Allianz

Founded Year

1890Stage

IPO | IPOMarket Cap

135.98BStock Price

352.70Revenue

$0000About Allianz

Allianz provides insurance products and asset management services for private and corporate clients. The company has a focus on sustainability and employee empowerment. It was founded in 1890 and is based in Munich, Germany.

Loading...

Loading...

Research containing Allianz

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Allianz in 4 CB Insights research briefs, most recently on Jul 31, 2025.

Jul 31, 2025 report

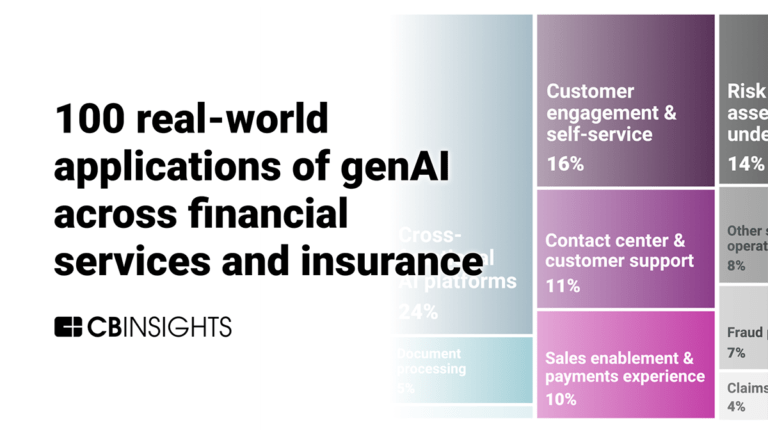

100 real-world applications of genAI across financial services and insurance

Oct 11, 2024

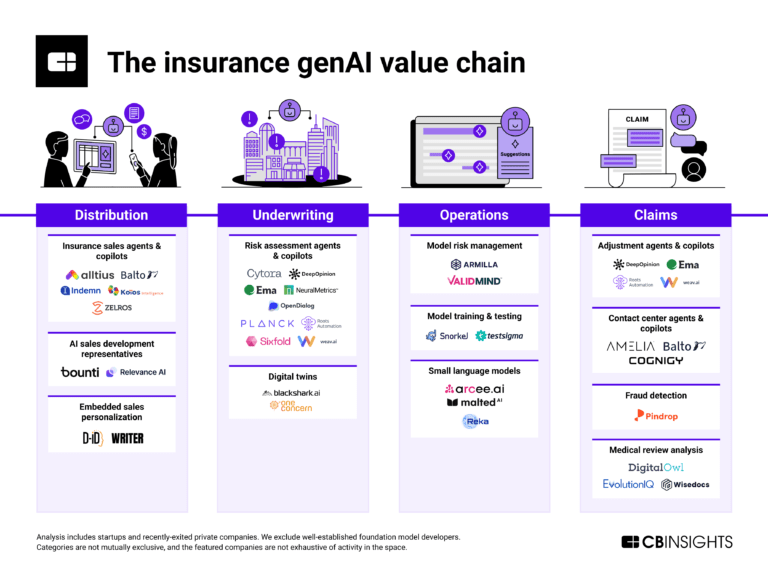

How genAI is reshaping the insurance value chain

Expert Collections containing Allianz

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Allianz is included in 1 Expert Collection, including ITC Europe 2025.

ITC Europe 2025

93 items

Sponsors, speaker companies, and startup kiosks as of May 5, 2025.

Allianz Patents

Allianz has filed 23 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/31/2019 | 8/16/2022 | Rare diseases, Proteins, Phenols, Neurological disorders, Drug discovery | Grant |

Application Date | 12/31/2019 |

|---|---|

Grant Date | 8/16/2022 |

Title | |

Related Topics | Rare diseases, Proteins, Phenols, Neurological disorders, Drug discovery |

