Agility Robotics

Founded Year

2015Stage

Unattributed VC | AliveTotal Raised

$189.74MLast Raised

$140K | 2 days agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+57 points in the past 30 days

About Agility Robotics

Agility Robotics develops humanoid robotics and automation solutions for various industries. The company provides robots designed to automate tasks in manufacturing, distribution, and retail, utilizing AI for control and operation. Agility Robotics serves sectors that require material handling and automation, including warehousing and logistics. It was founded in 2015 and is based in Pittsburgh, Pennsylvania.

Loading...

ESPs containing Agility Robotics

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

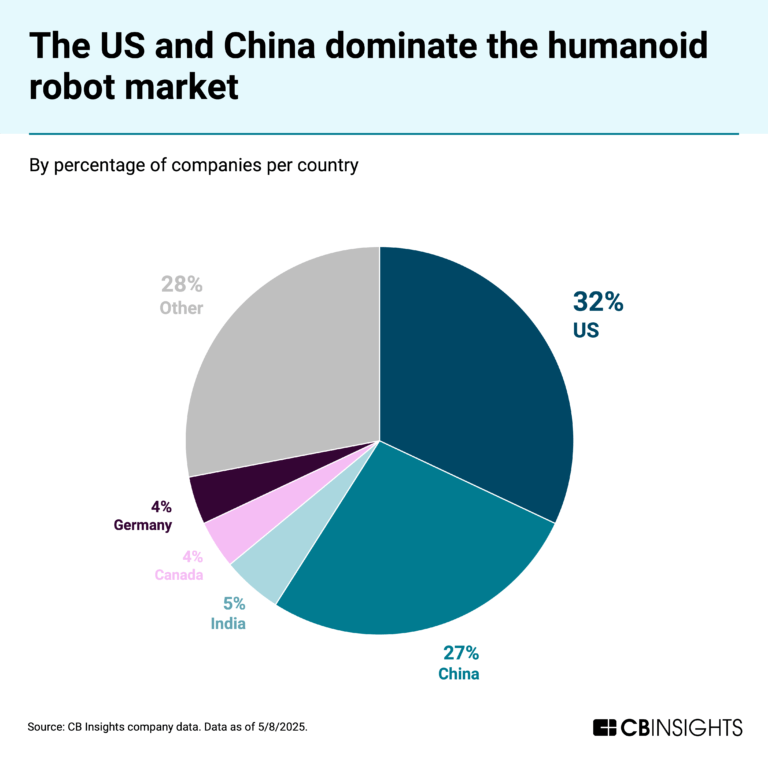

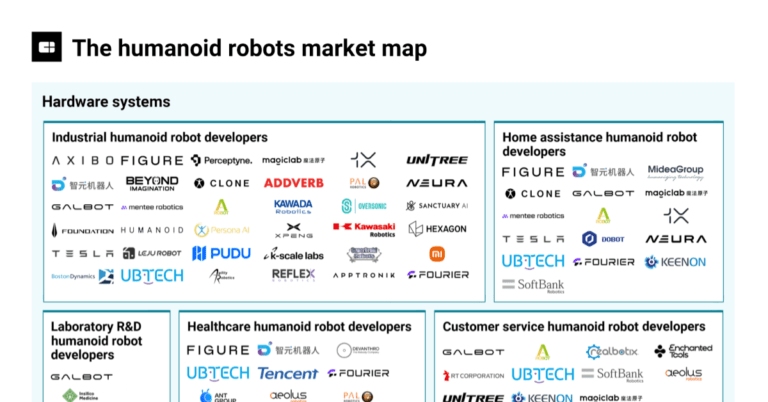

The industrial humanoid robot developers market focuses on the development and deployment of robots with human-like form designed specifically for industrial applications. These robots feature bipedal mobility, articulated limbs, and advanced sensors that enable them to navigate complex environments and perform tasks traditionally done by humans. Industrial humanoid robots enhance automation in in…

Agility Robotics named as Outperformer among 15 other companies, including Tesla, Xiaomi, and Hexagon.

Loading...

Research containing Agility Robotics

Get data-driven expert analysis from the CB Insights Intelligence Unit.

