AI21 Labs

Founded Year

2017Stage

Series D | AliveTotal Raised

$617MLast Raised

$300M | 4 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+56 points in the past 30 days

About AI21 Labs

AI21 Labs develops artificial intelligence systems and foundation models within the technology sector. The company offers generative AI solutions for enterprise workflows, including products like the engine for conversational AI and deployment options. It serves sectors that require AI integration, including financial technology, research, and business operations. It was founded in 2017 and is based in Tel-Aviv, Israel.

Loading...

AI21 Labs's Product Videos

ESPs containing AI21 Labs

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The open-source NLP libraries & frameworks market provides developers with freely available tools for natural language processing tasks including text analysis, entity recognition, language modeling, and text generation. These solutions offer pre-trained models, training frameworks, model architectures, and processing pipelines that developers can download, customize, and deploy on their own infra…

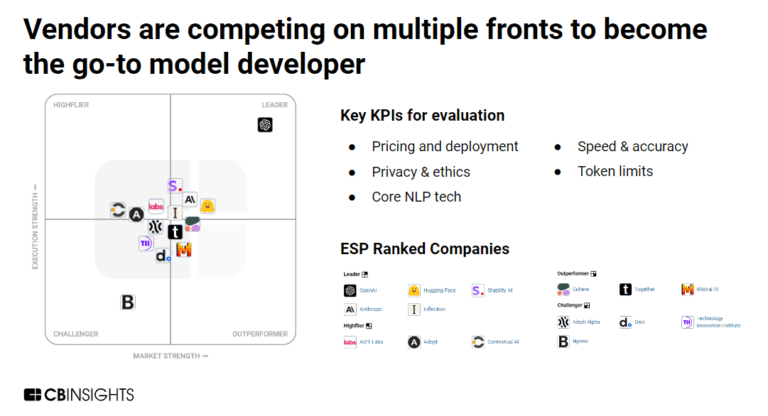

AI21 Labs named as Leader among 5 other companies, including Hugging Face, deepset, and Rasa.

AI21 Labs's Products & Differentiators

Jamba 1.6

the most advanced open model for private enterprise deployment, designed to meet real-world business needs without sacrificing security or performance. Built on AI21’s hybrid SSM-Transformer architecture, Jamba 1.6 delivers industry-leading results, outperforming leading models across key enterprise use cases while providing the best accuracy, speed, and security in the market. Jamba 1.6 outperforms its open model competitors from Mistral, Meta, and Cohere across multiple benchmarks, showcasing superior general quality (Arena Hard) and best-in-class performance on retrieval-augmented generation (RAG) and long-context question answering (QA). Critically, Jamba 1.6 achieves these results without compromising on speed, as demonstrated in scatter plot benchmarks.

Loading...

Research containing AI21 Labs

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned AI21 Labs in 10 CB Insights research briefs, most recently on Sep 5, 2025.

Sep 5, 2025 report

Book of Scouting Reports: The AI Agent Tech Stack

Aug 29, 2025 report

Book of Scouting Reports: Generative AI in Financial Services

Feb 27, 2024

The generative AI boom in 6 charts

Nov 15, 2023 report

State of AI Q3’23 Report

Oct 12, 2023 report

State of Venture Q3’23 ReportExpert Collections containing AI21 Labs

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

AI21 Labs is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,286 items

Artificial Intelligence

12,580 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Digital Content & Synthetic Media

2,287 items

The Synthetic Media collection includes companies that use artificial intelligence to generate, edit, or enable digital content under all forms, including images, videos, audio, and text, among others.

AI 100 (All Winners 2018-2025)

200 items

Generative AI 50

50 items

CB Insights' list of the 50 most promising private generative AI companies across the globe.

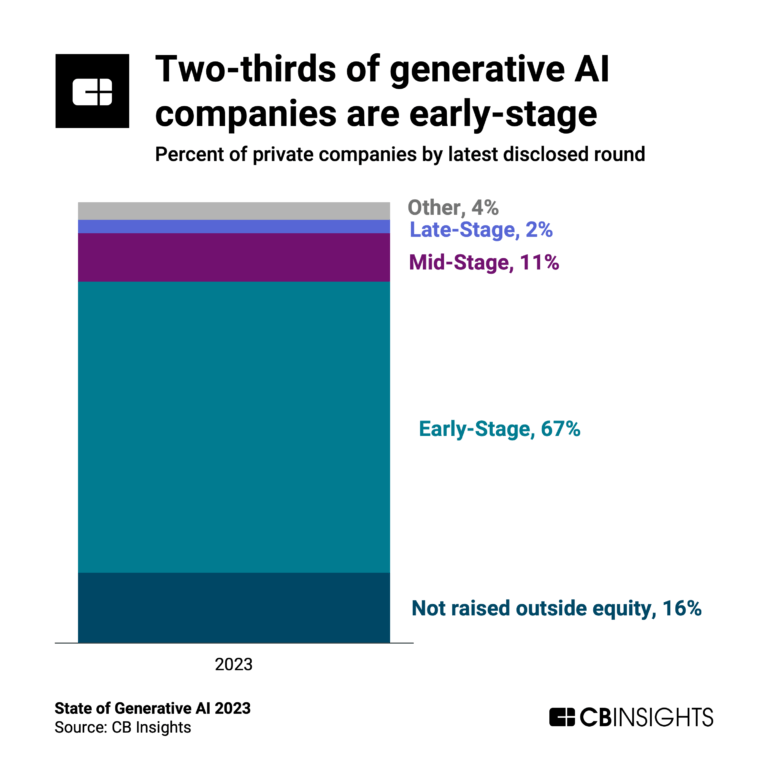

Generative AI

2,793 items

Companies working on generative AI applications and infrastructure.