Status | Grant |

Latest Allianz News

Sep 8, 2025

Get 30% Off All Global Market Reports With Code ONLINE30 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors ” — The Business Research Company LONDON, GREATER LONDON, UNITED KINGDOM, September 8, 2025 / EINPresswire.com / -- Get 30% Off All Global Market Reports With Code ONLINE30 – Stay Ahead Of Trade Shifts, Macroeconomic Trends, And Industry Disruptors What Is The Expected Cagr For The Passenger Accident Insurance Market Through 2025? In recent times, the passenger accident insurance market has significantly expanded. The market, which is valued at $13.23 billion in 2024, is projected to increase to $14.12 billion in 2025, exhibiting a compound annual growth rate (CAGR) of 6.7%. Factors such as increased usage of public transportation, heightened consciousness of personal safety, growing instances of cross-border travel, enhanced government commitment to public transit security, and an escalating demand for economical travel insurance have contributed to this historical growth. The future forecast predicts a noticeable spike in the passenger accident insurance market size over the coming years. The expectation is that it will swell to $18.08 billion by 2029, having grown at a compound annual growth rate (CAGR) of 6.4%. This anticipated uplift during the forecast period is due to several factors such as; increased usage of digital insurance platforms, rising demand for on-trip microinsurance, a higher rate of personalized insurance coverage adoption, a burgeoning middle-class in developing markets, and more collaborations between insurance companies and transport providers. Dominant trends predicted for the forecast period include advancements in technology that enable real-time policy issuance, innovative alterations in claims automation and fraud detection, progress in AI-facilitated risk assessment models, investments in insurance applications oriented towards mobile-first initiatives, and inventive strides in embedded insurance. Download a free sample of the passenger accident insurance market report: https://www.thebusinessresearchcompany.com/sample.aspx?id=27114&type=smp What Are The Key Factors Driving Growth In The Passenger Accident Insurance Market? Expectations are that the growing number of individuals traveling by air for business, recreation, and personal purposes, also known as air passenger traffic, will boost the development of the passenger accident insurance market . The surge in air passenger traffic can be attributed to the swift expansion of budget airlines, making air travel a more feasible option for a broader population, particularly in burgeoning markets and on local routes. Passenger accident insurance boosts travellers' confidence by offering payment for injuries or death during air travel and providing emergency assistance to promote more frequent air travel. For example, Eurostat, an EU-based statistical agency in Luxembourg, reported a noticeable increase in air travel in the EU in December 2023, with the total number of passengers hitting 820 million in 2022, a significant 119% rise compared to 2021. It's thus evident that the rising air passenger traffic is propelling the development of the passenger accident insurance market. What Are The Top Players Operating In The Passenger Accident Insurance Market? Major players in the Passenger Accident Insurance Global Market Report 2025 include: • Allianz SE • AXA S.A. • MetLife Inc. • Tokio Marine Holdings Inc. • The Progressive Corporation • Zurich Insurance Company Ltd • Chubb Limited • United Services Automobile Association (USAA) • Aviva plc • QBE Insurance Group Limited What Are The Upcoming Trends Of Passenger Accident Insurance Market In The Globe? Leading businesses in the passenger accident insurance market are innovating to develop robust solutions like travel accident protection plans. These innovations aim to extend all-inclusive coverage and fortify their market standing in the travel insurance division. A travel accident protection plan provides monetary coverage for accidental injuries, disabilities, or death while travelling. This ensures that travelers receive compensation and get help in unforeseen circumstances when on a trip. For instance, in September 2023, a reinsurance and insurance firm based in the UK, Everest Group Ltd., unveiled the Everest Business Travel Accident Insurance. This all-inclusive solution unifies insurance coverage with services related to travel, medical, and security. These are designed specifically for corporate and non-profit sector employers, their employees, and accompanying guests, during both domestic and international business journeys. The plan offers pre-departure advice, support for prescription medication, transportation to local medical practitioners, and emergency medical evacuation. Also, in a collaboration with Healix International, insured travelers are provided round-the-clock support while travelling within a country, travel monitoring, pre-journey evaluations and a comprehensive duty of care travel program that meets ISO 31-0030 standards. Comprehensive Segment-Wise Insights Into The Passenger Accident Insurance Market The passenger accident insurance market covered in this report is segmented – 1) By Policy Type: Single Trip Insurance, Annual Multi Trip Insurance, Group Insurance, Family Plan Insurance, Business Trip Insurance 2) By Coverage Type: Accidental Death Coverage, Medical Expenses Coverage, Personal Liability Insurance, Trip Cancellation Insurance, Emergency Evacuation Insurance 3) By Customer Type: Individual Travelers, Corporate Clients, Students, Senior Citizens, Adventure Travelers 4) By Distribution Channel: Direct Sales, Insurance Agents, Brokers, Travel Agencies, Mobile Applications Subsegments: 1) By Single Trip Insurance: Domestic Single Trip Coverage, International Single Trip Coverage, Short-Duration Travel Insurance, Adventure Activity Add-On Cover, One-Time Flight Accident Protection 2) By Annual Multi Trip Insurance: Frequent Flyer Accident Coverage, Regional Multi Trip Plans, Worldwide Multi Trip Protection, Unlimited Trip Duration Plans, Annual Policy With Emergency Add-Ons 3) By Group Insurance: Corporate Group Travel Accident Plans, Educational Group Travel Cover, Tour Group Insurance Policies, Non-Profit Organization Group Plans, Event-Based Group Travel Protection 4) By Family Plan Insurance: Family Flight Accident Insurance, Multi-Member Coverage Policies, Dependent Child Travel Protection, Spouse Inclusion Add-On Cover, Family Medical And Emergency Support 5) By Business Trip Insurance: Executive Travel Accident Coverage, Client Meeting Travel Protection, Conference And Seminar Travel Cover, Workforce Mobility Accident Plans, Short-Term Assignment Accident Insurance View the full passenger accident insurance market report: https://www.thebusinessresearchcompany.com/report/passenger-accident-insurance-global-market-report Global Passenger Accident Insurance Market - Regional Insights In the 2025 Global Market Report for Passenger Accident Insurance, North America held the top spot as the biggest market in 2024. It is projected that the quickest expanding region will be Asia-Pacific. Covered in the report are respective regions: Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa. Browse Through More Reports Similar to the Global Passenger Accident Insurance Market 2025, By The Business Research Company Business Travel Accident Insurance Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/business-travel-accident-insurance-global-market-report Accidental Death Insurance Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/accidental-death-insurance-global-market-report Motor Insurance Global Market Report 2025 https://www.thebusinessresearchcompany.com/report/motor-insurance-global-market-report Speak With Our Expert: Saumya Sahay Americas +1 310-496-7795 Asia +44 7882 955267 & +91 8897263534 Europe +44 7882 955267 Email: saumyas@tbrc.info The Business Research Company - www.thebusinessresearchcompany.com Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Oliver Guirdham The Business Research Company info@tbrc.info Visit us on social media: LinkedIn Facebook X Legal Disclaimer: EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Allianz Frequently Asked Questions (FAQ)