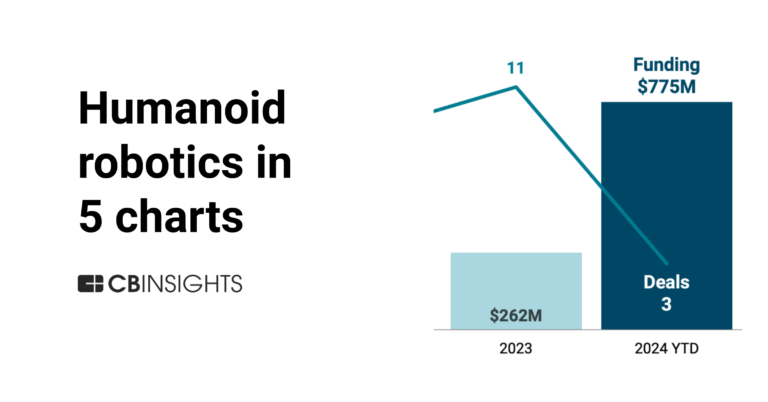

CB Insights Intelligence Analysts have mentioned Agility Robotics in 11 CB Insights research briefs, most recently on Aug 27, 2025.

Jun 26, 2025

The humanoid robots market map

Jun 26, 2025 report

Book of Scouting Reports: Humanoid Robots

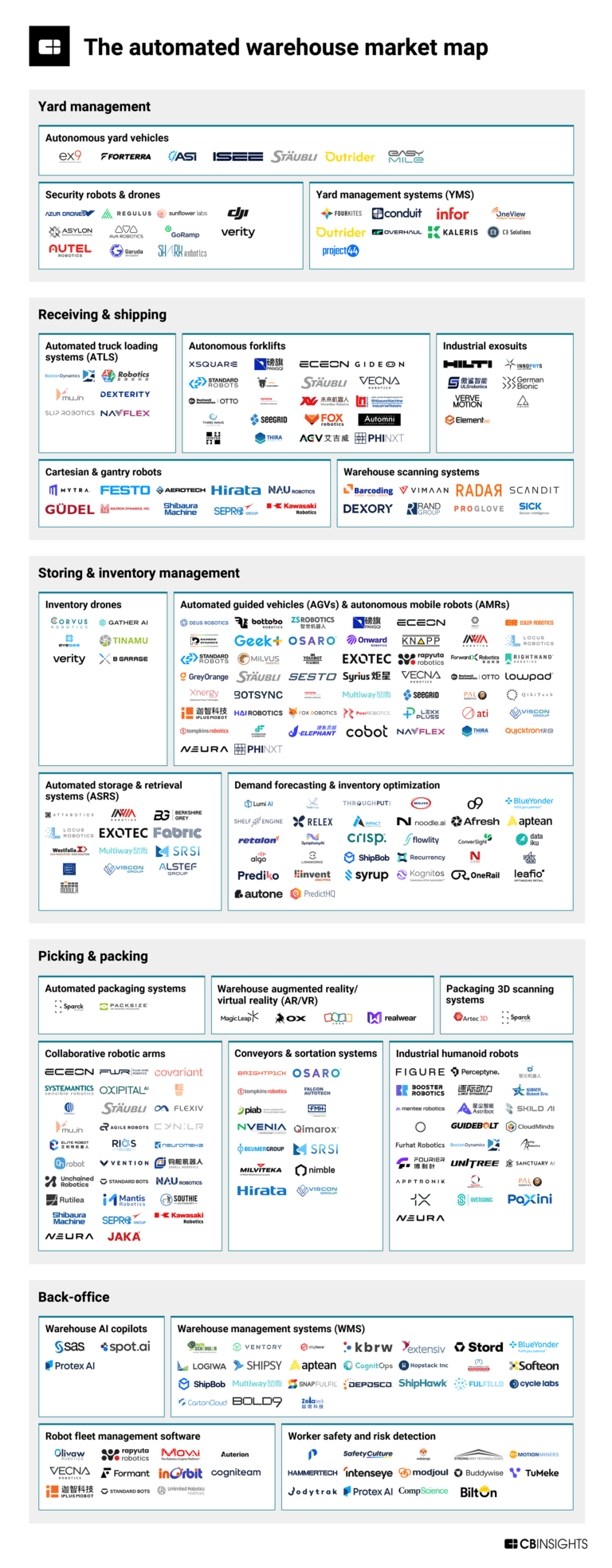

Feb 13, 2025

The automated warehouse market map

May 31, 2024

3 applications of generative AI in manufacturing

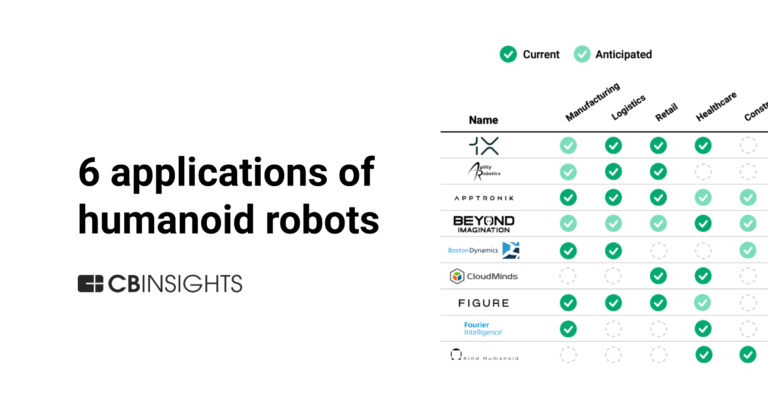

Mar 26, 2024

6 applications of humanoid robots across industriesExpert Collections containing Agility Robotics