AI21 Labs Patents

AI21 Labs has filed 19 patents.

The 3 most popular patent topics include:

- computational linguistics

- natural language processing

- tasks of natural language processing

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/11/2023 | 2/18/2025 | Natural language processing, Computational linguistics, Tasks of natural language processing, Semantics, Artificial intelligence applications | Grant |

Application Date | 5/11/2023 |

|---|---|

Grant Date | 2/18/2025 |

Title | |

Related Topics | Natural language processing, Computational linguistics, Tasks of natural language processing, Semantics, Artificial intelligence applications |

Status | Grant |

Latest AI21 Labs News

Sep 6, 2025

For years, artificial intelligence in finance has dazzled us with fluency. Models could summarize reports, draft emails, and even parse regulatory text. But when pushed to reason — to follow a logic chain across contracts, compliance rules, or fraud signals — the façade cracked. That’s the “cold maths era”: statistical fluency without the ability to show the work. Financial institutions, operating under the weight of trust, regulation, and systemic risk, cannot afford that fragility. The shift now underway — toward reasoning-native AI — may be the most consequential change since cloud-first banking. The Past: Brilliant Fluency, Brittle Trust Large Language Models (LLMs) excelled at pattern recognition on steroids. In trading, wealth management, and compliance, they could autocomplete tasks and accelerate productivity. But reasoning? That was emergent at best. Ask an LLM to summarize Basel III rules, and it would produce prose. Ask it to reconcile those rules against a complex derivative position, and it would stumble. Banks don’t need parrots. They need apprentices who can trace every step — because every step can be audited, regulated, and litigated The Present: Engineering Reasoning Into the Loop The AI research community is now explicitly training models to reason — not just predict. The implications for fintech are profound. Techniques that matter for finance: Scratchpads → models maintain intermediate steps, essential for audit trails in compliance. Self-consistency → multiple reasoning paths before settling on a decision, akin to credit committees voting on a loan. Tree-of-Thoughts → exploring multiple regulatory interpretations before resolving a case. ReAct frameworks → mixing reasoning with tool use (e.g., calling a risk engine, querying a trade ledger). Pause-and-Reflect training → OpenAI’s o1 and DeepSeek’s R1 show how reinforcement learning can prioritize quality of reasoning traces, not just final outputs. In banking terms: these techniques shift AI from being a fluent intern to a junior analyst who leaves a paper trail. Evidence: Where Reason-Native AI Is Proving Itself Formal verification : DeepMind’s AlphaProof used symbolic checkers to validate math Olympiad solutions. In finance, the analogy is verifying that an AI-driven credit model complies with regulatory capital requirements. Harder benchmarks : ARC-AGI and GPQA test deeper reasoning. In fintech, the equivalent could be cross-checking KYC data across multiple jurisdictions or detecting fraud patterns that mutate in real time. This isn’t about AI “understanding” like humans. It’s about building explicit reasoning structures that reduce hallucination risk — exactly what regulators demand. The Players: What the Industry Should Watch OpenAI (o1) → Reinforcement learning on reasoning steps, a blueprint for explainable compliance assistants. DeepSeek (R1) → Cost-efficient reasoning with pure RL; relevant for banks balancing AI ambition with tight margins. DeepMind (AlphaGeometry / AlphaProof) → Neuro-symbolic hybrids that could one day underpin risk model validation. AI21 Labs (MRKL) → Modular AI where discrete reasoning engines could slot into payment flows or trade reconciliation. MIT-IBM (NS-CL) → Neuro-symbolic concept learners, pointing toward AI that interprets contracts with both linguistic nuance and legal logic. What’s Really Being Used in Finance Today Behind the headlines, these are the methods financial firms can start applying: Chain-of-thought supervision → regulatory chatbots that explain every clause check. Self-critique → fraud models that re-evaluate suspicious transactions before escalation. Verifier-first design → smart contracts that must pass symbolic rule checks before execution. Symbolic-neural hybrids → AI that parses complex financial text, then cross-references symbolic compliance rules. This isn’t academic tinkering. It’s the scaffolding for AI systems that meet audit, compliance, and customer trust requirements. The Future: Toward Trusted Digital Colleagues The future of AI in finance is likely a system of systems : Neural networks for perception and language (parsing contracts, transactions, conversations). Symbolic logic engines for rules and regulatory frameworks. Verifiers to ensure compliance before execution. Reinforcement learning to continuously refine reasoning under shifting regulation. Not philosopher machines. But dependable colleagues that can: Verify a syndicated loan complies with multiple jurisdictions. Trace every reasoning step in an anti-money-laundering decision. Show regulators not just what they decided, but how What This Means for Financial Services For banks → Reasoning-native AI is the bridge from copilots to auditable digital co-workers. For fintechs → It’s the differentiator between flashy apps and trusted infrastructure. For regulators → It’s the opportunity to demand transparency, not just outcomes, from financial AI. For customers → It’s the quiet promise that when AI touches your money, it leaves an audit trail. Final Thoughts Artificial intelligence in finance is still cold maths at heart. But scratchpads, search trees, and symbolic hybrids are teaching it to act less like a parrot and more like an analyst who can justify every line in a spreadsheet. Reasoning-native AI won’t replace fiduciary judgment. But it will reshape the rails of financial trust: explainable, verifiable, auditable intelligence. And that’s exactly the kind of intelligence our industry needs.

