Allstate

Founded Year

1931Stage

PIPE | IPOMarket Cap

52.78BStock Price

200.31Revenue

$0000About Allstate

Allstate provides insurance products and services. Its products include property and casualty insurance, vehicle insurance, life insurance, business insurance, and registered securities. The company also provides protection plans against theft, lightning, fire, sprinkler leakage, explosions, and more. It was founded in 1931 and is based in Northbrook, Illinois.

Loading...

Loading...

Research containing Allstate

Get data-driven expert analysis from the CB Insights Intelligence Unit.

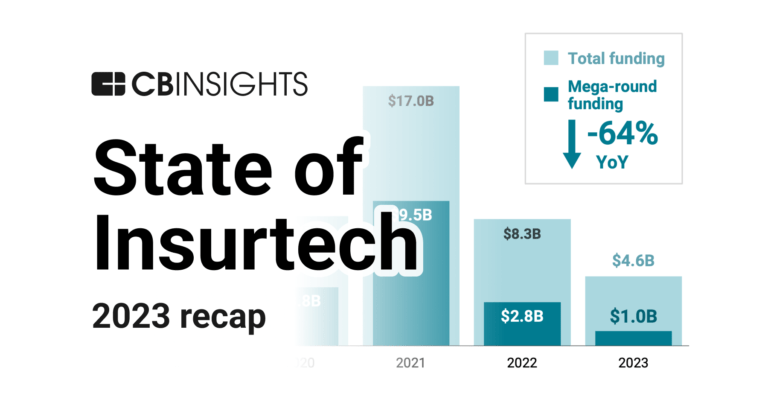

CB Insights Intelligence Analysts have mentioned Allstate in 4 CB Insights research briefs, most recently on Feb 29, 2024.

Feb 9, 2024 report

State of Insurtech 2023 ReportExpert Collections containing Allstate

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Allstate is included in 2 Expert Collections, including Fortune 500 Investor list.

Fortune 500 Investor list

590 items

This is a collection of investors named in the 2019 Fortune 500 list of companies. All CB Insights profiles for active investment arms of a Fortune 500 company are included.

Conference Exhibitors

6,062 items

Companies that will be exhibiting at CES 2018

Allstate Patents

Allstate has filed 1300 patents.

The 3 most popular patent topics include:

- data management

- wireless networking

- insurance

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

7/23/2020 | 4/8/2025 | Car sharing, Sustainable transport, Block ciphers, Serial buses, Embedded systems | Grant |

Application Date | 7/23/2020 |

|---|---|

Grant Date | 4/8/2025 |

Title | |

Related Topics | Car sharing, Sustainable transport, Block ciphers, Serial buses, Embedded systems |