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

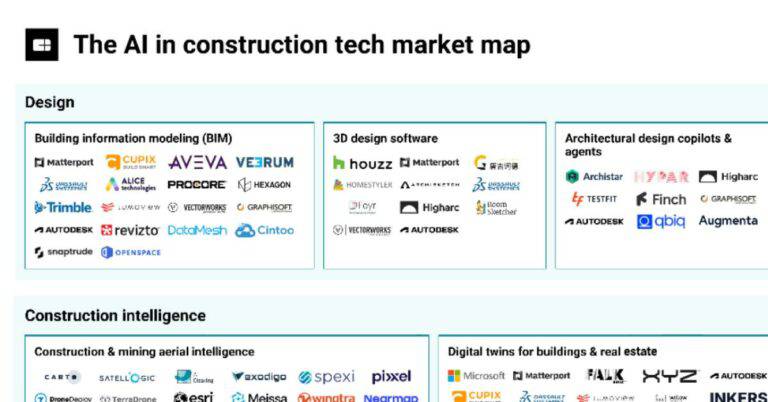

Agility Robotics is included in 9 Expert Collections, including Construction Tech.

Construction Tech

1,508 items

Companies in the construction tech space, including additive manufacturing, construction management software, reality capture, autonomous heavy equipment, prefabricated buildings, and more

Supply Chain & Logistics Tech

6,016 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Robotics

2,716 items

This collection includes startups developing autonomous ground robots, unmanned aerial vehicles, robotic arms, and underwater drones, among other robotic systems. This collection also includes companies developing operating systems and vision modules for robots.

Advanced Manufacturing

6,887 items

Companies in the advanced manufacturing tech space, including companies focusing on technologies across R&D, mass production, or sustainability

AI 100 (All Winners 2018-2025)

200 items

Job Site Tech

960 items

Companies in the job site tech space, including technologies to improve industries such as construction, mining, process engineering, forestry, and fieldwork

Agility Robotics Patents

Agility Robotics has filed 10 patents.

The 3 most popular patent topics include:

- robotics

- actuators

- automotive transmission technologies

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/2/2023 | 4/1/2025 | Analog circuits, Bridge circuits, Sensors, Electrical signal connectors, Resistive components | Grant |

Application Date | 8/2/2023 |

|---|---|

Grant Date | 4/1/2025 |

Title | |

Related Topics | Analog circuits, Bridge circuits, Sensors, Electrical signal connectors, Resistive components |

Status | Grant |

Latest Agility Robotics News

Sep 16, 2025

The robot end-effector market size was valued at US$ 5.47 billion in 2024 and is expected to reach US$ 13.76 billion by 2031. The robot end-effector market size is estimated to register a CAGR of 14.5% during 2025-2031. Traditional industrial robots often demand high upfront costs and complex infrastructure, making them less accessible to smaller businesses. In contrast, mobile collaborative robots (cobots) offer scalable automation solutions that fit the budget and operational needs of SMEs. Their user-friendly designs and intuitive programming interfaces allow firms with limited technical expertise to adopt automation easily. These cobots rely on advanced, adaptable end effectors-such as grippers, suction cups, and tool changers-to perform a wide range of tasks including assembly, packaging, material handling, and quality inspection. Moreover, the plug-and-play nature of modern end effectors perfectly suits SMEs that lack deep technical resources. Manufacturing, packaging, and logistics SMEs are increasingly using mobile cobots to improve efficiency, reduce errors, and meet rising consumer demands and production complexities. Beyond boosting productivity, these robots also address labor shortages by ensuring consistent output and effectively expanding the workforce. In 2023, the National Institute of Standards and Technology (NIST) advanced cobot adoption in SMEs through its Measurement Science for Manufacturing Robotics (MSMR) program. This initiative tackles common barriers such as dynamic work environments, technical limitations, and integration challenges by providing tailored tools, standards, and technologies-like digital twins and sensor-based end effectors-to simplify robotics integration. North America held the significant market share in 2024. As companies strive to boost productivity, accuracy, and safety, the demand for advanced robotic systems, including sophisticated end effectors, has surged. North America, with its strong industrial foundation and early adoption of smart manufacturing, leads this transformation. Industries such as automotive, aerospace, electronics, and healthcare increasingly use robotic arms with advanced end effectors to enhance assembly efficiency, perform complex tasks, and reduce human exposure to hazardous conditions. In November 2024, German auto parts manufacturer Schaeffler partnered with Agility Robotics to deploy a significant number of humanoid robots (Digit) globally by 2030, including in North America, signaling progress toward humanoid robots equipped with advanced end-effectors in manufacturing. Investment is growing in next-generation end effectors like adaptive grippers, vacuum tools, and sensor-integrated systems that enable precise, flexible operations. The rise of collaborative robots (cobots) further drives demand for end effectors designed to safely and effectively work alongside humans. In August 2024, Figure AI unveiled the humanoid robot "Figure 02," featuring advanced five-fingered robotic hands capable of lifting up to 25 kg, tested at a BMW plant in South Carolina-indicating a future of humanoid integration with sophisticated end effectors in industry. Additionally, reshoring manufacturing efforts and rising labor costs across the US and Canada are accelerating automation, particularly in small- and medium-sized enterprises (SMEs), creating expanded opportunities for end effector manufacturers. The growing e-commerce and logistics sectors also increasingly adopt robotic solutions for material handling, packaging, and sorting, all requiring customized end-of-arm tooling. ABB Ltd., SMC Corporation, DESTACO, Festo AG and Co. KG, Schmalz GmbH, KUKA AG, Piab AB, Staubli International AG, SCHUNK GmbH and Co. KG, and ZIMMER GROUP GmbH are among the key robot end-effector market players that are profiled in this market study. The overall robot end-effector market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the robot end-effector market size. The process also helps obtain an overview and forecast of the market with respect to all the market segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights. This process includes industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the robot end-effector market. TABLE OF CONTENTS ABB Ltd. Schmalz GmbH ZIMMER GROUP