When was Allianz founded?

Allianz was founded in 1890.

Where is Allianz's headquarters?

Allianz's headquarters is located at Koeniginstrasse 28, Munich.

What is Allianz's latest funding round?

Allianz's latest funding round is IPO.

Who are Allianz's competitors?

Competitors of Allianz include ARAG, Hollard Insurance, PICC Property and Casualty Company, Dai-ichi Life Insurance, Tokio Marine and 7 more.

Loading...

Compare Allianz to Competitors

American Family Insurance is a company that provides a range of personal insurance services within the insurance industry. Its main offerings include policies for auto, home, life, and umbrella insurance, aimed at protecting individuals and their assets. It was founded in 1927 and is based in Madison, Wisconsin.

ABC Life focuses on providing insurance services within the financial sector. The company offers a range of products including life insurance, accident insurance, and healthcare insurance, as well as wealth management and retirement planning services. ABC Life primarily serves individual and corporate clients with a variety of insurance and financial planning needs. It was founded in 2005 and is based in Dongcheng, China.

China Life Insurance offers a wide range of life, accident, and health insurance products and services. The company was founded in 1949 and is based in Xicheng District, China.

Aegon THTF Life Insurance operates in the insurance sector and provides life insurance, health insurance, and accident insurance. The company also provides reinsurance on life, health, and accident. Aegon THTF Life Insurance was founded in 2003 and is based in Shanghai, China.

Harel Insurance Company is a leading insurance and financial services provider in Israel. It offers a wide range of insurance products and services, including life insurance, health insurance, property & casualty insurance, and pension & retirement plans. Harel Insurance Company was formerly known as Shiloah Insurance Company. It was founded in 1975 and is based in Ramat Gan, Israel.

Nippon Life Insurance Company is a life insurer. The company offers life insurance services and manages a portfolio of investments, including equities, fixed income, private equity, private debt, and real assets. Nippon Life's asset management operations include investments in foreign securities. It was founded in 1889 and is based in Osaka, Japan.

Loading...