Status | Grant |

Latest Allstate News

Sep 8, 2025

The Business Research Company's Latest Report Explores Market Driver, Trends, Regional Insights - Market Sizing & Forecasts Through 2034” — The Business Research Company LONDON, GREATER LONDON, UNITED KINGDOM, September 8, 2025 / EINPresswire.com / -- "Get 30% Off All Global Market Reports With Code ONLINE30 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors What Is The Estimated Industry Size Of New Car Replacement Insurance Market? In the last few years, the market size for new car replacement insurance has witnessed significant growth. It is predicted to expand from $3.78 billion in 2024 to $4.14 billion in 2025, with a compound annual growth rate (CAGR) of 9.4%. Factors that contributed to this growth throughout the historic period include a surge in car ownership and sales, escalating repair and replacement expenses, heightened consumer awareness concerning comprehensive coverage, a growing inclination towards full-value compensation, and an augmented use of automotive insurance supplementary products. Forecasting robust expansion in the immediate future, the new car replacement insurance market is predicted to reach $5.85 billion by 2029, anticipating a compound annual growth rate (CAGR) of 9.0%. This projected growth during the forecast period is primarily due to the escalating demand for tailored insurance products, the increasing incorporation of telematics into auto insurance schemes, the surge in electric vehicles usage, the growth in internet-based insurance policy distribution, and the intensifying emphasis on consumer-focused insurance services. The forthcoming period will most likely see significant shifts such as enhancements in digital insurance claims processing, inventive adjustments in usage-based insurance models, the integration of AI and machine learning in insurance underwriting, the use of blockchain for insurance policy administration, and the evolution of mobile-centric insurance platforms. Download a free sample of the new car replacement insurance market report: https://www.thebusinessresearchcompany.com/sample.aspx?id=26997&type=smp What Are The Major Factors Driving The New Car Replacement Insurance Global Market Growth? The surge in accident rates is poised to bolster the expansion of the new car replacement insurance market. Unanticipated incidents or events causing harm, injury, or damage, often derived from human mistake, equipment malfunction, or external factors comprise accidents. The rise in accident occurrence is commonly attributed to inattentive driving, which minimizes road focus and escalates the likelihood of collisions. New car replacement insurance mitigates the fiscal repercussions of accidents by offering policyholders a fully replaced vehicle, promoting safer driving behaviors, and expediting recovery post-collisions. For example, the Australian Government, a governmental agency in Australia, revealed a 5.8% increase in road crash fatalities in 2022, amounting to 1,194 deaths in May 2023. Hence, the uptick in accidents is fueling the growth of the new car replacement insurance market. Who Are The Leading Companies In The New Car Replacement Insurance Market? Major players in the New Car Replacement Insurance Global Market Report 2025 include: • AXA S.A. • Allianz SE • Nationwide Mutual Insurance Company • American International Group Inc. • The Allstate Corporation • Liberty Mutual Insurance Company • The Travelers Companies Inc. • Aviva Plc • American Family Mutual Insurance Company S.I. • MAPFRE S.A. What Are The Main Trends, Positively Impacting The Growth Of New Car Replacement Insurance Market? Key players in the new car replacement insurance market, such as Acuity Insurance and the like, are championing ground-breaking alternatives in coverage, including endorsement-based adaptability, that give clients personalized coverage options. Such flexibility empowers customers to adjust their protection levels without needing to buy completely new policies, delivering greater policy value and boosting customer retention. An additional fee allows for the incorporation of extra coverages or perks to an existing insurance policy, presenting what is known as endorsement-based flexibility. In a recent example from March 2022, Acuity Insurance, an American insurance company, unveiled a fresh optional endorsement termed Replacement Benefits Coverage. This enhancement elevates regular auto policies by offering New Car Replacement Cost Coverage. Should a vehicle be deemed a total loss following an accident, this coverage ensures the provision of a brand new vehicle same make and model. This guarantees policyholders protection extending beyond the standard actual cash value payout, with the endorsement serving to provide increased financial stability and a sense of tranquility for those with newer vehicles. What Are The Primary Segments Covered In The Global New Car Replacement Insurance Market Report? The new car replacement insurance market covered in this report is segmented – 1) By Coverage Type: Comprehensive, Collision, Liability 2) By Vehicle Type: Passenger Vehicles, Commercial Vehicles, Electric And Hybrid Vehicles 3) By Customer Demographics: Age Group, Income Level, Occupation 4) By Distribution Channel: Insurance Brokers, Direct Response, Banks, Online Platforms 5) By End User: Individual, Commercial Subsegments: 1) By Comprehensive: Theft Protection, Fire And Natural Disaster Coverage, Vandalism And Malicious Damage, Glass Breakage, Animal Collision, Weather-Related Damage 2) By Collision: Single Vehicle Collision, Multi-Vehicle Collision, Parking Lot Damage, Hit-And-Run Coverage, Road Accident Coverage 3) By Liability: Bodily Injury Liability, Property Damage Liability, Personal Injury Protection (PIP), Uninsured And Underinsured Motorist Coverage, Legal Defense Costs View the full new car replacement insurance market report: https://www.thebusinessresearchcompany.com/report/new-car-replacement-insurance-global-market-report Which Region Is Forecasted To Grow The Fastest In The New Car Replacement Insurance Industry? In the 2025 New Car Replacement Insurance Global Market Report, North America holds the distinction of being the leading region. The region anticipated to register the most rapid growth in this timeframe is Asia-Pacific. The report encompasses various regions, specifically Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa. Browse Through More Reports Similar to the Global New Car Replacement Insurance Market 2025, By The Business Research Company Automotive Usage Based Insurance Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/automotive-usage-based-insurance-global-market-report Motor Insurance Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/motor-insurance-global-market-report Car Insurance Aggregators Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/car-insurance-aggregators-global-market-report Speak With Our Expert: Saumya Sahay Americas +1 310-496-7795 Asia +44 7882 955267 & +91 8897263534 Europe +44 7882 955267 Email: saumyas@tbrc.info The Business Research Company - www.thebusinessresearchcompany.com Follow Us On: • LinkedIn: https://in.linkedin.com/company/the-business-research-company Oliver Guirdham The Business Research Company info@tbrc.info Visit us on social media: LinkedIn Facebook X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Allstate Frequently Asked Questions (FAQ)

When was Allstate founded?

Allstate was founded in 1931.

Where is Allstate's headquarters?

Allstate's headquarters is located at 3100 Sanders Road, Northbrook.

What is Allstate's latest funding round?

Allstate's latest funding round is PIPE.

Who are the investors of Allstate?

Investors of Allstate include Trian Partners.

Who are Allstate's competitors?

Competitors of Allstate include INSURICA, AmTrust Financial Services, Travelers, Prudential, Farmers Insurance Group and 7 more.

Loading...

Compare Allstate to Competitors

American Family Insurance is a company that provides a range of personal insurance services within the insurance industry. Its main offerings include policies for auto, home, life, and umbrella insurance, aimed at protecting individuals and their assets. It was founded in 1927 and is based in Madison, Wisconsin.

Sunshine Property and Casualty Insurance offers property damage insurance, liability insurance, credit insurance and guarantee insurance, short-term health insurance and accidental injury insurance. The company also offers reinsurance regarding property and casualty. Sunshine Property and Casualty was founded in 2005 and is based in Beijing, China.

State Farm Insurance provides various insurance and financial services. The company offers products such as auto, homeowners, and life insurance, along with financial services like investment planning and retirement savings. State Farm Insurance serves individual customers and small businesses with their insurance and financial needs. It was founded in 1922 and is based in Bloomington, Illinois.

Frontline Insurance provides home and commercial property insurance. The company offers insurance solutions focused on state-specific coverage options. Frontline Insurance serves coastal homeowners and commercial property owners in the Southeast United States. It was founded in 1998 and is based in Lake Mary, Florida.

Tokio Marine North America Services provides support services within the insurance and financial services sectors. The company offers services including actuarial, finance, accounting, internal audit, legal, information technology, corporate communications, human resources, and facilities management. These services support the business and governance needs of Tokio Marine Group companies. It was founded in 2012 and is based in Bala Cynwyd, Pennsylvania.

EMC Insurance Group is a company in the insurance sector, providing property and casualty insurance products and services. The company's offerings include protection against risks for individuals and businesses, as well as reinsurance. EMC serves the insurance and reinsurance markets across the United States and globally. EMC Insurance Group was formerly known as Emcasco. It was founded in 1974 and is based in Des Moines, Iowa.

Loading...