Agility Robotics Frequently Asked Questions (FAQ)

When was Agility Robotics founded?

Agility Robotics was founded in 2015.

Where is Agility Robotics's headquarters?

Agility Robotics's headquarters is located at 4698 Truax Drive South East, Pittsburgh.

What is Agility Robotics's latest funding round?

Agility Robotics's latest funding round is Unattributed VC.

How much did Agility Robotics raise?

Agility Robotics raised a total of $189.74M.

Who are the investors of Agility Robotics?

Investors of Agility Robotics include Humanoid Global Holdings, Canon, Abico Group, Schaeffler Group, Bossa Invest and 13 more.

Who are Agility Robotics's competitors?

Competitors of Agility Robotics include Figure, Apptronik, Asylon, 1X, SI Robotics and 7 more.

Loading...

Compare Agility Robotics to Competitors

Figure develops autonomous humanoid robots. The company offers robots that perform tasks autonomously, using AI to learn and execute operations in sectors such as manufacturing, logistics, warehousing, and retail, as well as in home environments. It was founded in 2022 and is based in Sunnyvale, California.

Perceptyne Robots focuses on the integration of artificial intelligence with robotics within the deeptech and automation sectors. The company provides industrial humanoid robots intended to automate dexterous tasks in various industries, incorporating features like vision guidance, tactile sensing, and teleoperation training. Perceptyne Robots serves sectors that require automation solutions, including manufacturing. It was founded in 2021 and is based in Hyderabad, India.

Sanctuary AI focuses on the development of humanoid robots equipped with artificial intelligence to address labor challenges across various industries. The company specializes in creating robots that can perform tasks requiring dexterity, tactile feedback, and fine manipulation, mimicking human cognitive processes and movements. Sanctuary AI primarily serves sectors that require automation for dull, dirty, or dangerous jobs, such as automotive, manufacturing, and logistics. It was founded in 2018 and is based in Vancouver, British Columbia.

Boston Dynamics focuses on developing mobile robots in the robotics industry. Their offerings include robots for industrial inspection, safety and response operations, and warehouse automation. These robots are equipped with sensors and controls to perform tasks such as data gathering, hazard detection, and cargo handling. It was founded in 1992 and is based in Waltham, Massachusetts. Boston Dynamics operates as a subsidiary of Hyundai Motor Company.

1X is a company that develops humanoid robotics within the technology sector. The company creates general-purpose humanoid robots designed for home use, focusing on safety and intelligent behavior. The company makes that robots are intended to assist humans in domestic environments. It was founded in 2014 and is based in Moss, Norway.

Mentee Robotics specializes in the development of humanoid robots with advanced artificial intelligence capabilities within the robotics and AI technology sectors. Their robots are equipped with full-body motion planning and control, capable of performing complex tasks through dynamic interaction with their environment. The company's products are designed to serve sectors that require automation through sophisticated robotics, such as manufacturing, logistics, and healthcare. It was founded in 2022 and is based in Herzliya, Israel.

Loading...