AI21 Labs Frequently Asked Questions (FAQ)

When was AI21 Labs founded?

AI21 Labs was founded in 2017.

Where is AI21 Labs's headquarters?

AI21 Labs's headquarters is located at 124 Shlomo Ibn Gabirol Street, Tel-Aviv.

What is AI21 Labs's latest funding round?

AI21 Labs's latest funding round is Series D.

How much did AI21 Labs raise?

AI21 Labs raised a total of $617M.

Who are the investors of AI21 Labs?

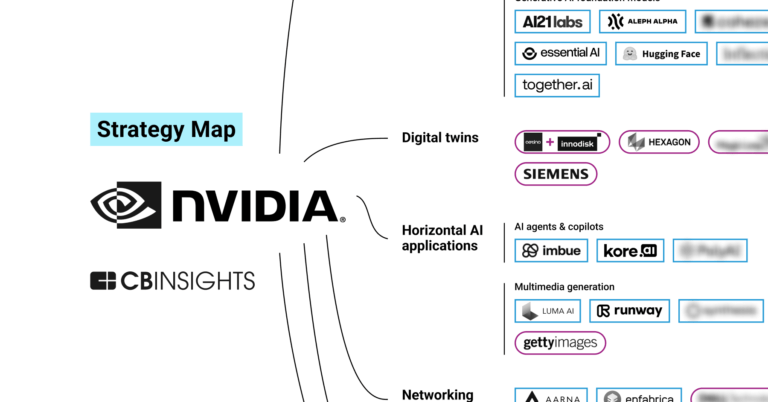

Investors of AI21 Labs include NVIDIA, Google, Ahren, Comcast Ventures, Intel Capital and 12 more.

Who are AI21 Labs's competitors?

Competitors of AI21 Labs include Mistral AI, Anthropic, OpenAI, Convergence, Goodfire and 7 more.

What products does AI21 Labs offer?

AI21 Labs's products include Jamba 1.6 and 1 more.

Who are AI21 Labs's customers?

Customers of AI21 Labs include Fnac and Educa Edtech.

Loading...

Compare AI21 Labs to Competitors

One AI specializes in generative artificial intelligence (AI) within the technology sector. The company offers services such as language analytics, customizable AI skills, and the processing of text, audio, and video data into structured, actionable insights. It primarily serves sectors such as customer service, e-commerce, media, healthcare, and government. It was founded in 2021 and is based in San Francisco, California.

Cohere operates as an enterprise artificial intelligence (AI) company building foundation models and AI products across various sectors. The company offers a platform that provides multilingual models, retrieval systems, and agents to address business problems while ensuring data security and privacy. Cohere serves financial services, healthcare, manufacturing, energy, and the public sector. It was founded in 2019 and is based in Toronto, Canada.

Fireworks AI specializes in generative artificial intelligence platform services, focusing on inference and model fine-tuning within the artificial intelligence sector. The company offers an inference engine for building production-ready AI systems and provides a serverless deployment model for generative AI applications. It serves AI startups, digital-native companies, and Fortune 500 enterprises with its AI services. It was founded in 2022 and is based in Redwood City, California.

Hugging Face is an open-source machine learning platform that focuses on artificial intelligence within the technology sector. The company provides a space for the machine learning community to develop models, share datasets, and host artificial intelligence (AI) applications, and offers enterprise solutions. Hugging Face was formerly known as Hugging Face. It was founded in 2016 and is based in Paris, France.

MI2.ai focuses on machine learning predictive models in the data science and artificial intelligence sectors. The company provides services related to responsible machine learning practices, including research and consulting. It serves the academic community and businesses interested in implementing AI practices. The company was founded in 2016 and is based in Warszawa, Poland.

Sakana AI focuses on developing artificial intelligence (AI) through nature-inspired foundation models within the research and development sector. Its main offering includes creating a new kind of foundation model that draws inspiration from natural intelligence, designed to advance the field of AI. It was founded in 2023 and is based in Tokyo, Japan.

Loading...