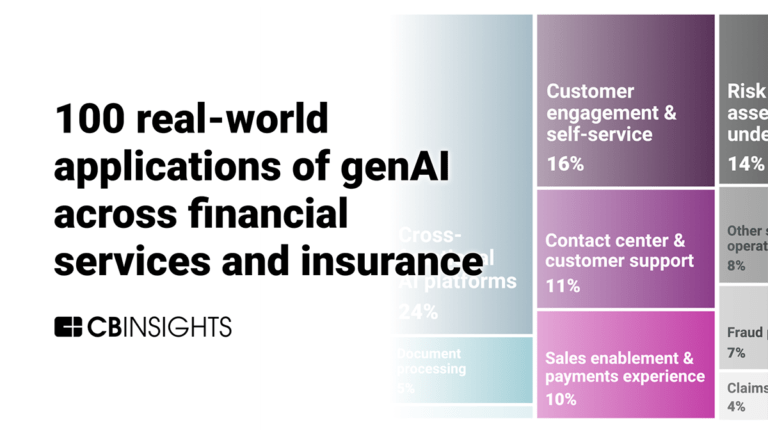

100 real-world applications of genAI across financial services and insuranceExpert Collections containing Amazon Web Services

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Amazon Web Services is included in 7 Expert Collections, including Conference Exhibitors.

Conference Exhibitors

5,302 items

Generative AI

2,825 items

Companies working on generative AI applications and infrastructure.

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Artificial Intelligence

10,402 items

NRF Big Show 2025: Exhibitors

959 items

AI agents

376 items

Companies developing AI agent applications and agent-specific infrastructure. Includes pure-play emerging agent startups as well as companies building agent offerings with varying levels of autonomy. Not exhaustive.

Latest Amazon Web Services News

Sep 12, 2025

Tech Collective Malaysia is moving quickly to position itself as Southeast Asia’s next digital infrastructure hub. With a new framework for AI adoption and data centre development unveiled this year, the government hopes to attract hyperscalers, cloud providers and local players eager to capitalise on the region’s surging digital economy. Flagship projects like the Elmina data centre underscore this ambition, signalling capacity for multi-billion-dollar investments and a long-term commitment to regional connectivity. Officials are also framing these builds as drivers of jobs, skills and sustainable energy integration, tying infrastructure growth directly to national economic resilience. We take a closer look at the new Malaysia National AI Office and what that means for AI trends in Southeast Asia Yet the pace of demand raises a critical question: can policy and infrastructure keep up with the speed and scale of AI-driven growth? Malaysia’s digital bet The country has already seen a sharp uptick in interest from global cloud operators. Amazon Web Services (AWS) activated a new Asia Pacific (Malaysia) region, committing over US $6.2 billion through to 2038 to support three availability zones underscoring its long‑term infrastructure confidence. Microsoft followed suit, unveiling its inaugural Malaysia West cloud region in Greater Kuala Lumpur- an AI‑ready hyperscale cloud infrastructure with three availability zones, backed by a US $2.2 billion investment that is expected to generate US$10.9 billion in revenue and create over 37,000 jobs by 2028. Meanwhile, Google has pledged US $2 billion toward its first data centre and cloud hub in Selangor, with an anticipated economic impact of US $3.2 billion and creation of 26,500 jobs by 2030 . In parallel, the Malaysian government is rolling out a national data centre framework, slated for implementation in October 2025. This framework centralises approvals with the Malaysian Investment Development Authority (MIDA) and aims to streamline policies, reduce bureaucratic delays and provide greater policy certainty to incentivise further investment. This matters because Southeast Asia’s digital economy is at an inflexion point. As consumers adopt digital services at scale and enterprises accelerate their cloud and AI strategies, demand for computing power is rising far faster than the region’s existing infrastructure base. Malaysia sees an opportunity to step into a gap created by Singapore’s land and power constraints and Indonesia’s evolving regulatory environment. AI workloads drive the next wave While traditional cloud and enterprise hosting continue to grow, AI workloads are emerging as the real driver of the next wave of data centre expansion. Training and running large-scale AI models demand high-density computing infrastructure and a massive energy supply. This is pushing data centres from being largely storage-focused facilities into becoming power-hungry compute hubs. Malaysia’s policymakers are betting that by offering land availability, relatively competitive energy pricing and a clearer regulatory regime, the country can attract this next wave of capital-intensive builds. Yet that also raises the stakes. AI-driven data centres can cost billions to construct and their sustainability footprint is far more visible. For Malaysia, success depends on its ability to provide reliable power, manage carbon intensity and keep regulatory signals consistent. Competing with Singapore and Indonesia The regional context is unavoidable. Singapore remains Southeast Asia’s financial and connectivity leader, but its land scarcity and moratorium on new data centres have forced it to pursue a selective, green-focused expansion strategy. Indonesia, with its vast domestic market, offers scale but faces challenges in regulatory predictability and infrastructure readiness. Malaysia sits between the two: large enough to attract hyperscale investment, yet nimble enough to introduce new frameworks quickly. Incentives such as tax breaks, streamlined approvals and an emphasis on sustainability standards are already shaping investment flows. The challenge will be whether Malaysia can maintain policy clarity while balancing foreign investment with meaningful local participation. Power, sustainability and ESG pressures Energy supply is the most pressing constraint. AI-driven facilities demand stable, high-capacity electricity and Malaysia’s grid is already under pressure from industrial demand. Questions remain about whether the country can expand renewable generation quickly enough to meet global ESG benchmarks while still offering competitively priced power to investors. At the same time, global customers are insisting on greener footprints. Tech multinationals are tying their investment decisions to sustainability metrics and investors are scrutinising alignment with ESG goals. Malaysia has made commitments to green energy integration, but delivering on those targets will be essential to securing its long-term positioning as a data centre hub. The road ahead Malaysia’s AI and data centre ambitions are bold and the timing is right. The global race for AI-ready infrastructure is intensifying and Southeast Asia’s growth markets need new capacity. By providing a clear policy framework and leaning into its comparative advantages, Malaysia has a real shot at establishing itself as a regional leader. The road ahead, however, is far from smooth. Energy supply constraints, sustainability pressures and the need to ensure consistent regulation could test the country’s ability to scale at the pace demanded by hyperscalers. Ultimately, Malaysia’s success will hinge on more than incentives; it will depend on whether policy, infrastructure and sustainability can move in lockstep with the AI-driven demands of the digital economy. Share this:

Amazon Web Services Frequently Asked Questions (FAQ)

When was Amazon Web Services founded?

Amazon Web Services was founded in 2006.

Where is Amazon Web Services's headquarters?

Amazon Web Services's headquarters is located at 410 Terry Avenue North, Seattle.

Who are Amazon Web Services's competitors?

Competitors of Amazon Web Services include 11:11 Systems, Render, CrewAI, Wallaroo.AI, aiXplain and 7 more.

Loading...

Compare Amazon Web Services to Competitors

Google Cloud operates as a cloud computing service provider offering various solutions, including artificial intelligence (AI) and machine learning, data analytics, and managed databases. The company provides a platform for businesses to leverage AI and machine learning, manage data with analytics, and modernize infrastructure. Google Cloud's services cater to different industries, offering tools for application programming interface (API) management and serverless computing. It was founded in 2008 and is based in Mountain View, California.

Microsoft Azure is a cloud computing platform that provides various services for building, testing, deploying, and managing applications and services through Microsoft-managed data centers. It includes solutions like virtual machine hosting, data storage, software development tools, and services for big data analytics, artificial intelligence, and Internet of Things integration. Microsoft Azure serves sectors that need computing resources and application development tools. It was founded in 2010 and is based in Redmond, Washington.

Alibaba Cloud is a company that focuses on cloud computing and data management services within the technology sector. The company offers cloud computing services to meet the networking and information needs of businesses, financial institutions, and government entities. Alibaba Cloud serves sectors that require cloud solutions, including e-commerce, finance, and other industries that are undergoing digital transformation. It was founded in 2009 and is based in Hangzhou, Zhejiang . Alibaba Cloud operates as a subsidiary of Alibaba.

Kion specializes in cloud enablement solutions and focuses on management and governance across multiple cloud platforms. The company offers automated CloudOps services for AWS, Azure, and Google Cloud, including account setup, access control, financial management, and compliance enforcement. Kion's platform is designed to simplify cloud operations for organizations, enabling them to manage their cloud resources more efficiently. Kion was formerly known as cloudtamer. It was founded in 2018 and is based in Columbia, Maryland.

Juniper Networks provides artificial intelligence-native networking, cloud, and connected security solutions within the technology sector. It offers products and services, including artificial intelligence (AI) native networking platforms, data center automation, enterprise-wide area network routing, network security, and wireless access solutions. It serves sectors including government, education, healthcare, retail, energy, media, and financial services. It was founded in 1996 and is based in Sunnyvale, California. In July 2025, Juniper Networks was acquired by Hewlett Packard Enterprise at a valuation of $14B.

Aramco Digital focuses on digital transformation and industrial connectivity solutions within the technology sector. The company provides services that enable data exchange and system optimization, utilizing technologies like artificial intelligence and multi-cloud infrastructure. Aramco Digital serves sectors that require digital solutions for operational efficiency and cost reduction. It was founded in 2023 and is based in Dhahran, Saudi Arabia.

Loading...